Most top miners failing Paris Agreement goals

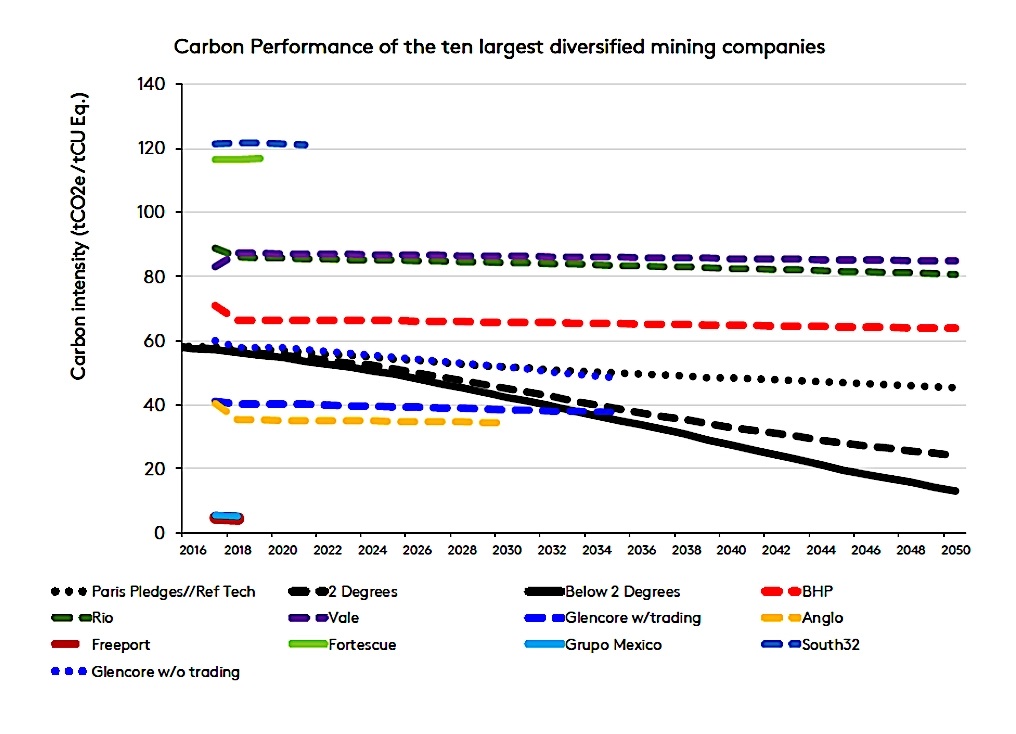

The Transition Pathway Initiative (TPI)’s study, published on Monday, shows that only Freeport-McMoRan (NYSE: FCX) and Grupo Mexico have lowered carbon emissions enough to keep global temperatures from increasing by less than 2°C a year by 2050.

TPI’s report states that Glencore and Anglo American are currently within the 2 °C benchmark set in the 2015 Paris Agreement on climate change. Their emissions pathways, however, are too flat to keep them on track to comply with the accord’s goals, it says.

Glencore’s plans to cut “Scope 3” emissions — those produced when customers burn or process a company’s raw materials — by 30% by 2035 are promising, but do not include its marketing activities.

Fortescue Metals Group (ASX: FMG) and South32 (ASX, LON: S32), the document says, have yet to set credible long-term targets. They also need to cut their overall carbon intensity by nearly 80% by 2050 to claim alignment with the Paris accord’s goals.

MMC Norilsk provided insufficient disclosure for assessment to be possible, TPI says.

“Zero” emissions under scrutiny

TPI notes that stated net-zero ambitions from BHP (ASX, LON, NYSE: BHP), Rio Tinto (ASX, LON, NYSE: RIO) and Vale (NYSE: VALE) only cover operational emissions, typically just 6% of the emissions the entity measures.

As a result, the miners, which are the world’s three largest iron ore producers, are actually further away from alignment in 2050 than they are today, the study notes.

The highly polluting process of making steel involves adding coking coal to iron ore to make the alloy, and is responsible for up to 9% of global greenhouse emissions.

Courtesy of The Transition Pathway Initiative.

Rio Tinto’s new carbon emissions reduction targets have triggered heated criticism from some investors and environmental groups, despite the company vowing to spend $1 billion over the next five years to reduce its carbon footprint.

Market Force, a subsidiary of activist investor Friends of the Earth, said in March that the company’s announcement was “simply a reflection of business-as-usual” energy cost savings and efficiency measures.

“Rio Tinto is essentially telling its shareholders it is aware of a massive financial liability sitting on its books, but isn’t planning to manage that risk down,” executive director Julien Vincent said.

TPI is a global initiative founded in 2017. It is now supported by over 60 investors with combined assets of over $18 trillion under management.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook