Rio Takes step toward M&A redemption with $6.7 billion lithium bet

According to me-metals cited from mining.com, Now — after billions in charges, cost cuts, plus several chief executives and multiple false starts — the miner has returned to the M&A fray, announcing the agreed $6.7 billion acquisition of Arcadium Lithium Ltd. this week.

Modest by comparison with past splurges, the all-cash deal is a significant and long-awaited expansion of Rio’s bet on lithium, a metal other diversified miners have stayed away from, worried about geological abundance among other factors.

It also marks a clear step back toward acquisitive growth.

“The development of the Arcadium acquisition was years in the making,” said Kaan Peker, analyst with RBC Capital Markets LLC. “Eventually, as we’ve seen over the course of the last couple of months, it was driven by a cyclical bottoming of the lithium price.”

The mining sector across the board is only just beginning to shift its focus to expansion and deals. For years after the last frenzy soured, shareholders demanded only better returns. But while rival BHP Group tested the waters since 2022, with the move for OZ Minerals Ltd. — and eventually bid unsuccessfully for Anglo American Plc, earlier this year — Rio has held back.

People familiar with the matter have long pointed to cumbersome internal structures and a conservative approach from chief executive officer Jakob Stausholm, who was chief financial officer until the 2020 ousting of his predecessor provided an unexpected opening at the top. Public comments pointed away from deals.

But it’s also true that the miner struggled with an issue that has dogged other large peers like BHP. When profit comes overwhelmingly from vast iron ore mines, it is hard to find additions that are lucrative — and sizeable — enough to move the needle. Copper is expensive and hard to find. Energy-transition friendly metals like lithium, used in batteries, tend to be smaller scale, with plenty of value in the processing and not just extraction.

Even with China’s sputtering economy, the profit margin for Rio’s Pilbara iron ore operations was 67% in the first half of 2024.

Battery bet

Rio has significant additional copper and iron production due from Oyu Tolgoi in Mongolia and Simandou in Guinea, respectively. Still, its answer to the question of where new, greener growth will come from has been lithium.

The path has not been smooth. Efforts to invest in new materials through private equity-inspired unit Rio Ventures, starting in 2017, went virtually nowhere and attempts to buy into lithium heavyweight SQM around that time were also thwarted. Projects too have stumbled, with Jadar in Serbia, Stausholm’s early bet, turning for a time into a local cause celebre.

“There were some people in Rio that were very disappointed they didn’t buy the stake in SQM. If you look back at Rio in those days they weren’t really ready,” said George Cheveley, portfolio manager at Ninety One UK Ltd.

“Since Jakob became CEO, he has been fixing internal problems and projects that were stuck. Operationally, we’ve seen them hit their targets. Now to be moving into lithium and getting back to M&A is the obvious next step. You can see him rebuilding the company back to where it was.”

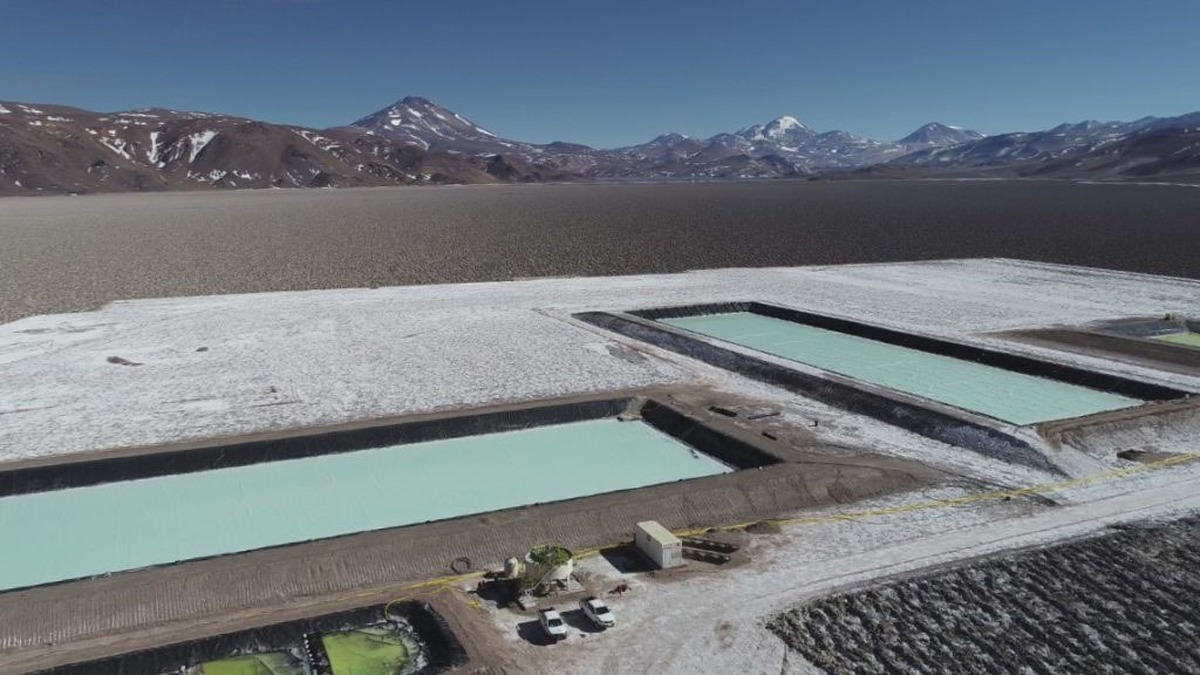

Rio completed its $825 million purchase of the Rincon project in Argentina in 2022, but it was the collapse of lithium prices since the end of that year that opened up more avenues for M&A, with many new suppliers struggling to stay afloat.

The second-largest miner has seized the opportunity, and investors are cautiously welcoming a move that brings future production — Arcadium is projected to be the world’s third-largest producer by 2030 — but also technological nous, particularly in direct lithium extraction, or DLE, which could turbocharge output.

“We are happy Rio’s CEO Jakob Stausholm showed discipline and waited for the right time; makes a lot of sense and Arcadium is a nice add-on,” said Matthew Haupt, a portfolio manager at Wilson Asset Management Ltd. in Sydney, who holds both Rio and Arcadium.

Others echoed the sentiment — even with a premium to the undisturbed price of 90%, hefty despite the halving of Arcadium shares this year.

“You could almost say it’s akin to what BHP did last year when they bought OZ Minerals. Go out there, do a deal that is a small percentage of your market cap, execute it and prove that you can buy well,” said Barrenjoey analyst Glyn Lawcock. “The question now is whether there’s more to come down the pipe after this.”

Still, Rio has work to do when it comes to convincing all its investors that it’s ready to get back to spending.

“If they indulge in large scale M&A, it’ll be a negative thing,” said Prasad Patkar at Platypus Asset Management. “I’m a little bit more comfortable with this transaction than I would’ve been with anything larger. Or any top-of-the-market stuff.”

A Rio spokesman pointed to Stausholm’s comments this week committing to remain disciplined in capital allocation, but declined to comment further.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts