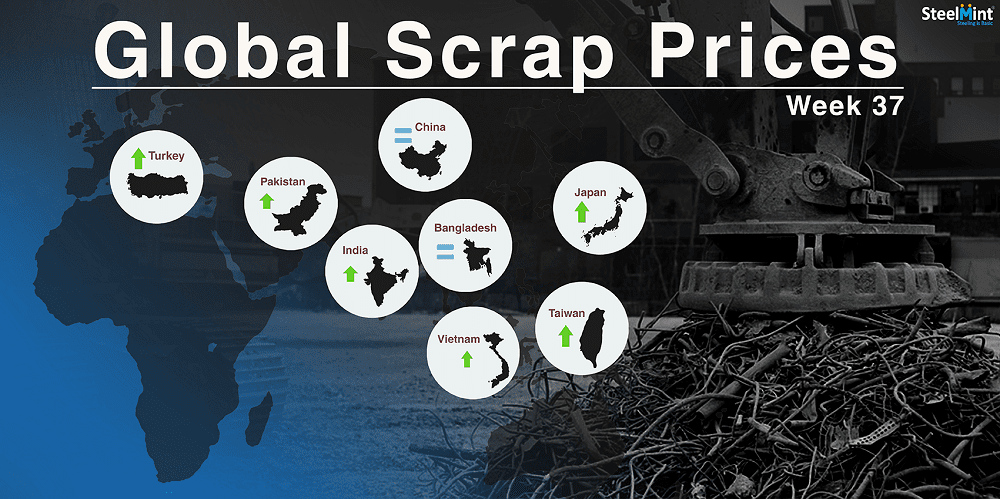

Global Ferrous Scrap Market Overview - Week 37, 2018

Japanese scrap prices in all other regions moved up to come in line with in Kanto region prices after recording marginal decrease in average bids fetched in Kanto monthly scrap export tender for September. South Korea's Hyundai Steel is less likely to resume bidding shortly. Shagang Steel scrap purchase prices remained unaltered.

Turkish mills book more scrap cargoes for Oct-Nov shipments - Turkey based scrap importers have continued to buy scrap in bulk cargoes with range bound prices. Turkish mills booked nearly 4-5 deep sea cargoes this week amid restocking activities. In a recent deal reported, UK base supplier sold 30,000 MT cargo comprising 25,000 MT of HMS 1&2 (80:20) and 5,000 MT of Bonus at an average price of USD 316/MT,CFR .While price assessment for USA origin HMS (80:20) scrap stands stable at around USD 319-320/MT, CFR Turkey on W-o-W basis.

Japan’s Kanto tender bids down USD 3/MT in Sept'18 - The average bids for ‘Kanto Tetsugen'- monthly ferrous scrap export tender Sept’18 were recorded at JPY 34,486/MT (USD 309), FAS, down by JPY 374/MT (USD 3) M-o-M as against the average bids fetched at JPY 34,860/MT (USD 312), FAS in Aug’18. In Sept’18 auction, total 15,510 MT of Japanese H2 scrap was awarded for three winning bids placed. However, market witnessed limited impact of Kanto tenders’ fall and prices remain high on decent demand for Olympics 2020 construction activities.

Japan’s Tokyo Steel raises scrap purchase price twice this week - On 13th Sept, Japan’s leading EAF steel mini-mill - Tokyo Steel raised prices at Okayama and Takamatsu Steel center by JPY 500/MT (USD 5) keeping prices at other three plants unchanged. While on 15th Sept, it raised prices again by JPY 500/MT (USD 5) at all its plants except at Utsunomiya. Tokyo Steel fetches H2 scrap at JPY 37,000/MT (USD 331) for its Kanto region based works i.e. Utsunomiya, the largest work in central Japan-Tahara and at Kyushu plant. Bids for the same grade is at JPY 36,500/MT at Okayama works in Western Japan while for its Takamatsu steel center company kept bids at JPY 36,000/MT in Southern Japan.

Hyundai Steel continued with individual negotiations for Japanese scrap - South Korea’s leading EAF steelmaker, Hyundai Steel has continued buying high grade Japanese scrap with individual negotiation and heard to have signed a contract for 50,000 MT remaining away from bidding for it. Hyundai may not resume bidding for Japanese scrap until the prices fall down significantly again. The steelmaker cut domestic scrap prices at all works by KRW 10,000/MT (USD 9) after almost 4 months amid increasing inventories at local plants.

Indian scrap importers slow down amid currency depreciation - Indian scrap importers have observed slight slowdown in scrap bookings this week majorly affected by sharp currency depreciation. Imported scrap prices inched up on W-o-W basis in recent minor deals reported. Western coastal steelmakers booked West African HMS scrap to be mixed with sponge iron as a substitute due to high sponge iron prices. Local scrap prices moved up amid uptrend in semis prices.

Offers for UK based containerized Shredded heard in the range of USD 360-365/MT, CFR Nhava Sheva, while deals for European Shredded concluded in the range of USD 357-360/MT, CFR. Dubai and South Africa based suppliers are holding offers in the range of USD 350-355/MT for HMS 1. Prices for HMS 1&2 (80:20) heard in the range of USD 335-345/MT, CFR from West Africa, EU, and UK.

Pakistan scrap buyers less active on weak local steel demand - Pakistan scrap buyers remained less active although inventories stand lower side over weak local steel demand. Local bala billet prices have come down to PKR 72,000-73,000/MT levels as there was no increase in finish steel demand. Increasing scrap requirements could create a shortage of scrap soon in Pakistan but at present local scrap prices are more feasible resulting in increasing usage of local scrap. Shredded being offered at USD 360/MT, CFR and few trades reported at USD 355-358/MT, CFR Qasim from Europe and UK.

Bangladesh imported scrap market observes slowdown – On heavy rains, lack of money allocation on upcoming parliamentary elections and increasing finish steel inventories, Bangladesh market slowed down. In a deal, 3000 MT of Shredded scrap from Europe booked at USD 365/MT, CFR Chittagong. Shredded 211 scrap in containers from UK & USA suppliers was being offered at around of USD 370-375/MT, CFR. Buyers were getting offers at USD 335-345/MT for HMS 1&2 (80:20) from Brazil, Chile and UK. Local scrap being cheaper over imported witnessed further correction in the prices.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

Minera Alamos buys Equinox’s Nevada assets for $115M

Adani’s new copper smelter in India applies to become LME-listed brand

OceanaGold hits new high on strong Q2 results

Cochilco maintains copper price forecast for 2025 and 2026

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

De Beers strikes first kimberlite field in 30 years

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%