Coal loses backing from another big bank

Australia is the world’s second-biggest thermal coal exporter, generating A$26 billion ($16.6 billion) in export revenue in the year to end-June 2019, but it has become increasingly difficult to bring new resources on stream as financial institutions across the globe bow to pressure from shareholders and climate groups to avoid coal investments.

Westpac has already reduced its total coal exposure to A$700 million and said in its climate action plan on Monday that it would not establish relationships with any new thermal customers. The bank would continue to finance metallurgical coal, while backing initiatives that reduce the steel industry’s dependence on the fuel.

“We continue to evolve our sustainable finance approach, recognizing the role financial institutions can play in facilitating the transition to a low carbon economy,” Westpac said in the report. It has also set a target of A$3.5 billion in new lending to climate change solutions over the next three years.

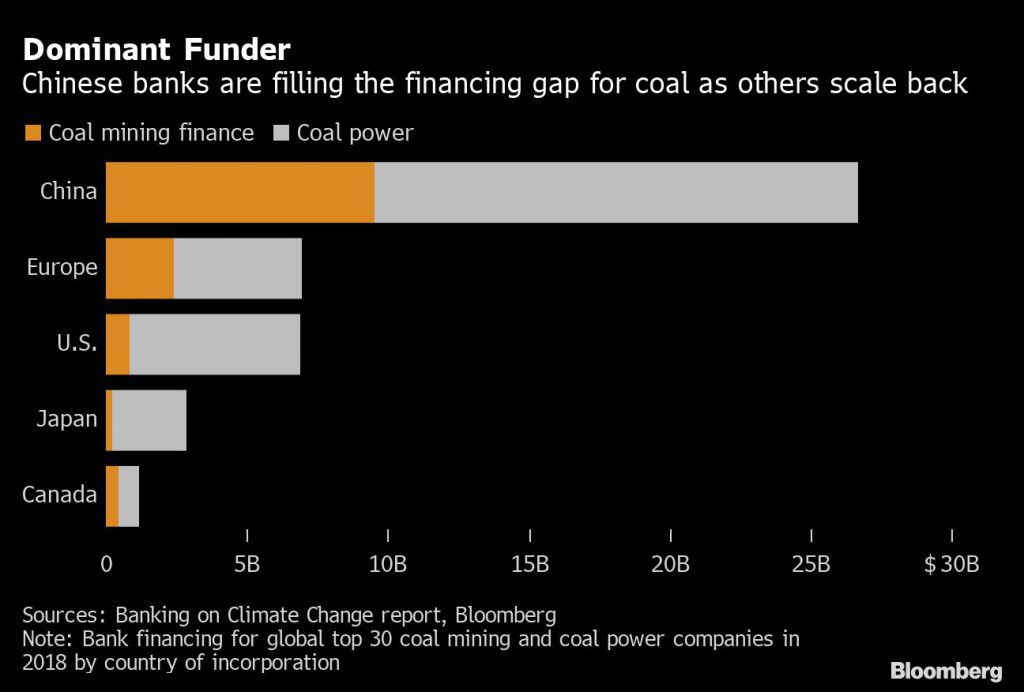

Commonwealth Bank of Australia and National Australia Bank Ltd. plan to be out of thermal coal by 2030 and 2035 respectively, while ANZ has said that it expects its involvement to decline, but has not set an official exit date. Japanese banks, among the world’s biggest lenders to coal power developers, are also starting to pare back their exposure, albeit at a slower pace, leaving the industry to turn elsewhere in search of funding.

“ANZ has made it unequivocally clear that the bank’s thermal coal mining exposure has, and will continue to, significantly reduce over time,” a spokesman for the bank said. “The nature of these businesses mean an orderly transition may not always be a straight line.”

India’s Adani Group is self-financing its controversial Carmichael coal project in Queensland after failing to secure outside backing. The thermal coal development, which would open up a new mining region, has become a lightning rod for the climate protest movement in Australia.

“Coming out of the Covid-19 crisis, Australian financial institutions should be looking to ensure their financing and investment portfolios address the compatible priorities of rebuilding our economy while mitigating climate change and preventing biodiversity loss,” said May House, economic analyst at the Australian Conservation Foundation.

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Gold Fields nears $2.4B Gold Road takeover ahead of vote

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014