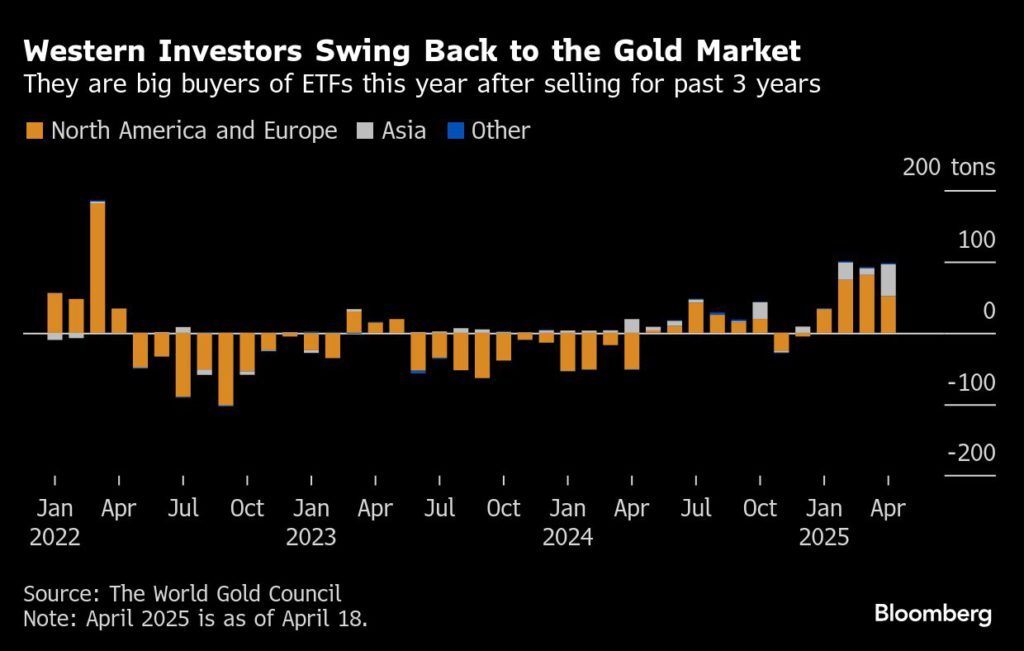

Western investors are piling into gold market after three-year hiatus

According to me-metals cited from mining.com, North American and European investors bought about 240 tons of gold in ETFs as of mid-April, according to data from the World Gold Council. That’s more than half the 441 tons they sold in the past three years.

The “swing from providing supply to absorbing supply — that’s a very large change,” Aakash Doshi, global head of gold strategy at State Street Global Advisors, said in an interview. “That has a high impact on prices, whereas central banks and China may continue to buy but that change isn’t going to be as large as the ETF buyer.”

The precious metal surged past $3,500 for the first time early Tuesday as US President Donald Trump’s criticisms of Federal Reserve Chair Jerome Powell rattled markets and triggered a flight to haven assets including gold.

Doshi predicts bullion will reach $5,000 over the longer term.

SPDR Gold Shares, the world’s largest gold-backed ETF, has seen $8.65 billion of net inflows as of Monday, with the majority of the inflows coming from institutional investors increasing allocations to gold as an equity-overlay hedge, economic-portfolio hedge and forex and rates hedge, according to Doshi.

Gold has climbed roughly 30% this year, already surpassing the 27% price increase achieved in 2024. The precious metal’s ferocious run started last year, helped by large purchases from central banks as they sought to diversify foreign-exchange holdings beyond the US dollar and insulate themselves from the threat of sanctions.

source: mining.com

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Emirates Global Aluminium unit to exit Guinea after mine seized

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

South Africa mining lobby gives draft law feedback with concerns

EverMetal launches US-based critical metals recycling platform

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study