Barrick’s Reko Diq in line for $410M ADB backing

According to me-metals cited from mining.com, The package includes two loans totaling $300 million to Barrick and a $110 million financing guarantee for the government of Pakistan, according to sources cited by Reuters.

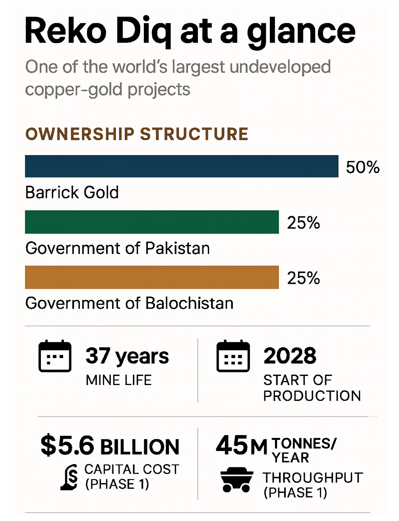

The funding forms part of a broader $6.6 billion development plan for the mine, owned 50% by Barrick and 50% by Pakistan and the Balochistan provincial government.

Shares of Barrick rose 0.6% Thursday morning, valuing the miner at $42.9 billion.

Reko Diq’s scale and outlook

Reko Diq is forecast to generate about $70 billion in free cash flow over its life and more than $90 billion in operating cash flow. The mine is expected to begin production in 2028, initially delivering 200,000 tonnes of copper annually in Phase 1, before expanding to 400,000 tonnes per year.

A recent feasibility update increased Phase 1 throughput from 40 to 45 million tonnes per year, with costs rising to $5.6 billion from earlier estimates of $4 billion. Phase 2 will process 90 million tonnes annually, up from 80 million.

While the mine’s current operating life is pegged at 37 years, Barrick believes upgrades and exploration could extend operations for decades beyond.

Growing international interest

The ADB’s commitment adds to a previously agreed $700 million financing package from the International Finance Corporation (IFC), the World Bank’s private investment arm. The project’s developers are also in talks with the US Export-Import Bank, Export Development Canada and Japan’s JBIC, with term sheets expected this quarter.

The financing push aligns with Islamabad’s efforts to attract foreign investment into its mining sector, including rare earths, and comes amid a thaw in relations with Washington.

US Secretary of State Marco Rubio recently highlighted critical minerals as a new area of cooperation, including potential joint ventures. Pakistan’s commerce ministry has indicated that American firms will be offered lease concessions and JV opportunities in Balochistan.

For Pakistan, Reko Diq is not just a mining project but a potential catalyst for wider investment in the country’s resource-rich Balochistan province. For the US and its allies, participation in the project supports efforts to diversify critical mineral supply chains away from China.

After years of delay due to legal disputes—finally settled in 2022—the project is moving ahead.

source: mining.com

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

Emirates Global Aluminium unit to exit Guinea after mine seized

South Africa mining lobby gives draft law feedback with concerns

EverMetal launches US-based critical metals recycling platform

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study