Asia Faces Costlier LPG

The drop in 2020 is expected to be about 289,000 bpd, or 4.6% below initial estimates, followed by 776,000 bpd in 2021, down 12% and then reaching the maximum decline of about 1.12 million bpd in 2022, down 16%, sad Platts Analytics.

"Due to the significant drop in recent oil prices, our latest forecast shows the near term, April-June, US NGL production falling. This essentially means low purity product -- ethane, propane and butane -- production," Platts Analytics said.

Upstream companies' debt-related issues have also led most of them to significantly revise down the capital expenditure guidance.

Enterprise Products Partners said it will slash 2020 capital spending by more than $1 billion and delay projects, as it adjusts to the changing energy environment and as the midstream sector adjusts to declining business and volumes due to the coronavirus pandemic.

Unlike crude oil, storage for NGLs is currently, or in the foreseeable future, not an issue, while lower NGL production makes this even less of a problem.

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

EverMetal launches US-based critical metals recycling platform

South Africa mining lobby gives draft law feedback with concerns

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

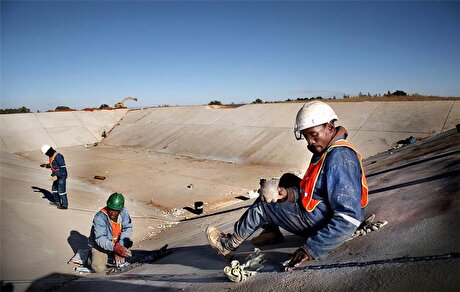

Tailings could meet much of US critical mineral demand – study