Gold surpasses euro as second-largest reserve asset: European Central Bank

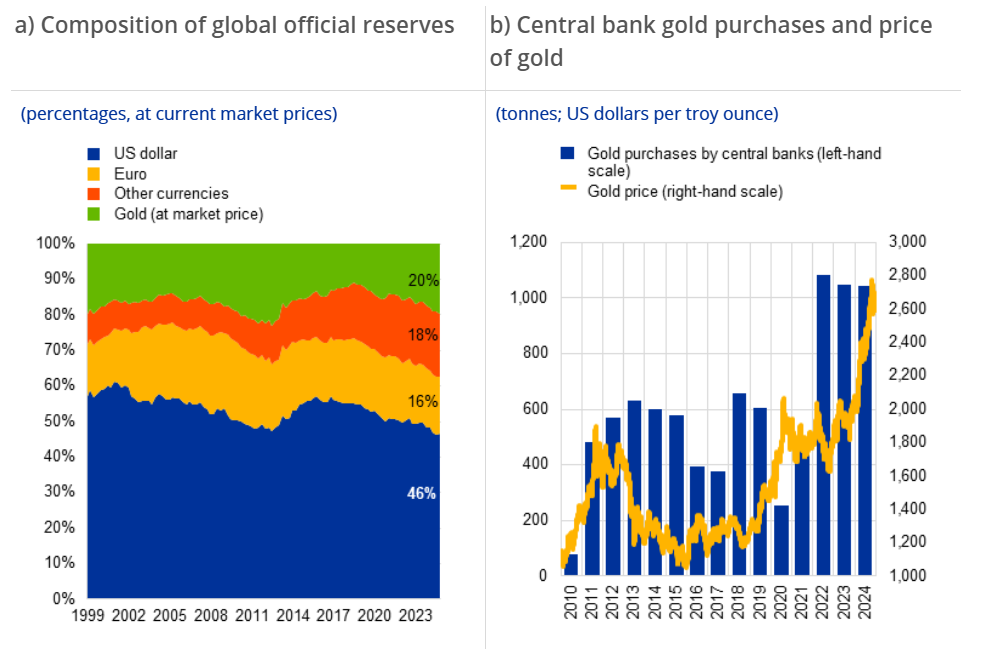

According to me-metals cited from mining.com, According to ECB’s annual currency assessment published Wednesday, bullion made up about 20% of the global official reserves at the end of 2024, surpassing the euro’s 16%. The US dollar, meanwhile, maintained its large lead at 46% but continued to see steady declines.

“Central banks continued to accumulate gold at a record pace,” the bank wrote, noting that 2024 was the third year in a row in which gold purchases surpassed 1,000 tonnes — twice as fast as the decade of the 2010s.

The amount of gold held by central banks worldwide is approaching historic highs last seen in the Bretton Woods era. In the mid-1960s, central bank holdings peaked at roughly 38,000 tonnes, while 2024 gold reserves totalled 36,000 tonnes, the ECB report showed.

According to the World Gold Council, the largest buyers of gold last year were Poland, Turkey, India and China, which together accounted for about a quarter of the global purchases.

The ECB attributes the rise in gold’s share in foreign reserves to the surge in the metal’s price, which rose nearly 30% during 2024 and continued to rally this year, setting a record high of $3,500 an ounce in April.

De-dollarization movement

ECB economists also pointed to rising geopolitical tensions as a major driving force behind some central banks’ motivation to diversify away from the dollar and into bullion.

“Gold demand for monetary reserves surged sharply in the wake of Russia’s full-scale invasion of Ukraine in 2022 and has remained high,” they wrote, noting that gold has historically been used by nations as a hedge against potential sanctions since 1999.

A survey conducted by ECB showed that two-thirds of central banks invested in gold for purposes of diversification, while two-fifths did so as protection against geopolitical risk.

“Countries that are geopolitically close to China and Russia have seen more marked increases in the share of gold in their official foreign reserves since the last quarter of 2021,” the bank said, emphasizing that geopolitical risks have led to the de-dollarization trend seen in many developing nations.

ECB’s analysis also found that the longstanding inverse relationship between gold prices and real yields broke down in 2022 as central banks began buying bullion as insulation from sanctions risk.

Geopolitics could continue to keep central banks’ gold holdings elevated in the coming years, as ECB’s survey suggests that 80% of official reserve managers consider this as a key decision-making factor for the next 5-10 years.

source: mining.com

Energy Fuels soars on Vulcan Elements partnership

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Critical Metals signs agreement to supply rare earth to US government-funded facility

Kyrgyzstan kicks off underground gold mining at Kumtor

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility