Ghana government takes control of Damang mine operated by Gold Fields

According to me-metals cited from mining.com, Johannesburg-based Gold Fields said on Monday that it had unsuccessfully applied to extend the Damang lease, which is due to expire on April 18, and was winding down operations as a result.

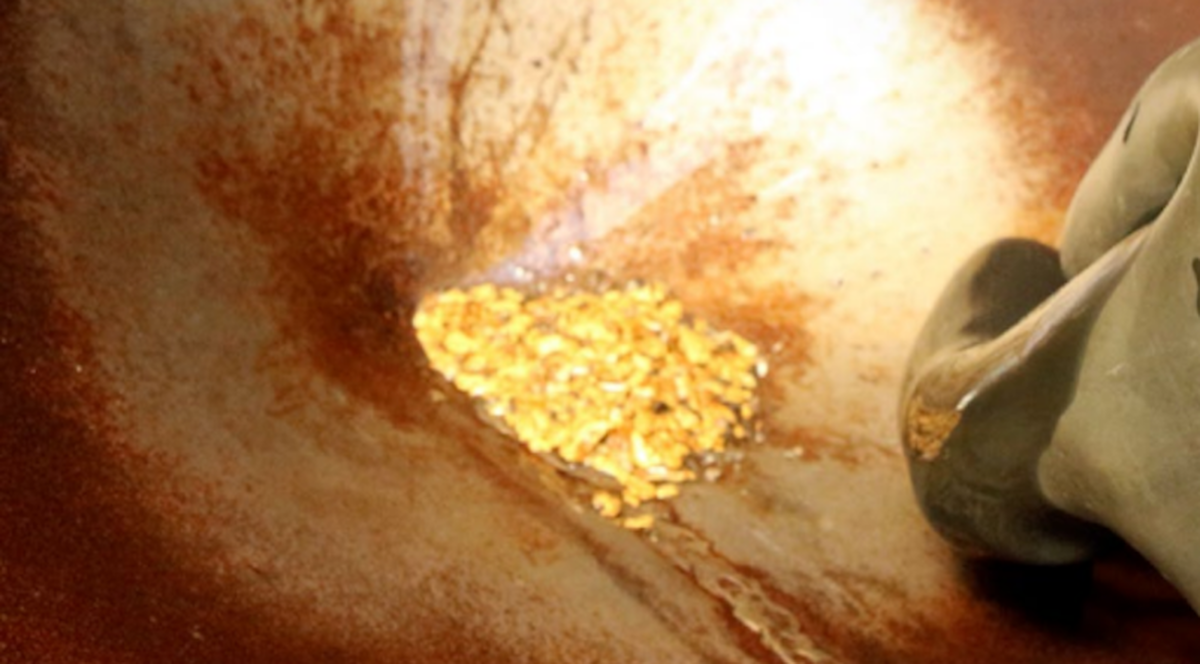

It was only processing stockpiles at Damang after ceasing mining operations in 2023, although it had committed to exit the operation in an orderly way as part of its end-of-life plan.The government said its decision to take control was based on a series of regulatory and operational shortcomings, including Gold Fields’ failure to declare verifiable mineral reserves in its lease renewal application, and the absence of a required technical program detailing past and future mining activities.

A Gold Fields Ghana spokesperson said they were unable to comment after closing hours.

A source familiar with the matter said Gold Fields planned to meet authorities to try and reach a different solution.

“There is a meeting planned for Friday but the way this is being escalated, there is less hope,” the source said.

“The Damang mine’s return to state oversight marks a critical step in Ghana’s economic reset, ensuring its gold reserves directly benefit citizens,” the government said in a statement issued by the Ministry of Lands and Natural Resources, which oversees mines.

It said the decision aligned with policy moves to stop the “neo-colonial” automatic renewal of mining licenses in gold-producing Ghana, but reassessing in order to maximize national benefit.

“We are on the lookout for value propositions on the utilization of our mineral resources that align with the same,” the statement said, adding that it would ensure uninterrupted operations and protect jobs throughout the transition.

Damang is the smaller of Gold Fields’ two mines in Ghana after Tarkwa, the biggest open pit gold mine in the country. Damang produced 135,000 ounces of gold in 2024, about 6% of the group’s total output of 2.15 million ounces.

The company has been weighing selling its smaller operations – including Damang and the Cerro Corona mine in Peru, which has less than five years left on its lifespan – as it focuses on its newly commissioned Salares Norte mine in Chile and the Windfall project in Canada.

source: mining.com

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

Emirates Global Aluminium unit to exit Guinea after mine seized

Iron ore price dips on China blast furnace cuts, US trade restrictions

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

EverMetal launches US-based critical metals recycling platform

Afghanistan says China seeks its participation in Belt and Road Initiative

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts