SolGold strikes again in Ecuador’s Andean copper belt

The Primary Economic Assessment initially indicated total revenues of $74bn over the life of the mine, but metallurgical test work being conducted ahead of a prefeasibility study, due out in the March quarter of 2020, has raised expectations.

The fresh results point to the recovery of an additional 4.4m ounces of gold, 24m ounces of silver and 354,000 tonnes of copper.

Improvements in copper and gold recoveries at its Alpala deposit in Ecuador could add $8.7bn of revenue over the planned mine life

The news is backed by a preliminary study published by Ecuador’s Energy Ministry in June, which suggests the Alpala mineral deposit could become “the largest underground silver mine, third-largest gold and sixth-largest copper in the world.”

Ecuador has attracted a flurry of interest from big miners eager to increase their exposure to copper. The highly conductive metal is in demand for use in renewable energy and electric vehicles, but big, new deposits are rare.

Diversified majors particularly favour such large-scale, long-life projects as SolGold promises.

BHP (ASX, NYSE:BHP), the world’s largest mining company, last year acquired a 6.1% stake in SolGold, as a way of boosting its exposure to copper.

The move pushed Australia’s largest gold producer, Newcrest Mining (ASX: NCM), to up its holding in the company, consolidating its position as SolGold’s top shareholder.

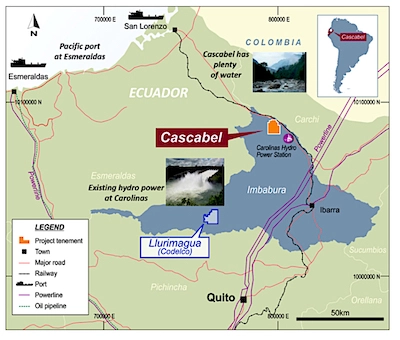

Cascabel project location. ( Courtesy of SolGold.)

Projects in Ecuador had faced potential delays and halts due to growing local opposition to the extraction of the country’s resources. Worries were partly cleared up after the country’s Constitutional Court rejected in September a request to make mining permits subject to popular approval.

The Andean nation is moving forward with plans to move from an explorer hotspot to mining exporter as its only large-scale copper mine readies to ship its first large cargo in November.

Ecuador plans to attract $3.7 billion in mining investments over the next two years, up significantly from the $270 million it received in 2018.

Barrick’s Reko Diq in line for $410M ADB backing

Pan American locks in $2.1B takeover of MAG Silver

US adds copper, potash, silicon in critical minerals list shake-up

Gold price gains 1% as Powell gives dovish signal

Gold boom drives rising costs for Aussie producers

Giustra-backed mining firm teams up with informal miners in Colombia

Energy Fuels soars on Vulcan Elements partnership

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook