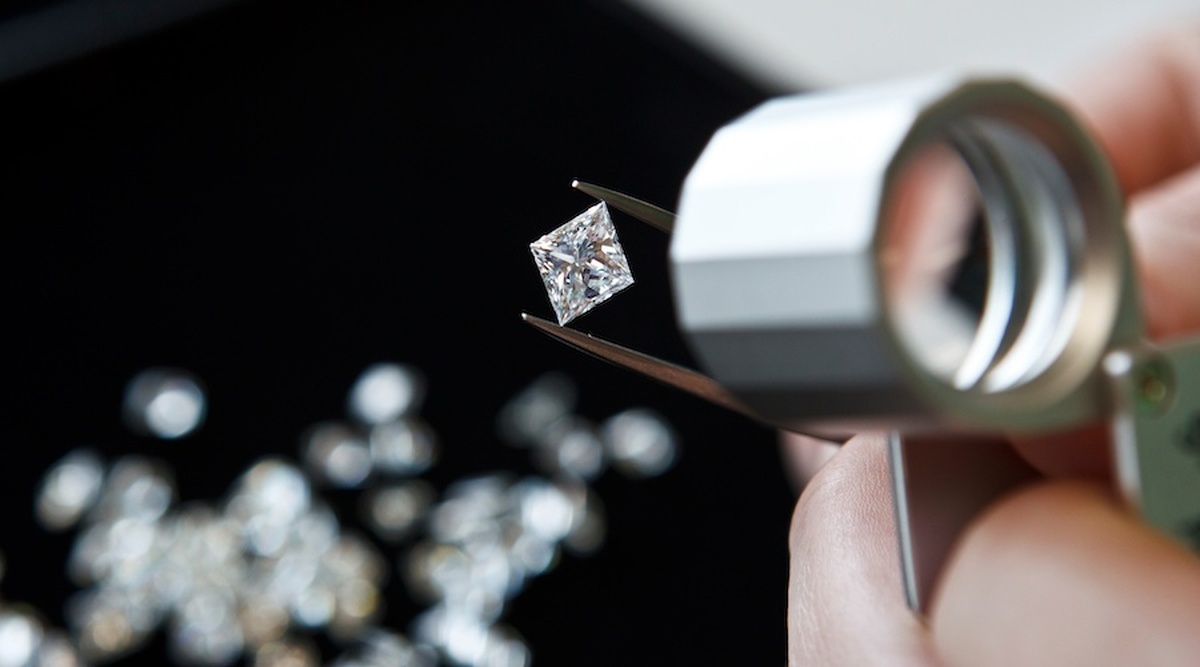

Lucara Diamond in the red as market conditions worsen

The figure is in sharp contrast with the $7.4 million in net income, or $0.02 in earning per share, the Vancouver-based producer reported in the same period last year.

Production for the quarter was in line with guidance. Lucara said it recovered 91,536 carats from 900,000 tonnes of ore mined, with eight diamonds greater than 100 carats each found in the period.

Lucara’s finds so far this year include an unbroken 549-carat white diamond of “exceptional purity”, dug up at its prolific Karowe mine in Botswana. That’s the same operation that last year yielded the 1,758-carat Sewelô (“rare find”), the second-largest diamond ever mined.

“Declared an essential service by the Botswana government on April 2, our Karowe mine continues to operate safely and at full production,” the company’s president and chief executive, Eira Thomas, said in a media release.

Cash flow, however, didn’t match production results. It totalled $2.4-million, compared with $10.6 million in the first quarter of 2019, largely owing to a weaker pricing environment and a decrease in revenue between the periods, Lucara said.

The company is evaluating how much cash flow expected from its operations it can put into the proposed $514 million underground expansion of Karowe. The project is expected to extend the operation’s life for 20 years — until 2040.

“Most of the previously approved capital spend of $53 million for the Karowe underground expansion project was scheduled to be invested in the latter part of the year and funded through cash flow from operations,” the company said.

“Given the uncertainty in global markets resulting from covid-19, these capital expenditures will be reduced until more certainty exists around Lucara’s cash flow projections,” it noted.

Diamond market distress

The diamond market began suffering from the effects of the covid-19 spread in early March, and measures to contain it have already pushed big and small miners over the edge.

The pandemic has already squashed diamond miners’ dawning hopes of a recovery in a sector already reeling from weak prices and demand since late 2018.

Russia’s Alrosa (MCX: ALRS), the world’s no.1 miner by carats, halted production this week at two of its assets, citing falling demand and sales for diamonds as the main reason behind the measure.

De Beers, the world’s largest producer by value cut 2020 production guidance by a fifth last month. It had earlier cancelled its April sales event.

Courtesy of Zimnisky Rough Diamond Index.

Canada’s Dominion Diamond Mines, the controlling owner of Ekati mine and a 40% partner to Rio Tinto in the Diavik mine, filed for insolvency protection in April.

South Africa’s Petra Diamonds (LON:PDL) has recently delayed interest payments to borrow $21 million in new debt, a crucial move to keep the company afloat.

Investment banks are increasingly reluctant to extend credit to diamond producers, as inventory is not being sold and defaults are possible, analysts have warned.

“We are concerned about oversupply of rough diamonds following the reopening of economies, as a lot of inventory could potentially be flooded into the system and the market might not be able to absorb all of it, resulting in increased pricing pressure,” Citi said in a note last week.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook