Indian Flat Steel Import Drops by 17% M-o-M in Feb’20 on Dull Demand

SteelMint’s assessment for Shredded 211 from UK/Europe stands at USD 290/MT CFR, down sharply by USD 10-11/MT against last week. Although offers for March loading are USD 300/MT and above due to premium for prompt shipment, however, for April loading, the offers stand at USD 289-290/MT CFR from UK. A couple of bookings were reported at USD 290-291 in the recent few days. Some offers from USA were reported slightly lower by USD 2-3/MT.

Buyers are currently targeting USD 285/MT levels for Shredded, and the workable price may drop to these levels. However, due to the continuation of the container shortage situation, market anticipates that the suppliers may not be able to deliver the shipments on time.

HMS scrap from Dubai is being offered at around 280-290/MT CFR, depending on quality and may decline further in the coming days.

Pakistani Rupee depreciated last week on slump in economy due the covid-19 outbreak and its impact on Chinese investments in Pakistan. From 154 levels over a week ago, the PKR slumped to 160 levels against USD by the end of last week and currently hovering at 158-159 levels.

Domestic Steel Prices Appreciate – Due to the Ramzan month starting from the last week of April, infrastructural projects are under pressure to get completed before that, resulting in some improvement in steel demand and consequently pushing the domestic prices up, which had remained more-or-less flat for several weeks now. Depreciation in currency and stock market situation also contributed to the rise in steel prices.

Local scrap and CC Billet prices also moved up by PKR 1500/MT w-o-w, while bala billet offers surged by PKR 2500/MT. In the northern region, rebar’s average offer prices were reported at around PKR 107,000-108,000/MT, ex-works (USD 671-677), up PKR 1000/MT w-o-w, while southern (Karachi region) steel mills are offering at PKR 109,000 ex works.

Average Offer Prices)17 Mar'20Last Assessment on 10 Mar'20Change W-o-W

PKR/MTPKR/MTPKR

Local Scrap (Equivalent to Shredded)68000665001500

Bala (Local Billet)87500850002500

CC Billet (Grade 40)92500910001500

CC Billet (Grade 60)93500920001500

Deformed bar (G-60), Ex-Punjab/KPK107,000-108,000106,000-107,0001000

Deformed bar (G-60), Ex-Sindh (Karachi)108,000-109,500107,000-108,5001000

Source: SteelMint Research

Steel News | Reports | About SteelMint | Subscription Details | My Account | Contact Us

SteelMint Alert : Hrc - 17 Mar 2020

Indian Flat Steel Import Drops by 17% M-o-M in Feb’20 on Dull Demand

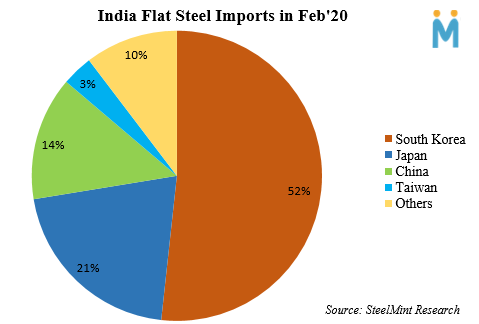

As per the latest data released by the customs and compiled by SteelMint, India’s finish-flat imports stood at 0.30 MnT in Feb’20 down by 17% on a monthly premise as against 0.37 MnT in Jan’20.

--Lacklustre demand and weak buying interest among buyers in the domestic market resulted to fall in import volumes in Feb '20.

-- Although the landed cost of HRC imports and domestic HRC prices were at par, which motivated stockists and traders to purchase locally rather than imports.

-- Meanwhile, on a yearly premise, the same slashed by 35% in Feb’20 in contrast with 0.46 MnT in Feb'19.

Indian HRC/Plate imports plunged by 27% in Feb '20-

-- The nation's HRC/Plates plunged by 27% M-o-M basis to 0.11 MnT in Feb’20 when compared with 0.15 MnT a month ago.

-- Indian electrical steel imports tumbled by 17% M-o-M basis to 0.1 MnT in Feb’20 over 0.12 MnT in Jan' 20.

-- The galvanized steel imports were consistent at 0.08 MnT in Jan and Feb’20.

-- Meanwhile, imports of CRC slashed to 0.01 MnT in Feb’20 as against 0.02 MnT in Jan' 20.

Imports from South Korea dipped by 32% in Feb'20-

-- The nation's imports from South Korea slashed by 32% M-o-M basis to 0.15 MnT in Feb’20 over 0.22 MnT in the previous month.

-- India's finish-flat steel imports from Japan surged to 0.06 MnT in Feb’20 as compared with 0.04 MnT in Jan' 20.

-- However, imports from China tumbled by 43 % M-o-M basis to 0.04 MnT in Feb’20, which was 0.07 MnT in the preceding month.

Imports at Mumbai port down by 8% in Feb'20-

-- Finish-flat steel imports at Mumbai port declined by 8% to 0.11 MnT in Feb’20 over 0.12 MnT a month ago.

-- Imports at the Chennai slimmed by 17% to 0.05 MnT in Feb’20 compared with 0.06 MnT in the previous month.

-- Meanwhile, imports at Mundra port tumbled to 0.04 MnT in Feb’20 from 0.05 MnT in the preceding month.

-- Also, imports at Kandla port in Feb'20 stood at 0.02 MnT which was 0.06 MnT in Jan '20.

--Meanwhile, in Feb’20, imports at JNPT port at 0.03 MnT, and Dahej at 0.01 MnT, remained consistent against imports in Jan’20.

Party wise flat steel importers in Feb '20-

-- POSCO India remained the largest importer in Feb' 20. Other major importers are mentioned in the table below.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts