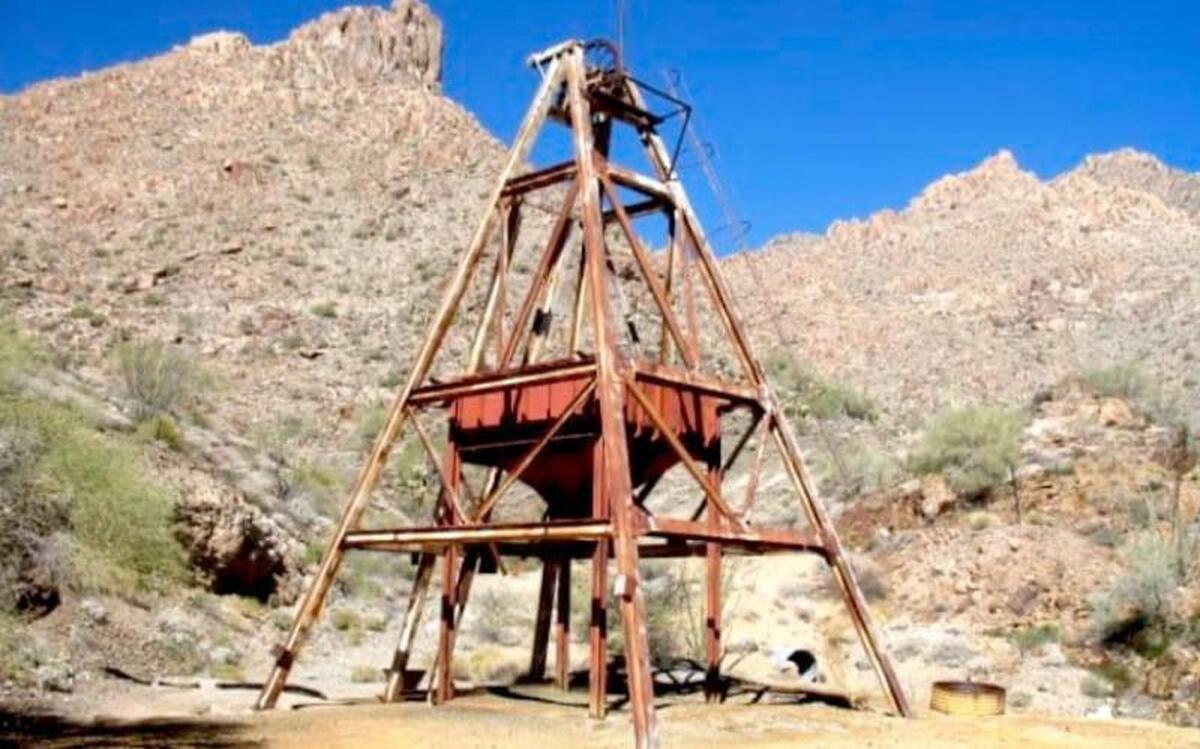

Galantas strikes JV deal to revive Omagh gold mine in Ireland

According to me-metals cited from mining.com, The Canada-based junior called the deal a “turning point” for the high-grade project, which operated as an open-pit mine until 2013.

Under the binding term sheet, Ocean Partners will convert about $14 million in existing debt into an 80% stake in Galantas subsidiaries Flintridge Resources and Omagh Minerals, which jointly hold the Omagh asset. Galantas will retain a 20% interest, with the option to convert it into a royalty.

Ocean Partners will also invest an initial $3 million to fund exploration, restart planning and cover administrative costs over a one-year term. Galantas will be free-carried during this phase but may choose to participate pro rata in future funding, including a potential second-phase investment of $5 million.

The agreement allows Ocean Partners to convert an additional $1 million in remaining debt into a 0.001% interest in Flintridge once mining resumes.

“This transaction enables Galantas to benefit from renewed production at Omagh while strengthening the company’s balance sheet,” chief executive officer Mario Stifano said. He added that Galantas would receive gold production once operations resume, while also advancing its Gairloch gold-copper VMS project in Scotland.

The joint venture plans to launch a drill program targeting high-grade zones such as the Joshua Vein and testing the northern extension of the Kearney Vein.

From Ireland to Scotland

The transaction requires shareholder approval and constitutes a “fundamental change of business” under market rules, as Galantas is effectively transferring control of its main operational assets.

The company said that, despite the shift, it will remain listed on the London Stock Exchange’s Alternative Investment Market (AIM) and will not be classified as a cash shell.

If approved, Galantas will shift its primary focus to the Gairloch project in Scotland, where it plans to initiate a maiden resource estimate and begin drilling.

Galantas has a one-year option to convert its 20% stake in the Omagh entities into a 3% net smelter return (NSR) royalty. Ocean Partners holds a buyback right for half of that royalty at $8 million.

If Galantas doesn’t exercise the option and its stake falls below 10%, its interest will automatically convert to a 1.5% NSR royalty, half of which Ocean Partners can repurchase for $4 million.

Ocean Partners chief executive officer, Brent Omland, is also a Galantas director and a shareholder and director of Ocean Partners’ parent company, making Ocean Partners a closely associated entity under EU market abuse regulations.

Omagh’s underground development was paused in 2017 until local police (PSNI) were able to increase availability of anti-terrorism cover.

Blasting activities were halted again in the late 2019 mainly because of limitations imposed by the PSNI. Ore production was then suspended in 2020 due to insufficient funds and the impact of the global pandemic.

Gold mining companies operating in Northern Ireland secured an agreement with the government in 2021, granting them free policing linked to the handling of explosives. The move allowed them to speed up sampling and project development.

source: mining.com

Energy Fuels soars on Vulcan Elements partnership

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Critical Metals signs agreement to supply rare earth to US government-funded facility

Kyrgyzstan kicks off underground gold mining at Kumtor

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility