Indian GE Price touches a New Low amid Slowdown in Steel Sector

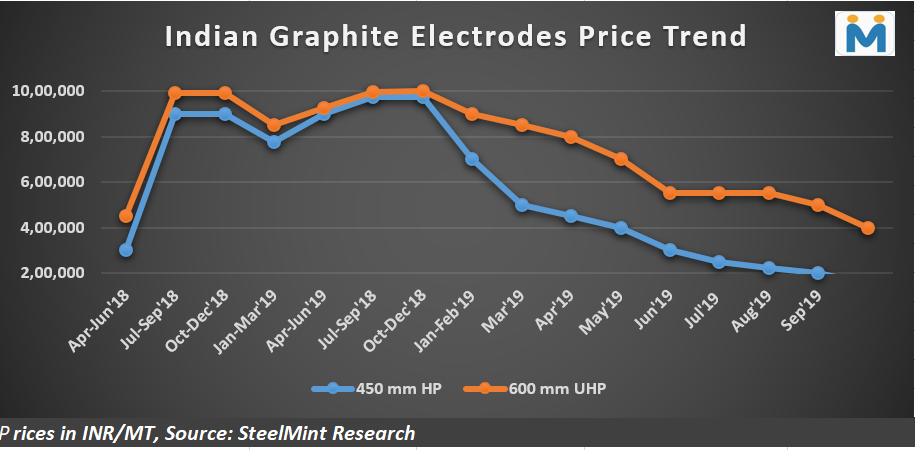

As per the SteelMint sources, UHP grade electrodes prices are heard to be in the range of INR 400,000 – 450,0000/MT (USD 5,600 – 6,300/MT) whereas that of HP grade are at INR 150,000 (USD 2,100/MT).

This free fall in the electrodes prices is mainly being led weak steel production in key EAF based geographies such as U.S. and Europe, destocking by steel companies and sanctions on supply to Iran which was a key GE procuring country for Indian electrodes manufacturer.

Amid the poor demand, majority of GE producers are now sitting at 2-3 months of finished goods inventory. If we talk about the utilization rates, Indian GE producers are operating at 60% utilisation levels against 85-90% last year due to lack of orders.

To everyone’s surprise, Indian electrodes prices at present are lower against its Chinese and other countries counterparts. The key reasons for the same being, China continues to supply their limited volumes to Iran where they are enjoying a little premium as no other country is venturing Iranian market due to U.S. sanctions. In case of Japan, the electrodes prices are reset only twice a year and are thus enjoying higher prices negotiated earlier in the month of June. The U.S. based GE producer, GrafTech has signed long term contracts of 3-5 years with good percentage of its clients at USD 10,000/MT and for non-contracted volumes it is selling electrodes at USD 6,500/MT. Apart from these factors, intense market share battle in domestic market between HEG and Graphite India is also adding to pricing pressure in India.

In terms of costs, petroleum needle coke prices for second half of 2019 has remained flat at USD 4500/MT. However, given the overall recession in steel and allied sectors, mid contract correction of USD 1000/MT from October 2019 is being anticipated.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

Adani’s new copper smelter in India applies to become LME-listed brand

Cochilco maintains copper price forecast for 2025 and 2026

Trump says gold imports won’t be tariffed in reprieve for market

Discovery Silver hits new high on first quarterly results as producer

De Beers strikes first kimberlite field in 30 years

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%