Millennial mining heirs bet the family business on Argentine copper

According to me-metals cited from mining.com, For the son of a wealthy mining mogul, this was something of an initiation. He spent the summer hunting for gold — shadowing grizzled prospectors and geologists, bushwhacking through the Boréal forest. He even dug holes for where the outhouses would go. “I just wanted to be kept busy,” he said.

Adam, 37, is now the chairman of Lundin Mining Corp., a publicly traded Canadian metals producer. His younger brother, Jack, 34, is the company’s chief executive officer. The Lundin boys, as they are known in Canada’s tight-knit mining circles, are the two middle sons of Lukas Lundin, a hard-driving magnate who inherited the business from his own father.

As the world races to build more clean energy products, many of the key companies that control vast quantities of critical minerals are family-owned, and the Lundin boys are part of a new generation taking the reins. They were groomed to inherit a commodities empire — copper, nickel and zinc mines across the Americas and Europe — along with a family fortune estimated at $7.3 billion, according to data compiled by Bloomberg News.

But unlike other mining families, the Lundins aren’t controlling shareholders. Together with their two brothers, Will and Harry, they own a collective 15.4% of Lundin Mining, making them the firm’s second-biggest shareholder.

“We’re doing this because we want to,” said Jack. “Not because we have to.”

In their twenties, Jack and Adam were put in charge of smaller outfits to test their business savvy. Jack was tasked with managing Lundin Gold Inc.’s project in Ecuador, while Adam steered Filo Corp., a copper project in Argentina. They were each appointed to boards of other Lundin-owned companies before eventually joining the upper ranks at Lundin Mining. Now, they rise at 5 a.m. most days to track European commodities markets.

Through a family trust managed out of Geneva, Switzerland, the Lundins are also top shareholders in nearly a dozen other commodities companies, including Botswana-based diamond driller Lucara Diamond Corp. and ShaMaran Petroleum Corp., an oil explorer with assets in Iraq.

Few in the industry were surprised to see Adam and Jack take over from their father, but it happened sooner than expected, after Lukas died suddenly of brain cancer in 2022. Two years later, they’re betting big on Argentina, where they’ve secured access to vast deposits of copper — putting them on the front lines of a frenzy for natural resources in the inflation-wracked country.

“As the world moves to electrify, we’re all going to need a lot more copper,” Adam said from his Vancouver office, overlooking the city’s jagged Pacific coastline. “We can play a big role in that.”

The bet on a metal in a country that has yet to really produce much of it is in keeping with tradition: The Lundins built a reputation for going to places that few others were comfortable venturing.

Adolf H. Lundin was a Swedish wildcatter who made a fortune from the 1976 discovery of a natural gas field off the coast of Qatar. In Europe’s staid commodities world, his swashbuckling business ventures brought him fame and controversy. He invested in gold projects in apartheid-era South Africa and oil drilling in Sudan while the country was ravaged by civil war. (To this day, the family’s defunct petroleum business is the subject of Sweden’s largest-ever criminal prosecution, concerning human rights abuses in Sudan.)

He was an “inveterate gambler, who always believed the riches were right around the corner,” said Pierre Lassonde, a Canadian mining financier and co-founder of Franco-Nevada Corp. “Drank his own liquor plenty,” he added.

Lukas’s brother Ian went into oil, exploring for petroleum sources in Africa and Europe. Lukas, meanwhile, helped expand the family business into mining through dealmaking that netted a sprawling portfolio of mines. He resettled to Canada in the late ‘80s, as Vancouver became a hub for mineral explorers and developers.

Appetite for adventure runs in the family — Lukas was a four-time motorcycle competitor in the Dakar rally and climbed Mount Kilimanjaro twice. Within months of his death, Jack climbed Mount Everest to pay homage. Earlier this year, he completed a 75-mile, eight-hour cycling race through British Columbia.

To build a copper mining district in Argentina, the brothers will have to navigate the raucous politics and economic vagaries of one of the more volatile countries in South America. The country’s new president, Javier Milei, has promised to ramp up resource extraction to help grow the economy.

“It’s a big bet,” said Martin Pradier, an analyst at Veritas Investment Research Corp. “They’re not just betting on this government. They’re betting on the next 10 governments.”

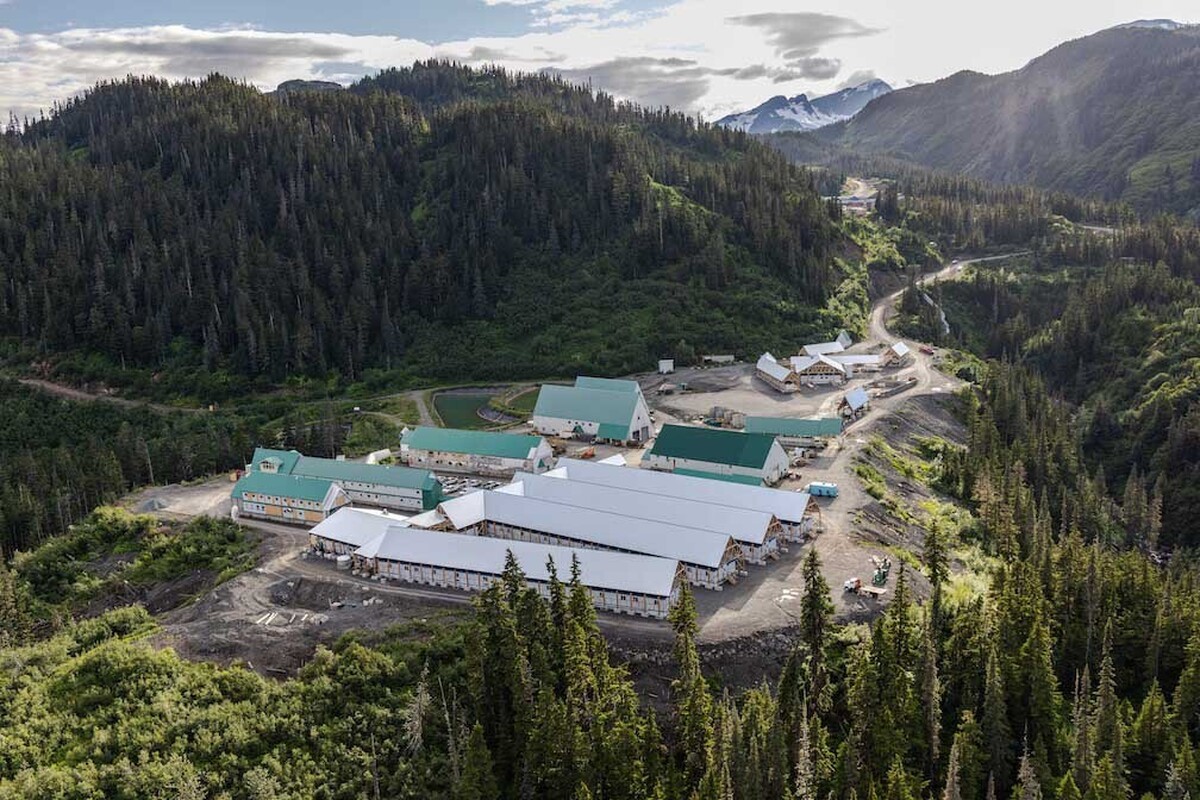

Mine-building is notoriously challenging, rife with uncertainty and cost overruns. Nowadays, most miners would rather acquire already-built operations than take on the risks of constructing new ones. The Argentine projects are located in the San Juan Province, a largely depopulated region defined by the Andes mountains and vast, arid desert. There are few roads and sparse access to the electrical grid. “You have to build roads, you have to get people to live at the base of the mine,” said Pradier.

The brothers have sought to manage risk with outside help. In July, they recruited BHP Group Ltd., the world’s top mining firm, to take 50% ownership of the Argentine project, forming a joint venture to build the district.

After Milei’s inauguration in January, Jack and Adam flew to Buenos Aires to meet with the new president and discuss the resource sector’s role in stabilizing a country rife with inflation and investor apprehension.

They emerged from the meeting with a selfie — Jack and Adam on either side of the new president, giving two thumbs up. And a few months later, Milei unveiled a sweeping package of tax, currency and customs benefits for major investors.

“It’s the best window I’ve seen in Argentina — ever,” said Adam.

source: mining.com

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

NextSource soars on Mitsubishi Chemical offtake deal

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Australia weighs price floor for critical minerals, boosting rare earth miners

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF