Bangladesh: Imported Scrap Prices Down; Limited Trades Reported

However, buyers prefer waiting before buying much to have more clarity as local steel movement remains average at the moment.

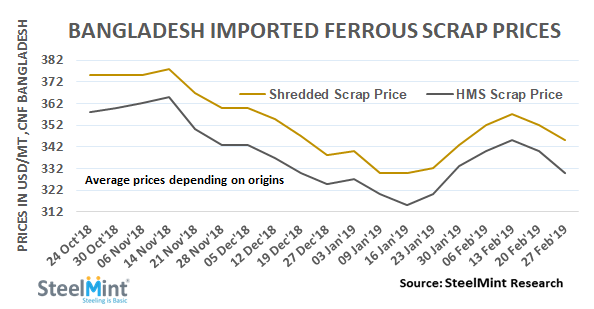

SteelMint’s' price assessment for Shredded scrap moved down marginally by USD 10/MT W-o-W in the range USD 340-345/MT, CFR as against the last report of USD 350-355/MT, CFR. Few scrap yards based in Europe, France and Belgium were quoting USD 345-350/MT, CFR for containerized Shredded but trades reported at around USD 345/MT, CFR Chittagong in limited quantity.

Containerized HMS 1 from Chile, Brazil and South Africa traded at around USD 335/MT, CFR while HMS 1&2 from South American origins assessed for April shipments in the range USD 330-335/MT, CFR Chittagong.

Price assessment of HMS 1&2 (80:20) from Europe, UK and USA stand at around USD 325/MT, CFR down USD 10-12/MT on W-o-W basis.

Current offers for PNS grade scrap is learned around USD 355-360/MT, CFR Chittagong and for Bushelling grade at USD 370/MT, CFR.

According to sources, steelmakers seem less interested in restocking scrap at high prices amid competitive Sponge Iron offers from India which has moved down USD 15-20/MT in last two weeks, however, as the gap between local and imported scrap has narrowed, this may support scrap imports in the near terms.

Domestic scrap prices improve after a correction on W-o-W basis - Local scrap and ship cutting plate prices observed slight increase after falling sharply on a weekly comparison. Shipyard scrap selling prices moved down by BDT 1000/MT during the closing of the last week and being reported again in the range BDT 37,000-37,300/MT, (USD 441-445) ex-Chittagong now while local HMS scrap heard at around BDT 35,000-35,500/MT (USD 416-422), ex-plant basis inclusive of local taxes.

Two bulk scrap vessels to arrive in Bangladesh shortly - After hitting a record high bulk scrap imports (236,783 MT) in Jan'19, the country likely to remain teeming with scrap supply again in Feb’19. As per vessel line-up data maintained with SteelMint, a bulk vessel carrying 7,200 MT scrap has already arrived at berth in mid-Feb’19 and two more vessels carrying 57,550 MT of ferrous scrap from USA and Japan are at ‘Expected’ position at Chittagong port in Bangladesh.

Chittagong’s ship breaking market continued gradually filling up both in terms of capacity and capable end buyers with available L/C & Bank limits. Although local fundamentals have been stable and there seems no immediate major reason for levels to be adversely affected, participants remain unsure about how much longer ship breaking prices will be maintained in the near terms.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse