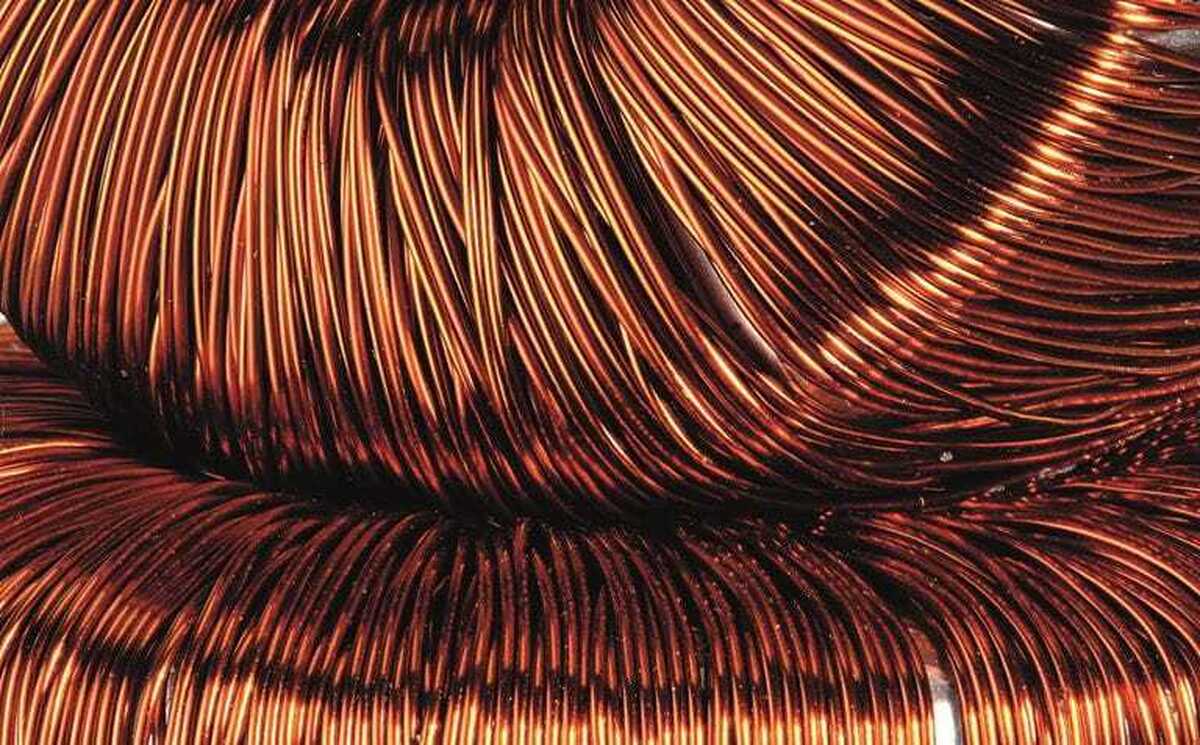

China copper market gauge hits 16-month high on demand flurry

According to me-metals cited from mining.com, The Yangshan premium — named after a key Shanghai trade terminal — jumped from a low of $35 a ton in late February to $94 on Tuesday, according to data from researcher Shanghai Metals Market.

The premium is paid by buyers on top of exchange prices for imported copper, and the sharp rebound reflects tightness in the market as trade tensions persist. Traders in China have reported a burst of strong domestic demand, and stockpiles in Chinese warehouses have plunged in recent weeks.

“The continuous destocking in the Shanghai region has kept Shanghai spot copper premiums firm,” ANZ Group Holdings Ltd. wrote in a note.

The threat of copper-specific tariffs has encouraged a large flow of metal to the US ahead of any duties, tightening markets elsewhere and spurring more competition for the industrial metal.

On the London Metal Exchange, copper has rebounded since its collapse during the wider market turmoil that followed US President Donald Trump’s unveiling of sweeping tariffs at the start of the month. The metal sank to its lowest in a year, triggering a wave of buying from China that helped lift prices.

LME copper rose 0.7% to settle at $9,440 a ton at 5:50 p.m. in London. Other LME metals were mixed, with aluminum rising 1.3% and nickel falling 0.4%.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts