Gold price could extend record run into 2025, Heraeus says

According to me-metals cited from mining.com, Heraeus expects gold prices to range from $2,450 to $2,950 per ounce in 2025, influenced by continued buying by major central banks, albeit in lesser quantities than in 2024, geopolitical risks in Ukraine and the Middle East.

Gold, often used as a safe store of value during times of political and financial uncertainty, tends to appreciate on expectations of lower interest rates, which reduce the opportunity cost of holding the non-yielding asset.

“If the Chinese government’s economic stimulus measures boost the economy, China and India could provide a solid basis for gold demand in 2025,” the company said in a report.

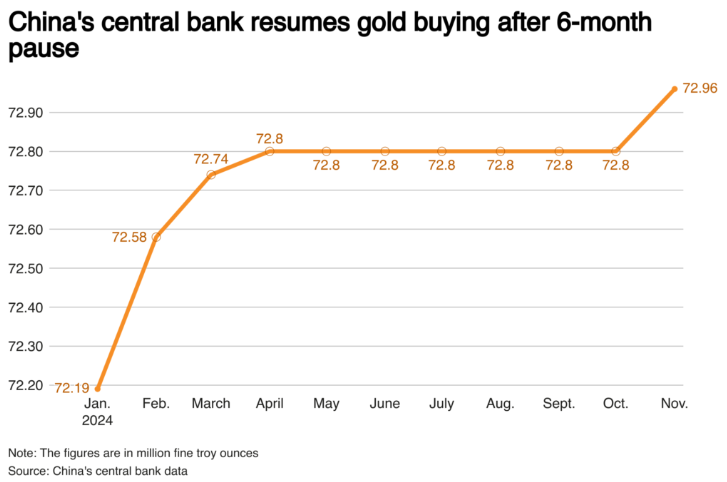

China’s central bank resumed buying gold for its reserves in November after a six-month pause, official data by the People’s Bank of China (PBOC) showed on Saturday.

“With the return of Donald Trump as US president, there is likely to be more uncertainty regarding trade and tariffs, which should also support the gold price,” said Steffen Metzger and Stefan Staubach, who have been leading the precious metals division of Heraeus.

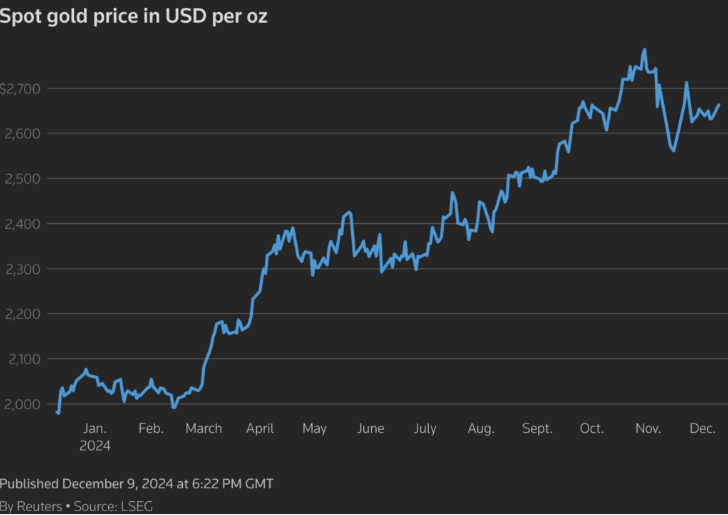

Gold has surged more than 29% this year and is on track for its best annual performance since 2010, driven by central bank interest rate cuts and growing geopolitical tensions.

Heraeus further noted that industrial demand for silver is expected to surge, propelled by the continued growth in solar photovoltaic demand.

The current gold-silver ratio indicates silver’s undervaluation compared to gold, suggesting that silver may outperform gold in late bull markets, with expected prices between $28 and $40 an ounce, the report said.

source: mining.com

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds