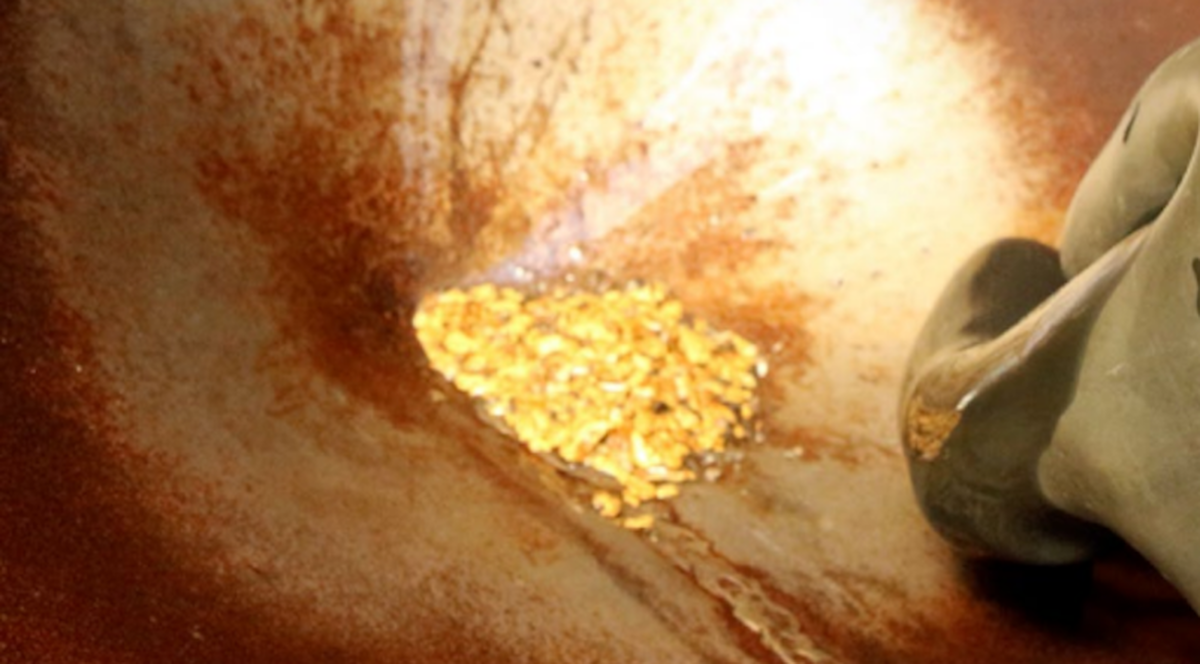

Gold price inches higher with spotlight on US-China trade talks

According to me-metals cited from mining.com, Spot gold rose 0.4% to $3,324.21 an ounce as of 11:20 a.m. ET, after dropping below the $3,300 level earlier in the session. US gold futures fell 0.1% to $3,343.40 per ounce.

Meanwhile, the US dollar remained subdued, keeping gold relatively cheaper for buyers.

Market participants are keeping a close eye on the US-China trade talks that are taking place in London. Last month, the two sides had agreed to a temporary pause, providing some relief to investors.

“In the short term, if there is a positive outcome of the meeting, it could be a little negative for gold, but not too much,” Bart Melek, head of commodity strategies at TD Securities said in a note.

“I think a weaker economy, likely interest rate cuts and lower momentum on the risk appetite side is getting people to move into gold. And, of course expectations of higher inflation.”

Investors also await US Consumer Price Index (CPI), data due on Friday, to assess the country’s economic health and predict the Federal Reserve’s rate cut trajectory.

Data over the weekend showed that China’s central bank added gold to its reserves for the seventh straight month in May.

Elsewhere, platinum extended its rally to reach its highest since May 2021.

source: mining.com

Energy Fuels soars on Vulcan Elements partnership

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Critical Metals signs agreement to supply rare earth to US government-funded facility

Kyrgyzstan kicks off underground gold mining at Kumtor

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility