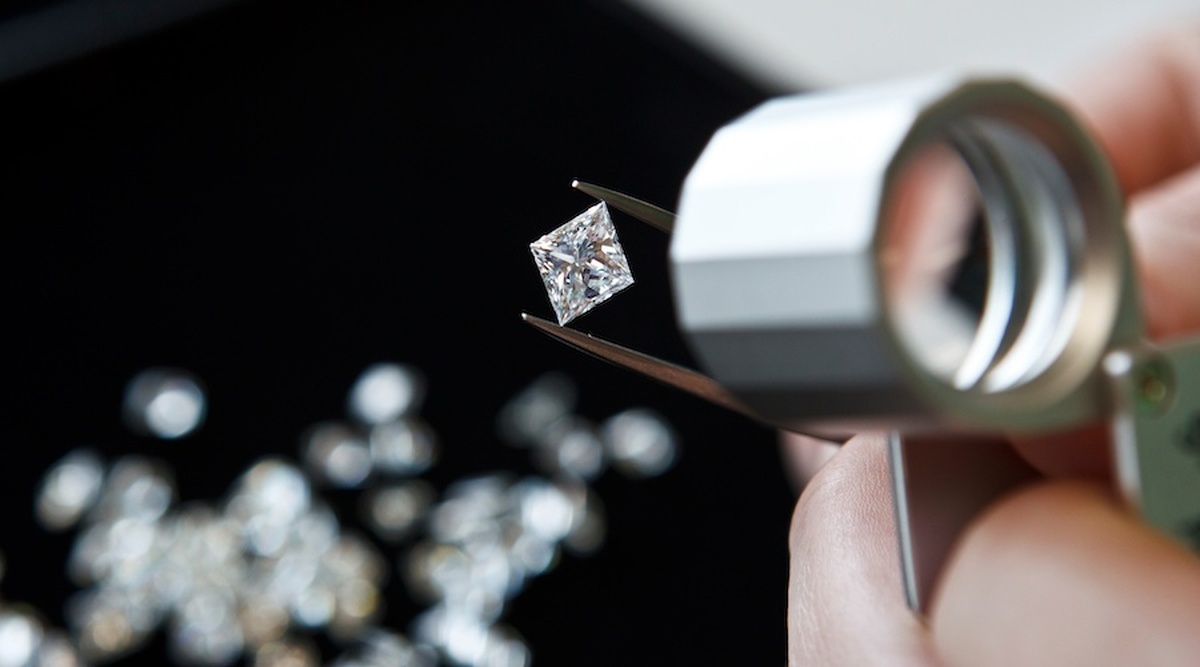

Alrosa plans production cuts and staff reduction for 2025

According to me-metals cited from mining.com, Marinychev, who was also added to the EU sanctions list, said the global diamond industry is in a “deep crisis,” with prices falling for the second consecutive year.According to the executive, the miner may reduce its labor costs by 10% in the coming year, which could include layoffs among its 35,000 staff.

“Certain areas that are less profitable, which are at the borderline of profitability, may be subject to suspension during this crisis period,” Marinychev told a local television station in the Yakutia region of Russia’s Far East, where most of Alrosa’s production is based.

He added that production in these areas could be quickly resumed if the market recovers.

“We are currently in a rather difficult situation. Our task is to endure and wait out this period, to wait for prices to start rising again,” Marinychev said.

Alrosa, which competes with Anglo American unit De Beers, stopped publishing sales data after Russia began its invasion of Ukraine in 2022.

By the end of that year, Alrosa’s production volume reached 35.5 million carats, a 10% increase year-on-year, accounting for over 90% of all Russian diamond production.

The Russian government regularly purchases diamonds from Alrosa through a state fund.

On Thursday, Deputy Finance Minister Alexei Moiseev said the country will continue to buy diamonds in 2025 to support the diamond industry and market.

The Russian budget for 2025-2027 has set aside $1.55 billion for the purchase of precious metals and gems, Moiseev said in a statement.

Russia will continue to ensure “stable global rough diamond prices in the wake of oversupply in the current market,” the statement read.

source: mining.com

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

Cochilco maintains copper price forecast for 2025 and 2026

Gold price stays flat following July inflation data

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Glencore seeks $13 billion in incentives for Argentina copper projects

HSBC sees silver benefiting from gold strength, lifts forecast

Hindustan Zinc to invest $438 million to build reprocessing plant

Samarco gets court approval to exit bankruptcy proceedings

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Afghanistan says China seeks its participation in Belt and Road Initiative

Gold price edges up as market awaits Fed minutes, Powell speech

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Abcourt readies Sleeping Giant mill to pour first gold since 2014

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Afghanistan says China seeks its participation in Belt and Road Initiative

Gold price edges up as market awaits Fed minutes, Powell speech

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper