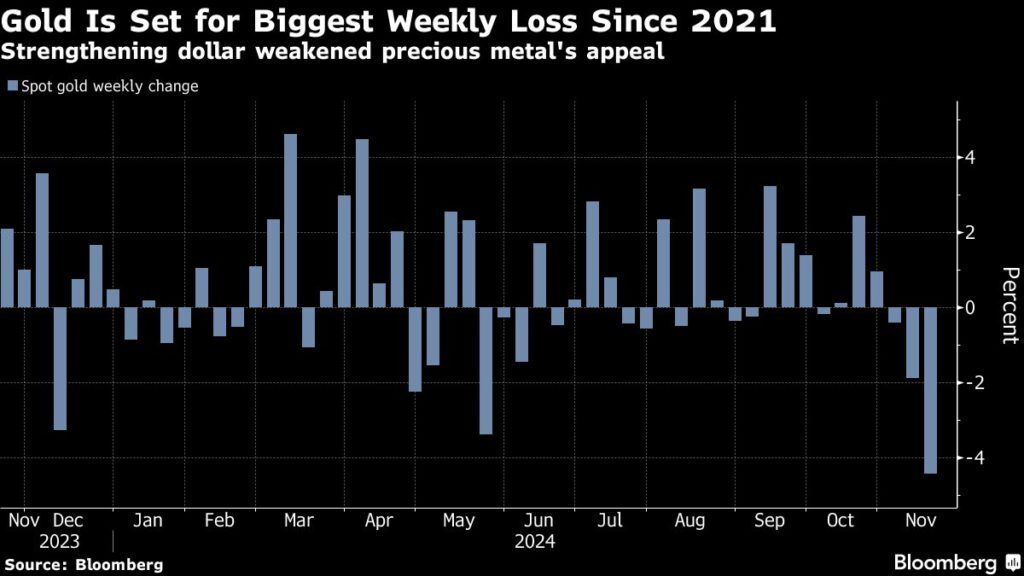

Gold price faces worst week since 2021 as Fed signals no rate-cut rush

According to me-metals cited from mining.com, Bullion has fallen six days in a row and is set for a weekly loss of more than 4%. Traders pared back expectations for lower rates in December and policy-sensitive US bond yields jumped after Powell said that the central bank will be in no rush to cut given the “remarkably good” performance of the economy. Lower borrowing costs and declining yields tend to benefit gold, as it doesn’t pay interest.

The precious metal has dropped about 8% from a record high on Oct. 31, with losses accelerating after Donald Trump’s election victory last week. A gauge of the dollar has risen to a two-year high on expectations that a Trump presidency will lift economic growth and corporate profits. A stronger greenback makes commodities priced in the currency more expensive for most buyers.

Still, gold is up more than 24% this year, with gains supported by the Fed’s easing cycle, central bank purchases and heightened geopolitical and economic risks that have driven haven demand.

Spot gold was little changed at $2,564.09 an ounce as of 12:37 p.m. in New York. The Bloomberg Dollar Spot Index was down 0.4% after hitting the highest level since 2022 on Thursday. Silver slipped, while platinum and palladium gained.

source: mining.com

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook