India: Chrome Ore Auction Prices Rise as Producers Start Stocking Before Mining Lease Expiry

Meanwhile, in November OMC reduced its base price by 33% due to the sluggish Ferro Chrome Market in India. However, it received an unparalleled response and the ores were booked at approximately 40% higher than the base price. Although the auction received much higher bids, yet it was comparatively lower to the October’s prices. OMC conducted the e-auction for the year on 24 Dec’19. The auction received an overwhelming response, as almost the entire quantity was booked at approximately 28% higher than the set base price. The quantity of Chrome Ore offered was significantly lower in the past two months from OMC.

With the ongoing auction of the Chrome Ore merchant mines, the producers remain worried about acquiring Chrome Ore in the future and will be mostly dependent on the OMC auctions. An Odisha based producer stated that with the changing of hands, the production of Chrome Ore may get disrupted for a longer period than what was being expected. It may take almost a year to normalize the mining process from the auctioned mines. The mines that were put under the hammer were BC Mohanty, Misirlall Mines, and TATA Steel Sukinda mines. Meanwhile, the acquiring companies need to ensure the availability of Chrome ore at a reasonable price to the Ferro Chrome manufacturers, comparable to the falling global market price. OMECL has acquired the TATA Steel’s Sukinda mines and the company needs to operate at efficient levels as the TATA steel.

Although we can already see the supply shortage of Chrome Ore in the market, it is expected to intensify. Meanwhile, the producers who were dependent on Chrome Ore from TATA steel for the conversion of Chrome Ore will also be participating in the auctions. Ferro Chrome manufacturers are concerned that it may be a situation of many monks and less porridge, even though the OMC reduces the base prices, the bid prices may keep getting higher due to aggressive bidding.

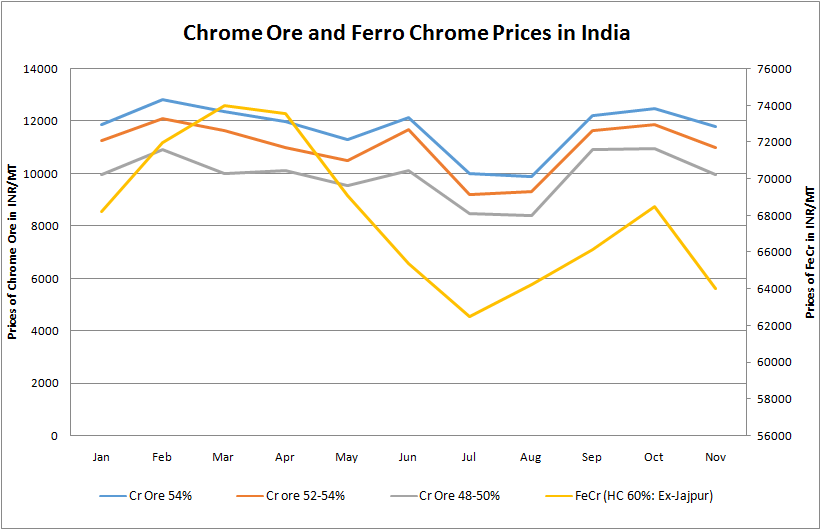

It is interesting to note that the Chrome ore prices in Jan'19 and Nov'19 were at the same levels, however, there is a huge difference in prices for Ferro Chrome for the same period. The prices of Ferro Chrome in January remained approximately higher by INR 10,000/MT than November 2019. Inventory of Chrome Ore with the buyers is not much and the producers are stocking up Chrome Ore amid expected severe supply disruptions in the coming months.

On the future outlook, the prices of Chrome ore in the auctions may remain firm and it is expected that OMC auctions may receive aggressive for quite a while now. Moreover, the concern over the supply of Chrome ore is strong among the ore suppliers and Chrome alloys producer.

Going ahead, the state-owned miners may have to look beyond the country and invest in mines that are outside India. Also, it opens doors for the up-gradation of the technology that is being currently used, so that low-grade ores can be consumed as well.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook