Weekly : Indian Steel Market Snapshot

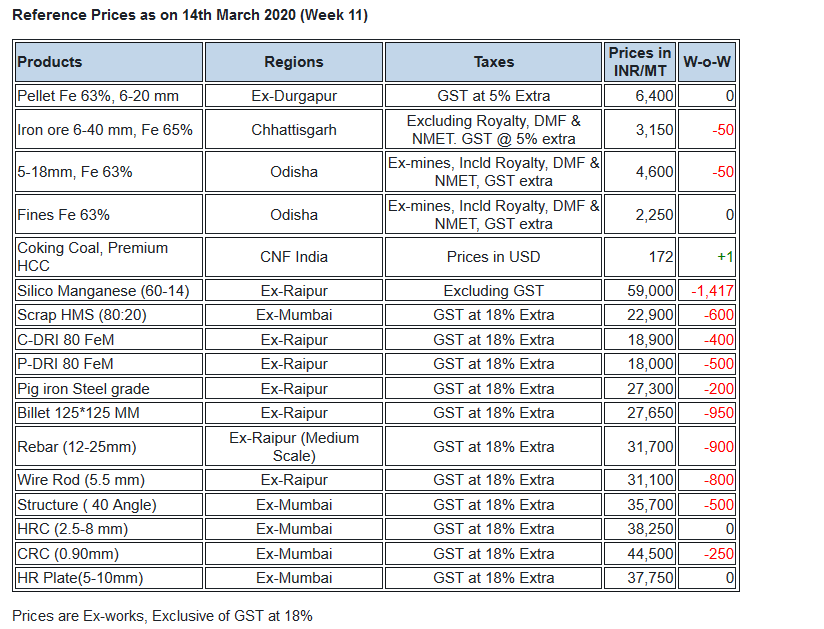

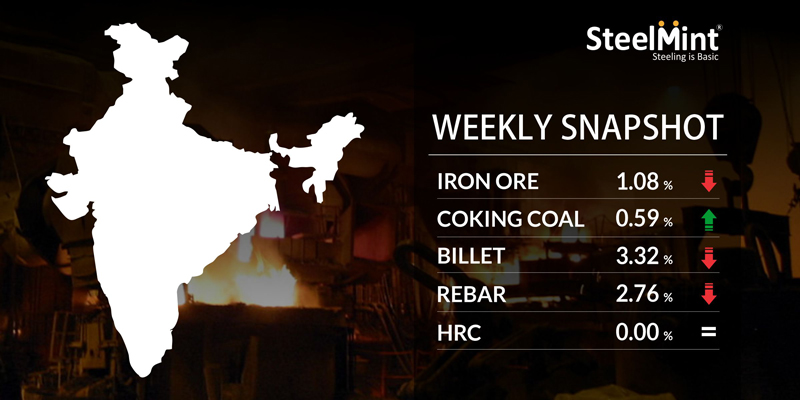

As per SteelMint's assessment, in these days the prices of Semis products - Sponge iron & Billet down by INR 400-1,500/MT (USD 5-17) & Finished Long steel upto INR 1,200/MT through the mid sized mills. Further, Flat steel prices have remained stable over limited trade in domestic market.

IRON ORE and PELLETS

Serajuddin- Odisha's major merchant iron ore mine was declined iron ore lump offers effect from 13 March for 5-18 mm (Fe 63%) by INR 500/MT to INR 4, 500/MT (ex-mines, including Royalty, DMF, & NMET). SteelMint's index for Odisha iron ore fines price for Fe 63% stands stable at INR 2,200-2,300/MT and that of 5-18 mm lumps at INR 4,500-4,700/MT (ex-mines, including Royalty, DMF & NMET). NMDC (C.G) heard to have lowered iron ore fines and lumps prices today (i.e 14 March) by INR 50/MT and DR CLO by INR 60/MT.

As per the reliable sources report to SteelMint, there is some sort of slow-down to place a new order, as the buyers are reluctant to place any fresh orders for the delivery of material by 31 March.

-- PELLEX down marginally by INR 50/MT to INR 6,600/wmt (DAP Raipur). Raipur based pellets makers concluded around 30,000- 40,000 MT deal at INR 6,400-6,500/MT to Raipur and outside Raipur based steel mills, normalizing for freight to Raipur at INR 6,550-6,650/MT (DAP Raipur).

-- Jamshedpur based pellet makers sold around 10,000 MT pellets at INR 5,900-6,000/MT ex-plant in the last couple of days. This week, Bellary based pellet maker sold around 10,000 MT pellet in the local market at around INR 6,900/MT Ex-plant.

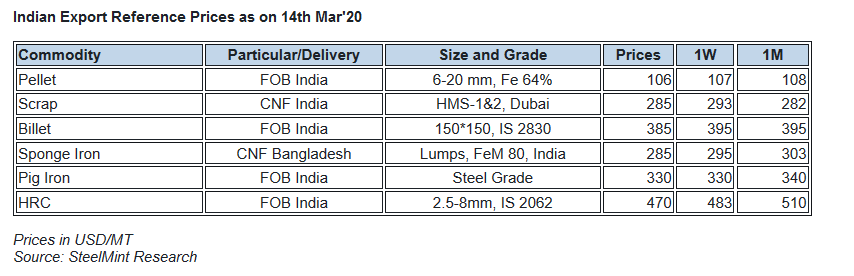

-- A central India based pellet maker has concluded a pellet export deal on 13 March for 55,000 MT Fe 64% grade pellets with 3% Al at around USD 104-105/MT, FoB India. SteelMint assessment for pellet export offer for regular grade pellets (Fe 64% and 3% Al) down by around USD 2/MT to around USD 115-117/MT, CFR China.

COAL

Seaborne coking coal prices for the premium low-volatile segment leaped higher this week on stronger bids for April and May laycan cargoes in the Asia-Pacific markets.

Higher firm bids were observed as buyers sought April and May laycan cargoes, expecting spot prices to be firm until supply concerns ease, with Australian key port terminals closed till Sunday due to weather-related disruptions. The China market observed little demand with mixed sentiments in the spot market as the steel market has yet to show significant improvement.

-- Latest offers for the Premium HCC grade are assessed at around USD 161.75/MT FOB Australia, USD 169.25/MT CNF China and USD 171.90/MT CNF India.

FERROUS SCRAP

Imported Scrap trades to India turned slow towards the end of week, with buyers turning cautious on account of ongoing fall in prices at the global level as well as the sharp hike in rates of containers.

Steelmint’s assessment for Shredded scrap from US/Europe stands at USD 300/MT CFR Nhava Sheva. Earlier in the beginning of the week, few bookings were reported for Shredded at around USD 302-303/MT CFR, post which the buyers are mostly waiting for more clarity on the global market. Offers for Shredded scrap now stand at USD 298-300/MT, CFR Nhava Sheva which is lower by USD 6-7/MT W-o-W.

-- HMS 1&2 (80:20) offers from UK stand at USD 270/MT CFR levels, while Australian origin HMS 1&2 (80:20) is being reported at around USD 278/MT CFR. Dubai origin HMS 1 (no ci gi) offers are now down to USD 290/MT CFR, while HMS 1&2 from Dubai is assessed at USD 285/MT CFR

-- SteelMint learned that Port Health Organization (Govt of India) has issued a notification regarding cargo vessels clearing at JNPT which are coming from COVID-19 impacted countries like China, Thailand, Hong Kong, Singapore, Japan, South Korea, etc and the vessels will be screened and declared 'suspect' or 'healthy' by the govt.

FERRO ALLOYS

-- Silico Manganese prices fell in both Raipur and Durgapur due to dull demand in the domestic and export market.

-- Ferro Manganese prices remained stable amid limited production and moderate demand in both the domestic and export market.

-- Prices of Ferro Chrome fell amid depreciation of Indian currency against US Dollars. Producers are looking for exports, meanwhile, buyers are negotiating for much lower prices in the domestic market.

-- Indian Ferro Silicon prices remained stable despite dull demand in the domestic market. Meanwhile, the export market remained near to absent.

SEMI FINISHED

This week, Indian Semi finished steel market observed less than average demand as Billet offers plunged in the range of INR 700-1,500/MT (USD 9-20).

While Sponge iron offers dropped by INR 400-900/MT and majorly in eastern India – Durgapur & Rourkela by INR 800-900/MT (USD 12) W-o-W. SteelMint learned that, improved supply amid weak demand in domestic & exports have led to significant drop in Indian domestic steel prices, specifically in eastern region.

Inline, Steel grade pig iron prices in Indian domestic market fell by INR 200-500/MT due to less demand from domestic buyers along with fall in local billet prices.

-- Indian sponge iron (80 FeM, 100% lumps) export offers drop by USD 10/MT to USD 270/MT CPT Benapole, equivalent to USD 285/MT CFR Chittagong, Bangladesh. As per sources about 5,000-7,000 MT deals concluded this week.

-- Indian mid sized mills export offers to Nepal down by USD 15/MT (W-o-W) and currently evaulated at USD 365/MT for Billet (induction grade, 100*100 mm) & USD 415-425/MT for Wire rod (commercial grade, 5.5 mm), ex-mill at Durgapur.

-- Jindal Steel has reduced steel grade pig iron price by INR 300/MT (W-o-W) to INR 27,000/MT ex-Raigarh, Central India.

-- SAIL’s Rourkela Steel Plant (RSP) has registered the highest production of hot metal from two of its blast furnaces in the month of February. The plant produced 2,29,704 MT of hot metal from Blast Furnace-5 and 82,300 MT from Blast Furnace-1, officials reported.

-- RINL had cancelled the invited e-tender for the export of 40,000 MT Bloom and 20000 MT Billets for end Mar'20 shipment, whose due date was on 03 Mar'20 due to lower bids than expectations.

FINISH LONG

Indian finish long steel prices of secondary mills have narrowed down over limited construction work due to the inappropriate presence of manpower owing to festive week (Holi) & the rebar price range has been contracted by INR 300-1,200/MT in most of the locations.

-- The trade reference rebar prices (12-25 mm) through midsized mills assessed at INR 31,700-31,900/MT ex-Raipur, INR 35,700-36,000/MT ex-Jalna & INR 34,600-35,000/MT ex-Chennai.

-- Raipur based heavy structure manufacturers have maintained trade discount by INR 200-400/MT and trade reference prices stood at INR 34,600-34,900/MT (200 Angle) ex-work.

-- Trade discounts in Raipur wire rod is currently at INR 700-900/MT and trade reference prices stood at INR 30,600-31,000/MT ex-Raipur and INR 30,800-31,300/MT ex-Durgapur, size 5.5 mm.

FINISH FLAT

This week Indian HRC prices remained range-bound amid absence of significant trades and bearish sentiments prevailing in domestic market. Market participants shared that prices are same as last week but transactions are very low since buyers have postponed their purchases.

Current trade reference prices of HRC (2.5-8 mm, IS2062) assessed at INR 38,000-38,500/MT ex-Mumbai, INR 38,000-38,500/MT ex-Delhi, and INR 39,000-40,000/MT ex-Chennai. The trade reference prices of CRC (0.9 mm, IS 513) stands at INR 44,000-45,000/MT ex-Mumbai, INR 42,200-45,000/MT ex-Delhi and INR 44,500-46,000/MT ex-Chennai. Prices mentioned above are basic, and extra GST@ 18% will be applicable.

Labours have not yet returned after Holi festival so expect some trades to pick up next week. Thus traders are trying to hold the prices and absence of discounts and rebates from major mills largely kept trade activities sluggish.

Barrick’s Reko Diq in line for $410M ADB backing

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Pan American locks in $2.1B takeover of MAG Silver

US adds copper, potash, silicon in critical minerals list shake-up

Gold price gains 1% as Powell gives dovish signal

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

Gold boom drives rising costs for Aussie producers

Giustra-backed mining firm teams up with informal miners in Colombia

US seeks to stockpile cobalt for first time in decades

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook