Column: Copper market pays the price for forgetting its TACO hedge

According to me-metals cited from mining.com, US President Donald Trump’s proclamation “to address the effects of copper imports on America’s national security” was not what traders were expecting.

There will be 50% tariffs on copper imports effective Friday but only on semi-manufactured products such as wire and tube. Refined copper is excluded, at least until January 2027, when a tariff may be phased in if warranted.

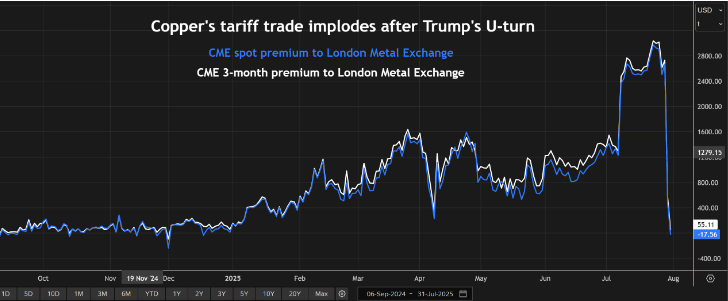

The tariff trade, which has defined the copper market since February, has imploded. The CME’s US contract plummeted by more than 20% on the news, wiping out the previous high premium over the London Metal Exchange (LME) price.

The United States is now awash with metal it doesn’t need after traders shipped huge tonnages through the yawning arbitrage gap.

The copper market forgot Trump’s tendency to back down on his most extreme tariff threats. It has, to borrow a current investor meme, just been TACO’d, which stands for Trump Always Chickens Out.

Copper products targeted

The tariffs on semi-finished copper products cover between 400,000 and 500,000 metric tons of annual US imports.

America imports considerably more copper as refined metal. Imports last year were just over 900,000 tons.

Canada is the largest single supplier of copper products to the US, but the supplier base is highly diverse. Last year’s imports of copper tubes, for example, came from 32 different countries.

The tariffs will also be extended down the product chain to copper-intensive derivative products such as cables, connectors and electrical components, likely ensnaring more supplier countries.

The new tariff wall should be a boost for domestic processors, but only if they have the capacity to cover the range and quality of what is currently being imported.

The number of product-specific exemptions granted in the coming months will provide an answer.

Scrap wars heat up

The tariff wall on products will be complemented by restrictions on exports of US mined concentrates and recyclable copper.

A quarter of domestically-produced “copper input materials” will be required to be sold in the United States from 2027. That rate will rise to 30% in 2028 and 40% in 2029.

That may need more capacity than exists at the current three domestic smelters, even assuming Grupo Mexico reactivates its idle Hayden plant in Arizona.

“High-quality copper scrap” will also be subject to a 25% minimum domestic sales requirement to stimulate domestic recycling.

The European Union is also considering export quotas on recyclable copper to stop what it calls “scrap leakage.”

The prime target is China, which is the world’s largest buyer of secondary raw material.

The country imported 2.25 million tons of copper scrap in 2024, the highest annual total since 2018, the year before authorities tightened up the purity specifications on imported material.

Imports have already slowed this year thanks to a 42% drop in shipments from the United States due to the high CME price premium.

Growing resource nationalism in the global scrap market promises profound structural changes in the flow of recyclable materials.

Can we have our copper back now?

But not for refined copper, which is what everyone was expecting.

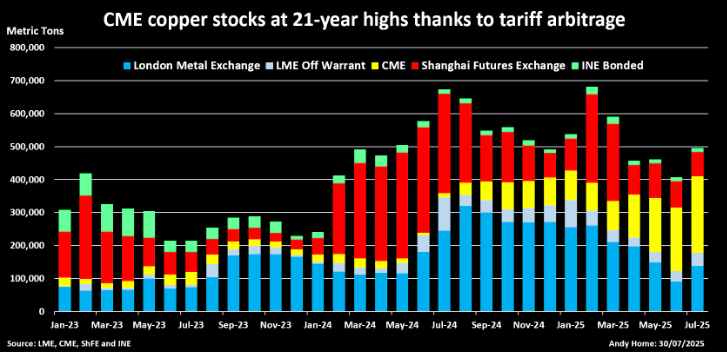

Big trade houses have shipped over half a million tons of copper to the United States for a trade that is now redundant, even if it was a bonanza for those involved.

CME warehouses currently hold 232,195 tons of copper, which is the highest tonnage since 2004. Metal is still arriving daily thanks to the last-minute dash to beat what traders thought was the August 1 deadline.

The supply chain in the rest of the world is still compensating for the huge suction effect created by the prospect of tariffs.

China exported almost 260,000 tons of refined copper between March and June, compared with 78,000 tons in the prior four-month period.

Some of it was delivered against a short squeeze on the London market created by the raid on LME stocks for US-deliverable brands of copper.

China’s surging export flows have depleted Shanghai Futures Exchange stocks, which have fallen to 73,423 tons, the lowest level since December.

While the futures tariff trade has collapsed overnight, the physical supply chain will take longer to readjust.

Analysts are already running the numbers to gauge whether it makes sense for copper to reverse flow back out of the United States.

Same time next year?

Is that it for the copper tariff trade?

Probably not, given the explicit reference to the option of a phased tariff on imports of refined copper, starting at 15% in 2027 and rising to 30% in 2028.

It will depend on an update on the state of the domestic market by Commerce Secretary Howard Lutnick scheduled for the end of June next year.

It also depends, of course, on whether Trump changes his mind again before then.

You never know with Tariff Man.

source: mining.com

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

EverMetal launches US-based critical metals recycling platform

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

South Africa mining lobby gives draft law feedback with concerns

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014