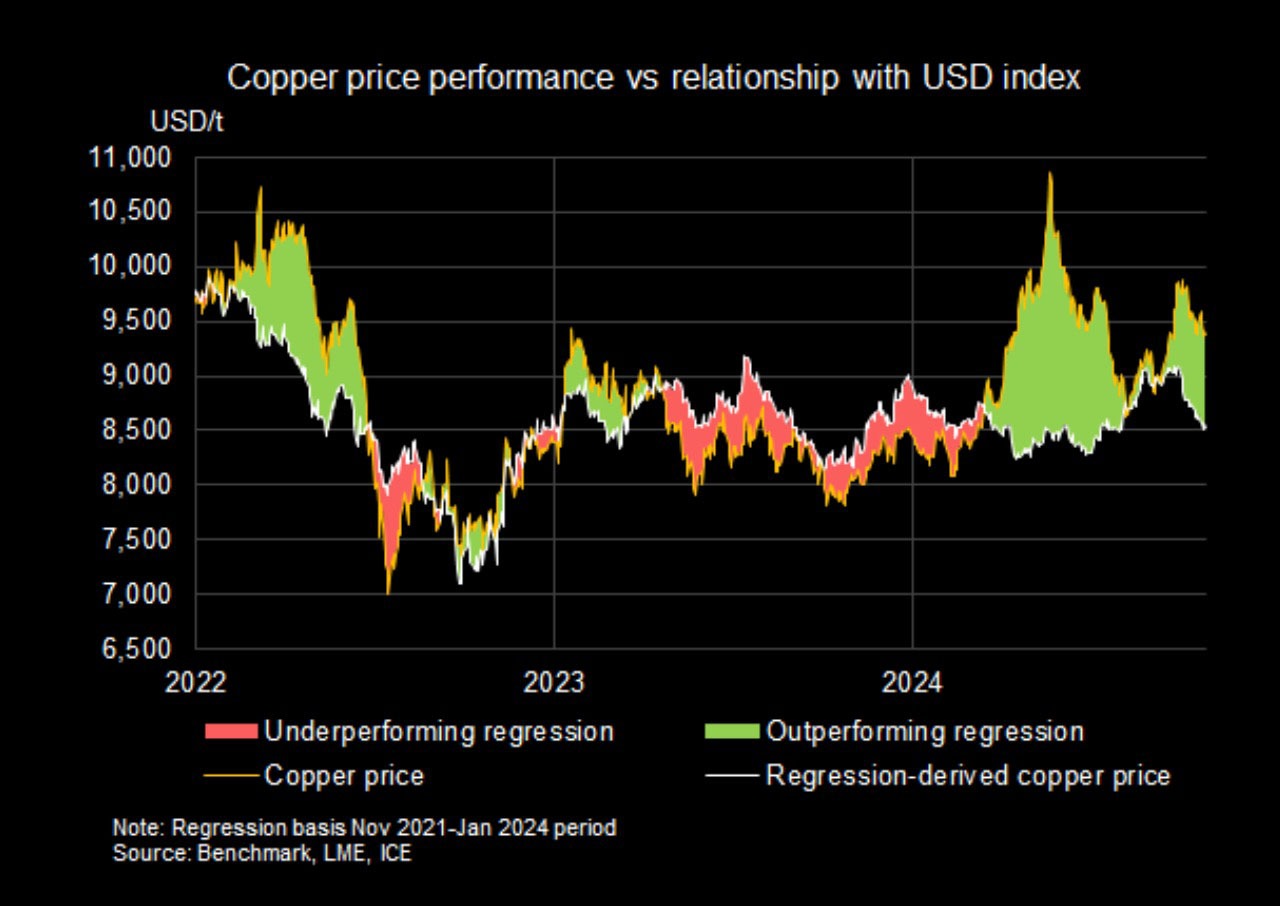

CHART: Copper price is being held hostage by Beijing

According to me-metals cited from mining.com, The rather hopefully named Beijing “bazooka” was expected to be followed up by another stimulus blitz the following week, this time focused more on fiscal policy and infrastructure investment, but the latter turned out to be a damp squib, with prices down 9% since then.

Next week could be another make or break moment for the copper price in a highly anticipated meeting of the Standing Committee of China’s National People’s Congress, the country’s highest lawmaking body, scheduled for 4–8 November.

Copper markets will be hoping for more detail of the scale and nature of Beijing’s stimulus measures, but in a note the copper service of Benchmark Mineral Intelligence points out that the announcement did not mention debt or fiscal policy on the agenda, so it remains to be seen how forthcoming policymakers are with details:

“If the meeting fails to shine further light on the scale of fiscal stimulus, we expect copper prices to come under renewed pressure. We note that copper prices have trended significantly above their implied relationship with the USD index since the announcement of China’s stimulus ‘blitz’ in late September.

“If Chinese authorities follow through on the market’s expectations, we could see a permanent step-change in this relationship (just like we did post-COVID). Conversely, if the market loses faith in China’s stimulus efforts and deems them inadequate or superficial, our regression analysis suggests that copper stands to drop by close to $1,000 per tonne.”

source: mining.com

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

EverMetal launches US-based critical metals recycling platform

South Africa mining lobby gives draft law feedback with concerns

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study