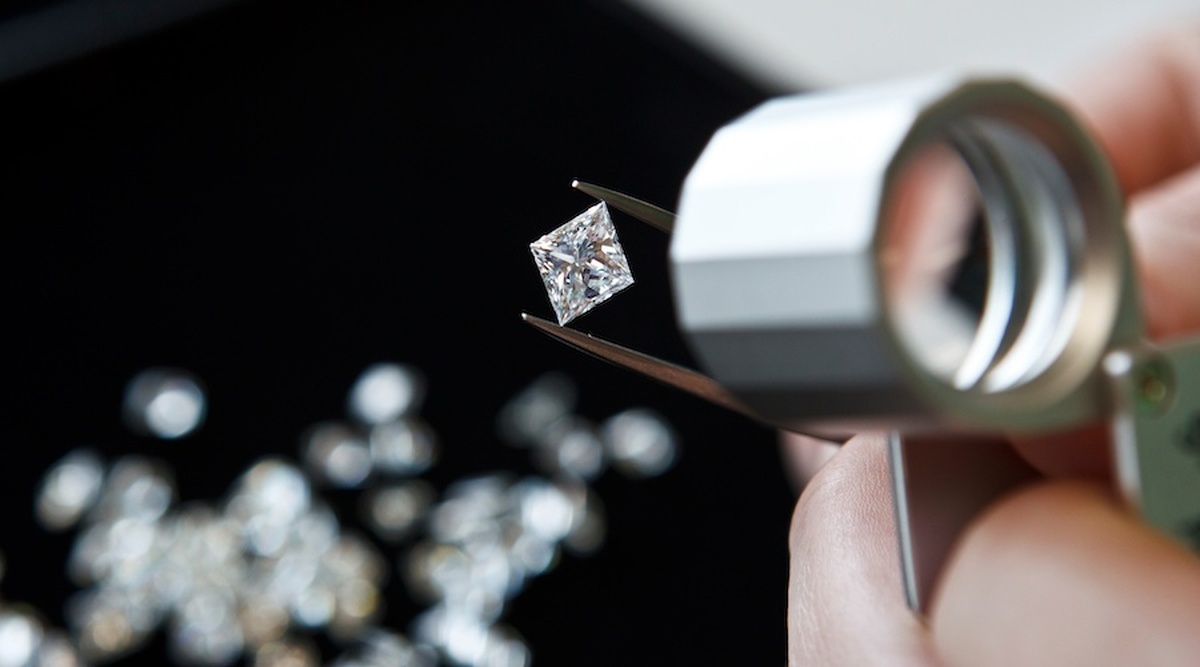

Former De Beers CEOs circle diamond giant as sale nears

According to me-metals cited from mining.com, De Beers, the world’s leading diamond producer by value, has been on the chopping block since May 2024, when Anglo announced plans to either sell the unit or launch an initial public offering (IPO). This decision came as part of a corporate overhaul triggered by Anglo’s successful defence against a £39 billion ($49 billion) takeover bid by Australian rival BHP (ASX: BHP).

Former De Beers bosses Gareth Penny and Bruce Cleaver are both leading groups that are potential buyers, as is Australian mining veteran Michael O’Keeffe, according to anonymous sources quoted by Bloomberg.

Penny is chair of Ninety One, an investment firm with over $175 billion in assets under management. Cleaver has served for nearly a year as chair and independent non-executive director at Gemfields (LON: GEM) (JSE: GML), which mines emeralds and rubies. O’Keeffe, who orchestrated the $3.7-billion sale of Riversdale Mining to Rio Tinto in 2011, currently sits on several mining boards, including Burgundy Diamond Mines (ASX: BDM), which operates Canada’s Ekati mine.

Other names rumoured to be interested in De Beers include billionaire Anil Agarwal, the chairman of Vedanta Resources, Indian diamond firms KGK Group and Kapu Gems, as well as Qatari investment funds.

Anglo American declined MINING.COM’s request for comments. Penny, Cleaver and O’Keeffe could not be reached.

Under pressure

The sale of De Beers comes amid unfavourable market conditions. Prices have fallen amid rising competition from lab-grown precious stones and weakening demand in China. In February, Anglo slashed the unit’s valuation for a second time, bringing it down to $4.1 billion. CEO Duncan Wanblad said at the time that De Beers might remain under Anglo’s ownership into 2026, depending on market conditions.

Recent figures highlight the severity of the crisis. De Beers reported a 44% revenue drop in the first quarter of the year and is sitting on $2 billion worth of unsold stock.

The company also plans to cut more than 1,000 jobs at its Debswana joint venture, according to the mine workers union, even though the operation is the backbone of Botswana’s economy.

source: mining.com

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook