Copper mine output to rise 2.9% annually over next decade, says Fitch’s BMI

According to me-metals cited from mining.com, This production growth, says BMI, is largely down to several new projects and expansions coming online, supported by historically elevated copper prices and a positive demand outlook.

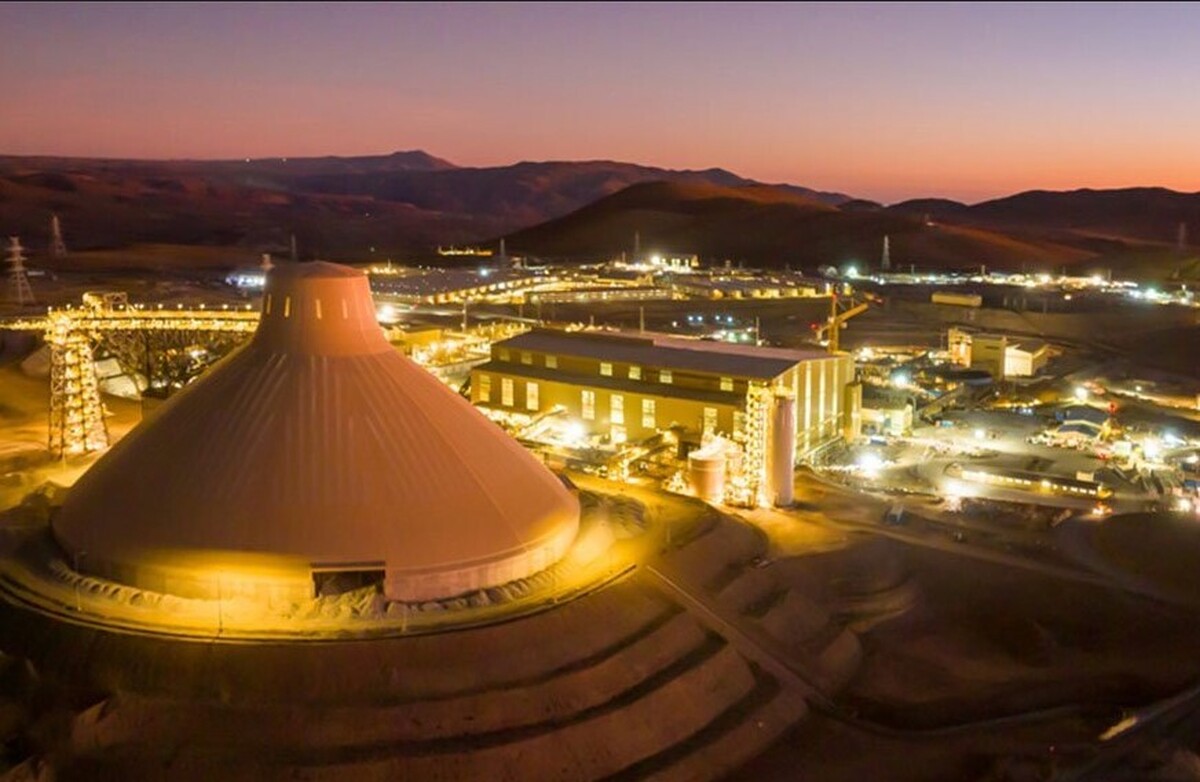

This year, BMI estimates global copper mine output to rise 2.5% as production in Chile recovers and the giant Oyu Tolgoi mine in Mongolia ramps up. Those in Peru, Russia and Zambia will also remain among the major contributors, it adds.

The Fitch unit cites data from the International Copper Study Group showing a 2% year-on-year output rise during the January-April period, backed by higher production from the Las Bambas, Quellaveco and Toromocho sites in Peru, the Kamoa-Kakula mine in the Democratic Republic of the Congo and the aforementioned Oyu Tolgoi project.

However, this 2025 growth projection was revised down to reflect the reduced guidance at Kamoa-Kakula, which was recently impacted by seismic activity. The Fitch unit also highlights the downside risks flagged by major miners such as Glencore and Anglo American. Still, many others, including top producer Codelco, have set a positive outlook to support higher global production.

Chile to remain leader

Regionally, BMI expects Chile to remain the dominant force in the copper supply chain, with output growing at 3% in 2025 to 5.7 million tonnes, accounting for a quarter of the global mine production.

A major contributor to Chile’s increase is the continued ramp-up at Teck’s Quebrada Blanca site, which would offset some of the challenges faced at the state-owned Codelco.

In the long term, it says Chile’s outlook remains positive “despite a range of factors that could limit investment in the sector over the coming years,” as the nation’s vast critical mineral reserves will encourage future investment as demand rises alongside the acceleration of the green energy transition.

The DRC is also expected to see 3% growth, though downside risks remain due to Kamoa-Kakula’s reduced guidance. Peru, meanwhile, is forecast to see 3.2% growth, recovering from a 1% decline in 2024.

source: mining.com

Chile’s 2025 vote puts mining sector’s future on the line

Torex Gold buys Prime Mining in $327M Mexico expansion

Column: EU’s pledge for $250 billion of US energy imports is delusional

Gold price retreats to near 3-week low on US-EU trade deal

Peru mulls green light for $6 billion in mining projects

Pilot Mountain tungsten project in Nevada gets $6M from Department of Defense

Copper price pulls back sharply ahead of US tariff deadline

Majestic Gold halts Chinese mine following fatal accident

Trump’s deep-sea mining push defies treaties, stirs alarm

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge

Gold price rebounds nearly 2% on US payrolls data

Winning consortium vows responsible mining at Guinea’s Simandou

Column: Copper market pays the price for forgetting its TACO hedge

Codelco confirms death of one trapped El Teniente miner

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge

Gold price rebounds nearly 2% on US payrolls data

Winning consortium vows responsible mining at Guinea’s Simandou

Column: Copper market pays the price for forgetting its TACO hedge

Codelco confirms death of one trapped El Teniente miner