Bangladesh : Imported Scrap Offers Stable, Bulk Scrap Imports Up 46% in Nov'18

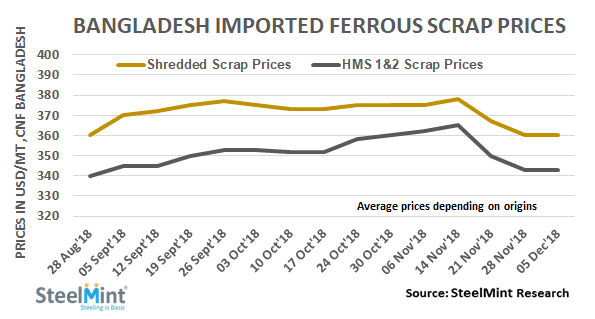

Offers for containerized Shredded 211 scrap from Europe and USA stand stable in the range USD 355-360/MT, CFR Chittagong. However, last week minor quality trades were booked in the range USD 350-355/MT, CFR. Supplier expectations remain firm at around USD 360/MT from USA and Canada amid limited availability.

P&S scrap of USA origin is being offered at around USD 365/MT, CFR stable W-o-W. According to sources, offers for HMS 1 stand slightly up at USD 345/MT, CFR Chittagong as against last week’s report at USD 340-345/MT, CFR. Containerized HMS 1&2 (80:20) from South America was offered at around USD 335/MT, CFR for end Jan’19 shipments.

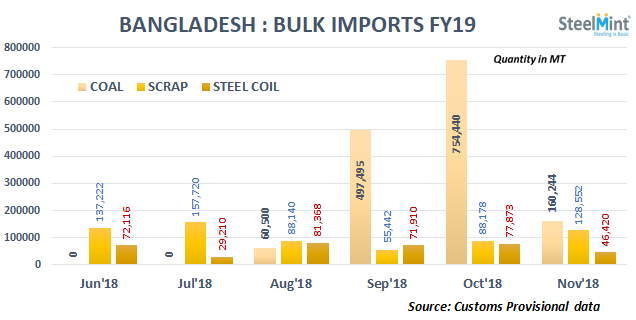

Bulk ferrous scrap imports up 46% in Nov’18 - According to port data maintained with SteelMint, Bangladesh imported total 128,552 MT bulk ferrous scrap in Nov’18, up 46% M-o-M as against 88,178 MT bulk ferrous scrap in Oct’18. Four bulk scrap vessels arrived to berth on the Chittagong port in Nov’18. With rising steel capacities and increased dependence on secondary steel production, the country has been observing a sharp rise in scrap imports in FY19.

Bangladesh observed the first export shipment of bulk mill scale in last one and half year comprising 42,000 MT volume in Nov'18 loaded from Chittagong port for Vietnam delivery. On the other hand, bulk billet imports continue nil volumes since last four months.

Bulk ferrous scrap imports cross 1 MnT mark during Jan-Nov’18 - The country imported 1,014,314 MT bulk ferrous scrap during Jan-Nov’18 against 890,004 MT during Jan-Nov’17. Top ferrous scrap exporters were USA, UK, Japan and Russia.

Domestic ship breaking scrap prices stand around BDT 35,000/MT levels inclusive of taxes while local scrap assessed marginally up at around BDT 35,500-35,800/MT (USD 424-428), ex-works as against the last report.

Local ship cutting plate prices stand unchanged on a weekly basis. Prices stand at around BDT 41,500-41,600/MT for 16 mm, at around BDT 40,500/MT for 12 mm and at around BDT 42,500-42,700/MT for plate thickness 20 mm & above.

Indian Sponge iron export offers to Bangladesh slightly increased following a surge in domestic prices and the latest offers reported at around INR 360-365/MT as against last week at USD 355-360/MT, CFR Chittagong.

Ship breaking prices continue downtrend - The assessment for ship cutting prices fell further by USD 5-10/MT W-o-W. It stands at USD 420/LDT for general dry bulk cargo, at USD 430/LDT for tanker cargo and at USD 440/LDT for containers on CNF Bangladesh basis. The market is expected to remain silent until the conclusion of the upcoming elections on 30th Dec’

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

Minera Alamos buys Equinox’s Nevada assets for $115M

Adani’s new copper smelter in India applies to become LME-listed brand

OceanaGold hits new high on strong Q2 results

Cochilco maintains copper price forecast for 2025 and 2026

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

De Beers strikes first kimberlite field in 30 years

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%

Hindustan Zinc to invest $438 million to build reprocessing plant

Flash Metals USA advances critical minerals recovery plant in Texas

Glencore trader who led ill-fated battery recycling push to exit

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

US appeals court temporarily blocks land transfer for Resolution Copper

Glencore seeks $13 billion in incentives for Argentina copper projects

Iron ore price falls with BHP results, soft China demand in focus

UBS lifts 2026 gold forecasts on US macro risks

BHP shares near priciest valuation since 2021 on shift to miners

African Rainbow boosts Surge Copper stake to 19.9%