Manganese Ore: South African Suppliers Drop down Offers Sharply to Liquidate Stocks

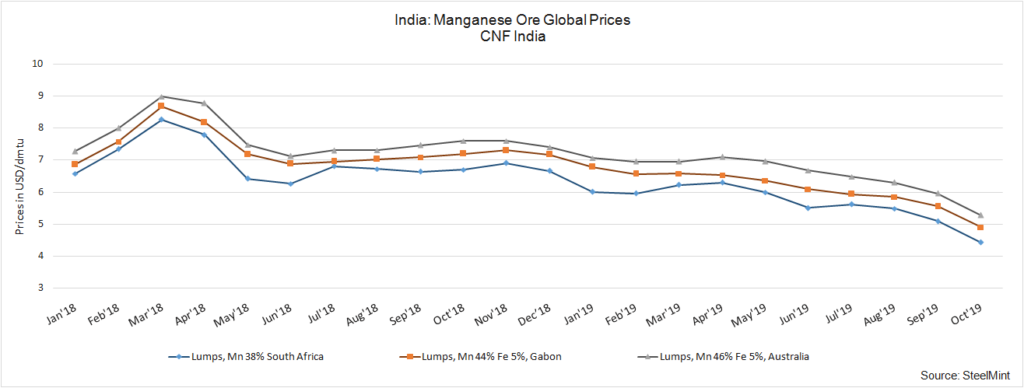

As the prices for imported Manganese ore decreased continuously since October, buyers were cautious about purchasing and the traded volume kept hitting low. Keeping in mind, the falling Manganese alloy prices and the downstream buying interest, alloy manufacturers believe that the prices may go down further.

South African suppliers had to reduce their prices to significant levels to liquidate stocks. Oversupply of ores is mainly driving the pricing dynamics of the ores. According to market sources, it is now safe to secure cargoes for December shipments as the prices have hit to the bottom levels. In contrast to the sentiment, producers also shared their concern over the further falling alloy prices in the market.

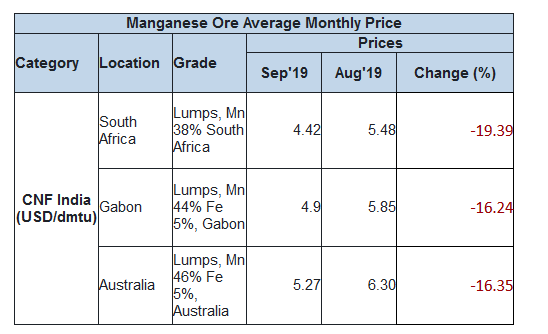

Prices for Australian Lumps, Mn 46%, Fe 5% is down to USD 4.70/dmtu CIF India. South African Carbonate Ore (Lumps, Mn 37-38%) is down to USD 3.65/MT CIF India, and Manganese Ore Lumps, Mn 44%, Fe 5% from Gabon is down to USD 4.35/dmtu for December Shipments. Prices have fallen significantly by up to 19% M-o-M in line with low transactions.

Chinese Market:

The downstream and external markets continue to be weak, and the manganese ore market is difficult to seek support. Since the beginning of this year, it has been falling continuously and overhanging for more than half a year. Compared to the beginning of the year, the current spot price of manganese ore in the port has dropped by more than 30%. This year, the stability of the manganese ore market is relatively poor, and the decline is still a strong possibility. Since October, the rhythm of daily decline has basically been maintained, and oversupply of material in the ports has kept the traders at bay. However, such lower prices may entice producers to book cargoes for December shipments.

On the future outlook, prices of Manganese Ore may reduce further, as the miners are competing for shipments, and the buyers are resistant to purchase any further stock. Indian Manganese Alloy producers also believe that MOIL may revise its prices in line with the falling prices of Imported ores.

Barrick’s Reko Diq in line for $410M ADB backing

Pan American locks in $2.1B takeover of MAG Silver

US adds copper, potash, silicon in critical minerals list shake-up

Gold price gains 1% as Powell gives dovish signal

Gold boom drives rising costs for Aussie producers

Giustra-backed mining firm teams up with informal miners in Colombia

Energy Fuels soars on Vulcan Elements partnership

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook