Trump tariffs could reshape global copper landscape

According to me-metals cited from mining.com, A review of the US–Mexico–Canada Agreement (USMCA) was scheduled for 2026 but could be pulled forward since the tariffs would all but nullify the free trade accord signed by Trump during his first term in office.

In a note, the copper service of Benchmark Mineral Intelligence points out that if implemented (and that remains a big if because Trump tied the sanctions to border security) these tariffs will have reverberations not only across the copper value chain but also for end-use copper demand in the region. More so should Canada and Mexico decide that retaliation is the only option that remains.

While dwarfed by the energy and crude oil trade between the two countries, Canada is a major supplier to the US copper market. Given its widespread use, disruptions to copper supply could have many downstream effects, particularly in the automotive sector which constitutes the third largest portion of the more than $900 billion US-Canada yearly bilateral trade.

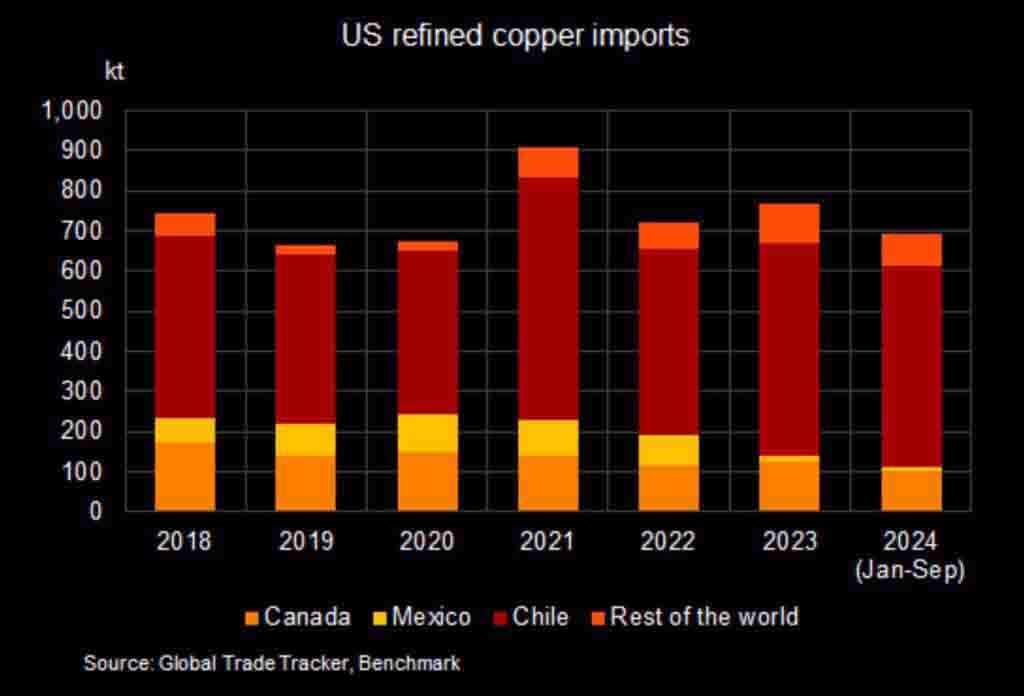

According to Benchmark, US imports of refined copper in 2023 totalled 767kt and in this year through September 2024, were at around 691kt. Most of the imports are from Chile, followed by Canada and Mexico.

Imports from Canada and Mexico were 128kt and 14kt, respectively, in 2023 representing around 16% of total US imports. The US also exported 33kt of refined copper last year (net of re-exports).

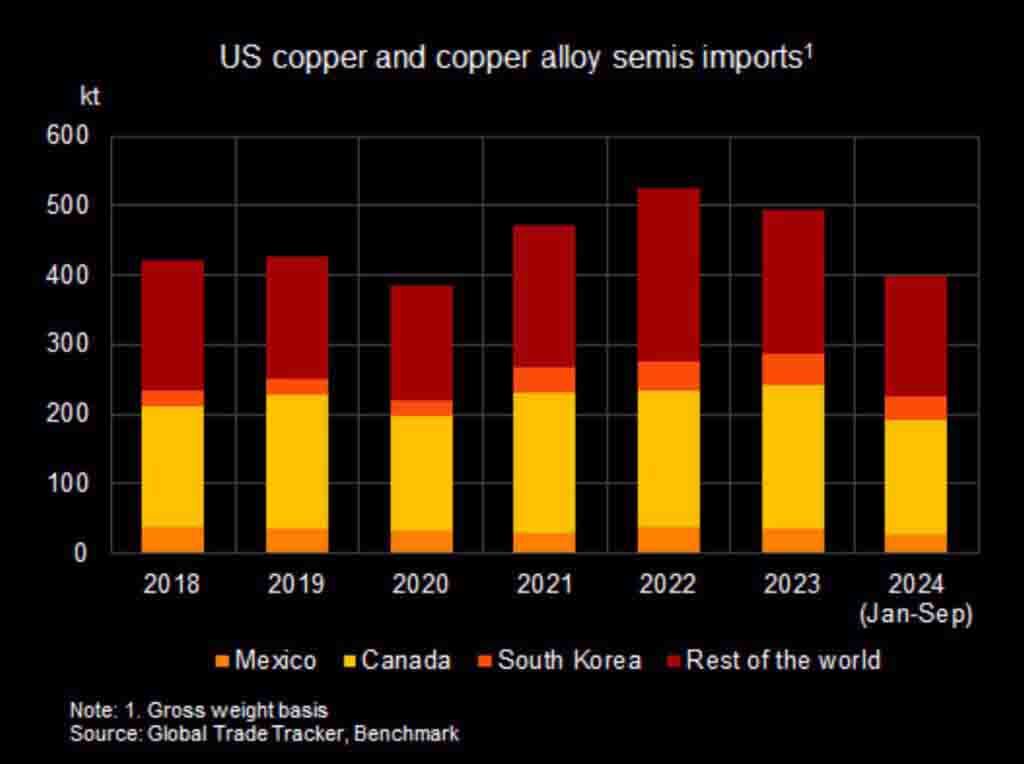

While Canada is a sizable supplier of cathodes, the country’s exports of copper and copper alloy semi-finished products to the US constituted a full 42% or 207kt of the total in 2023.

Benchmark says imports of semis from Canada are predominantly for copper wire rod with the country meeting over 80% of the US wire rod import requirements over the past decade.

Canadian and Mexican imports would likely not be cost-competitive at high tariff levels and would need to be procured from elsewhere for instance refined copper from Chile and semis from Korea, Japan or India, redrawing the copper landscape in the process, says Benchmark:

“Besides a rejig of trade flows, this should also in theory support domestic production with investment into production capability.

“IRA has shown that with the right incentives, US can build the domestic industry quickly and compete with the imports.

“However at the moment, no rincentives are proposed besides increasing the imported material costs for the US based manufacturers.

”Copper for delivery in March bounced on Tuesday trading at $4.20 in early afternoon trade in Chicago, up 1.7% on the day. The priceal e of the bellwether metal is still trading well below recent highs and is now trading 6% below levels held before the US presidential election.

Tuesday’s rise was ascribed to a weaker dollar and reports that Chinese importers are reluctant to buy US scrap given the uncertainty surrounding Trump, who has threatened to add to already punitive levies on Chinese exports.

So far this year China imported some 300kt of copper scrap from the US, supplying over 17% of China’s annual demand and making the US the top scrap exporter to the country.

Benchmark says the situation is reminiscent of 2018, when China raised tariffs on US-origin copper scrap to 25% in response to Trump’s trade war with the country.

This time around the US may decide to restrict exports of secondary copper to feed the domestic industry and make up for any shortfall due to disruption caused by tariffs on its closest trading partners.

source: mining.com

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

Minera Alamos buys Equinox’s Nevada assets for $115M

Adani’s new copper smelter in India applies to become LME-listed brand

OceanaGold hits new high on strong Q2 results

Cochilco maintains copper price forecast for 2025 and 2026

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

De Beers strikes first kimberlite field in 30 years

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%