Indian Melting Scrap Prices Likely to Remain Range-bound

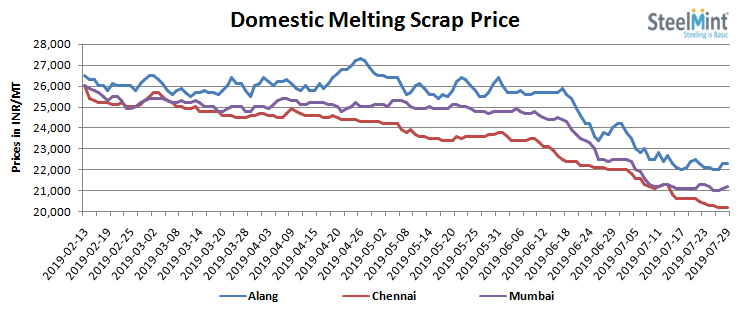

As per conversation with participants, domestic melting scrap price might remain supported or remain to range bound considering limited supply in west region, which is known as major scrap consumer i.e. Gujarat as well as Maharashtra state.

Further in southern India - scrap prices in Chennai remained near to range bound with minor fluctuation amid average supply and the trade reference prices may vary by INR 200-300/MT depending upon the quality & quantity.

As per assessment, imported scrap (HMS 1) viability seems limited in India as fresh offers are hovering at USD 290-300/MT CFR of Dubai origin HMS 1, which landed cost to western India base plants will be close to INR 22,700-800/MT including INR 2,300-2,500/MT logistic, customs clearance & import duty. However the domestic scrap prices hovering at INR 22,000-22,100/MT in Gujarat market.

Whereas domestic trade reference scrap prices in Chennai market is at INR 20,200-20,400/MT and landed cost of imported scrap calculated at INR 21,300/MT considering USD 280/MT from West Africa with 20 MT loading.

However, few participants shared that they have booked West Africa scrap (HMS 80:20) at USD 270/MT during last week which is ultimately cost INR 20,600/MT equivalent to domestic scrap prices and buying interest hovering at USD 265/MT level due to cast iron presence.

Conclusion: Analyzing the limited supply movement in domestic market, scrap prices is less likely to see a major change in near term comparing to less viable imported scrap and dull finish steel demand.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Fortuna rises on improved resource estimate for Senegal gold project

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI