Troilus lands second offtake deal with major European copper producer

According to me-metals cited from mining.com, Together, these partnerships further validate the quality of Troilus’ anticipated concentrate and highlight the project’s strategic importance within the European critical minerals supply chain, the company stated in a press release.

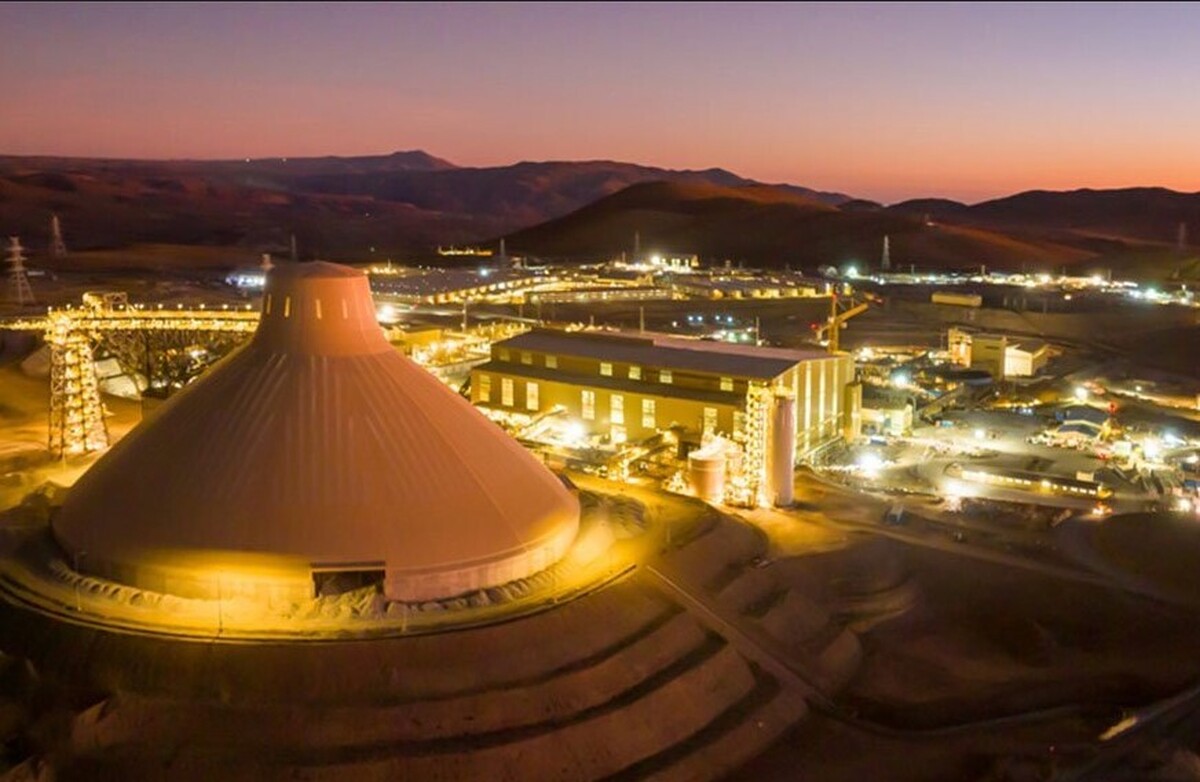

Troilus is currently focused on bringing the former copper-gold mine of the same name in north-central Quebec back into production. The historic mine located in Val-d’Or district had previously produced nearly 70,000 tonnes of copper between 1996 and 2010.

Large copper asset

With mineral reserves of 6 million oz. gold, 484 million lb. copper and 12 million oz. silver, the Troilus project represents one of the largest undeveloped copper-gold assets in North America.

As outlined in its 2024 feasibility study, the restarted mine is expected to have average annual production of approximately 135.4 million lb. in copper equivalent, or 75,000 wet metric tonnes of concentrate containing payable copper, gold and silver.

“We are proud to welcome one of Europe’s most respected mining and smelting companies as an offtake partner, renewing a long-standing relationship that began during Troilus’ past-producing years, when Boliden processed some of the site’s original concentrate,” Justin Reid, CEO of Troilus Gold, commented on the new partnership.

As with the Aurubis offtake, the agreement with Boliden is expected be made binding upon completion of the project’s broader $700 million debt financing package, which is being structured by a syndicate of global financial institutions including Société Générale, KfW IPEX-Bank and Export Development Canada. The financing is also expected to receive support from European export credit agencies including those from Finland and Sweden.

Environmental review

Last month, Troilus’ project reached a major milestone after the company submitted its environmental and social impact assessment (ESIA) with both the Quebec and Canadian governments.

The ESIA, which follows five years of studies and community engagement, “not only derisks the project, but also reinforces our long-standing commitment to sustainable development,” Reid said in a June 26 release.

It is anticipated that final decisions of the ESIA review will be made by year-end 2026.

Shares of Troilus Gold traded 0.7% higher at C$0.70 apiece by market close Thursday, for a market capitalization of nearly C$280 million.

source: mining.com

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

EverMetal launches US-based critical metals recycling platform

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

South Africa mining lobby gives draft law feedback with concerns

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014