China issues second batch of oil product export quotas

The government has granted 28.03mn t of export quotas in the latest batch, 39,000t more than in the first batch that was issued at the end of last year but down by 470,000t compared with the second batch in 2019. A breakdown by gasoline, diesel and jet fuel has not been announced.

The government has now awarded 49.18mn t of quotas in the two batches this year, up by 3.89mn t or 8.6pc from the first two awards last year. China issued a total of 55.89mn t of quotas in 2019.

The quotas cover both general trade and exports under third-party processing deals. The general trade quotas total 24.63mn t, up by a slight 79,000t on the first batch and 840,000t higher than a year earlier. The quotas have been awarded to five state-controlled companies - Sinopec with 10.47mn t, PetroChina with 8.53mn t, SinoChem with 2.72mn t, CNOOC with 2.82mn t and aviation fuel distributor CNAF with 90,000t. Sinopec is the only company to have received a lower quota compared to the first batch, down by 490,000t.

Quotas granted for third-party processing deals total 3.4mn t, lower by 40,000t compared with the first batch and down by 1.31mn t year on year. The quotas are shared between Sinopec and PetroChina, with 2.6mn t and 800,000t respectively. CNOOC and SinoChem were awarded 100,000t and 140,000t in this year's first batch but were not included in the latest list.

Private-sector firms remain shut out of the clean product export market, even after Rongsheng's ZPC received a 1mn t bunker fuel export quota last month under a pilot project for the Zhoushan free trade zone. This award raised expectations that Rongsheng would be awarded more product export rights.

The product export quotas will help relieve oversupply in the Chinese domestic market, even as the export sector has been hit hard by the coronavirus outbreak. Persistently negative export margins are also limiting flows out of China, with Singapore spot gasoline prices having stayed below prices in Guangdong since early March. And exports are likely to remain under pressure in the second quarter, as global fuel demand is likely to remain subdued in the coming months as the Covid-19 pandemic continues.

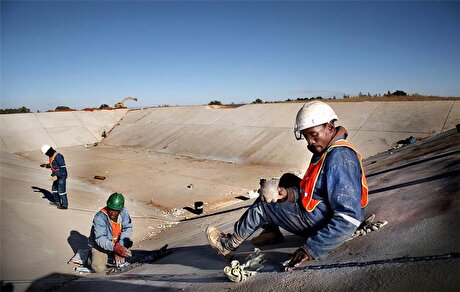

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

Emirates Global Aluminium unit to exit Guinea after mine seized

South Africa mining lobby gives draft law feedback with concerns

EverMetal launches US-based critical metals recycling platform

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Barrick’s Reko Diq in line for $410M ADB backing

Gold price gains 1% as Powell gives dovish signal

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Gold boom drives rising costs for Aussie producers

Vulcan Elements enters US rare earth magnet manufacturing race

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study