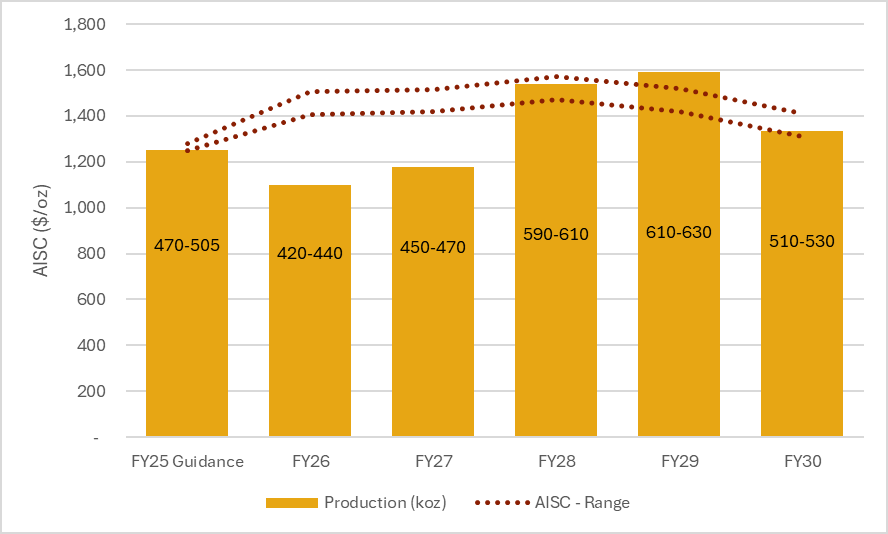

Perseus forecasts 2.7 million oz. gold production over five years

According to me-metals cited from mining.com, The five-year outlook covers Perseus’ three existing mines — Edikan in Ghana, and Sissingué and Yaouré in Côte d’Ivoire — as well as the Nyanzaga project in Tanzania that is scheduled to begin mining in early 2027.

The largest contributor over the five years will be Yaouré, accounting for one-third of the projected total production of 2.6-2.7 million oz. The mine, which entered commercial production in March 2021, is expected to produce 210,000 oz. annually over a 12-year mine life.

Meanwhile, the Edikan mine — Perseus’ first producing asset — is expected to make up 28% of the group’s gold production until FY2030, while the Sissingué gold complex would provide 10% of its output. The recently committed Nyanzaga project in Tanzania is anticipated to contribute the remaining 28%In its press release Wednesday, the Australian miner said it “has strong confidence” in its ability to deliver on this five-year outlook, underpinned by a mine plan with high geological and technical certainty, with 93% of the production forming part of the existing ore reserves.

Total development capital of $878 million has been allocated to the operating assets during the period to achieve this production outlook, it added.

Short-term setback

In 2023, Perseus delayed its Meyas Sand project in Sudan to prioritize the development of Nyanzaga instead, a decision it says would drop its annual gold output below 500,000 oz. in 2026 and 2027. The company first achieved that annual production target in FY2022.

CEO Jeff Quartermaine said in a news release. “It is clear that this is a temporary setback and that Perseus’s strategy of consistently producing between 500,000 to 600,0000 oz. of gold per year at a cash margin of not less than $500/oz., is eminently achievable,” CEO Jeff Quartermaine said in a news release.

“With cash and undrawn debt capacity currently exceeding $1.1 billion, Perseus is fully funded to not only deliver the five-year outlook as presented today but also consider a prudent mix of future growth opportunities beyond the current plan,” he added.

Perseus Mining’s Toronto-listed shares fell 5.3% to C$3.24 apiece by 12:30 p.m. ET on the five-year outlook, giving the company a market capitalization of C$4.45 billion ($3.26 billion).

source: mining.com

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Kyrgyzstan kicks off underground gold mining at Kumtor

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Kyrgyzstan kicks off underground gold mining at Kumtor

Ukraine launches tender for major lithium deposit

KoBold Metals granted lithium exploration rights in Congo