Chinese rare earth shipments held up as trade war upends exports

According to me-metals cited from mining.com, The delays could take weeks to clear as questions including code classifications are clarified, according to people with knowledge of the issue. Companies are rushing to submit documents to apply for export permits but those can take about 45 working days, the people said, asking not to be named as they are not authorized to speak to the media.

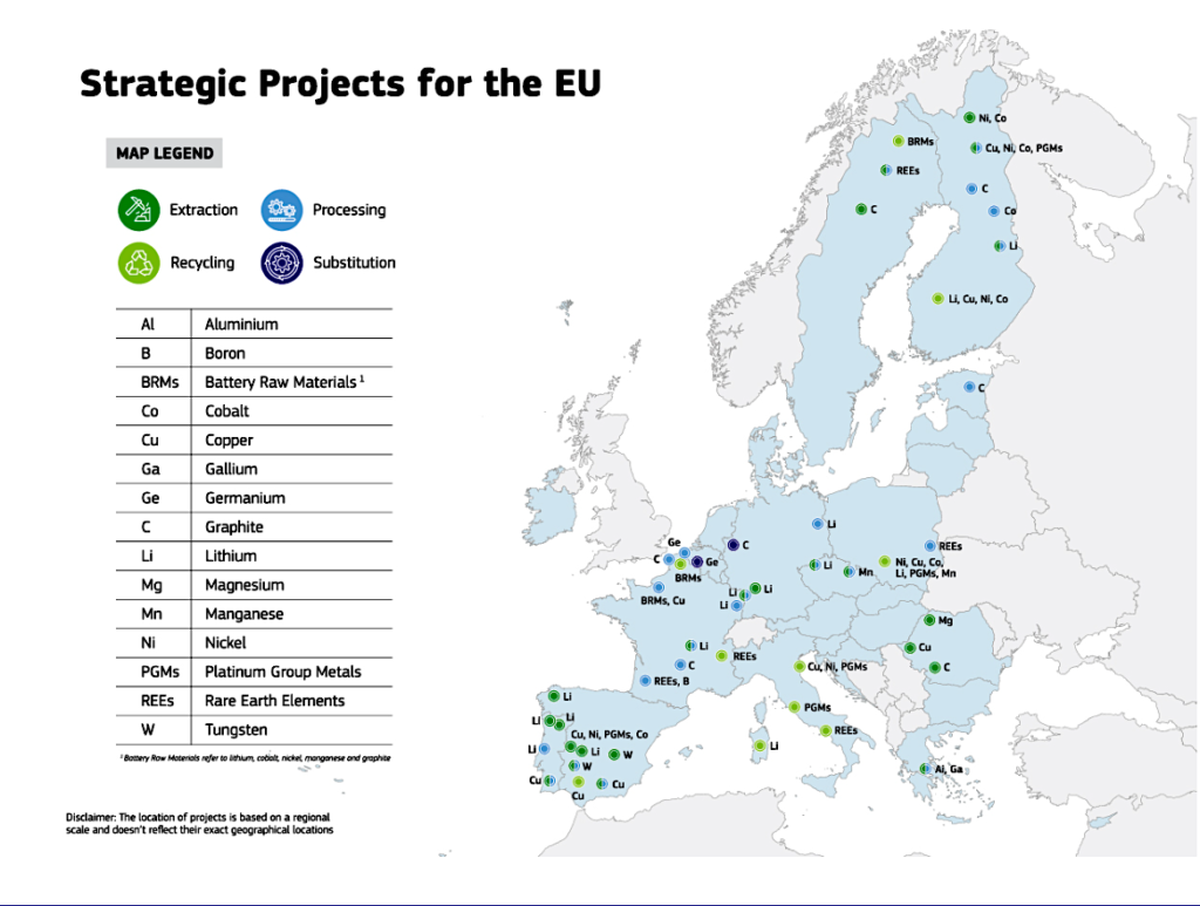

Beijing added seven rare-earth minerals — out of an accepted list of 17 — to its export control list last Friday, in response to increasingly punitive tariffs imposed by US President Donald Trump. The move, which adds to supply curbs on other minor metals where China dominates output, threatens to shake-up the global supply chains for niche materials that are vital for high-tech manufacturing.

The latest list of restricted rare earths includes samarium, gadolinium, terbium, dysprosium, lutetium, scandium and yttrium, used in displays and powerful magnets, plus crucial medical and even defense technology. Two of the most common rare earths — neodymium and praseodymium — weren’t included. Analysts said China may have targeted elements that are more scarce overseas.

The delays will mean some buyers outside of China could be left short of supply and face production cuts, the people said.

The latest controls are expected to have broad impacts in the US, Europe and Japan due to the wide usage of the minerals, which also includes optical lasers, radar devices, magnets for wind turbines, jet engine coatings and other advanced technologies.

Other critical minerals placed under similar export controls in the last two years, such as gallium, germanium, antimony, saw export volumes crash to zero for months after controls were rolled out, as exporters need time to get certified.

source: mining.com

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Copper price slips as unwinding of tariff trade boosts LME stockpiles

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Fresnillo lifts gold forecast on strong first-half surge

Codelco seeks restart at Chilean copper mine after collapse

Why did copper escape US tariffs when aluminum did not?

NextSource soars on Mitsubishi Chemical offtake deal

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

De Beers strikes first kimberlite field in 30 years

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Peabody–Anglo $3.8B coal deal on the brink after mine fire

De Beers strikes first kimberlite field in 30 years

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

South Africa looks to join international diamond marketing push