How India’s Graphite Electrodes Trade Dynamics Changed in Last Two Years?

However, after time span of two years, the situation normalised with setting up of new GE units in China and increased supplies from the country. These events had a direct impact on India GE trade dynamics also.

While Indian GE prices saw a of jump of 200% and a drop of 90% in past two years two years, India’s export trend also observed a change due to U.S. sanctions on Iran as the latter was a key export destination for India.

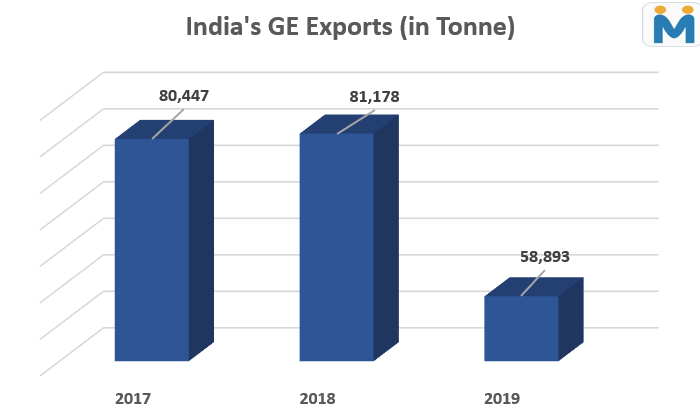

According to the customs data with SteelMint research, India exported about 80,447 tonne of GE in 2017 with highest export being made to Iran (17%) followed by U.S (10%) and Turkey (10%).

In 2018 when U.S. imposed sanctions on Iran in the latter half of the year, India exported about 81,178 tonne of electrodes in total with highest exports being made to Saudi Arabia (13%) followed by Iran (11%) and Turkey at 10%. Iran still found place in India’s list of top export destinations as the first round of sanctions were imposed by U.S. on Iran in the month of August prior to which the Indian manufacturers had sold considerable quantity of electrodes to the country.

The actual impact of U.S. sanctions on Iran was seen in 2019 when India’s total electrodes exports plunged down by 27% y-o-y basis and stood at around 58,893 tonnes. Apart from the fall in exports, Iran was completely missing from India’s list of top GE export destinations during the year. As per the customs data, South Korea made it to the top of the list with percentage share of 15% in total exports followed by Egypt at 12%, Turkey at 9% and U.S. at 8%.

According to the market sources, while China is still continuing to supply electrodes to Iran via re-routing of shipments through other countries, Indian GE manufacturers are not taking the risk of supplying the same resulting in fall in its exports.

In Jan’20, India exported about 3,769 tonne of electrodes against 4,343 tonne in Jan’19, the customs data shows. During the month, highest exports were made to Egypt (16%) followed by Bangladesh and South Korea at 7%. However, with the Wuhan virus outbreak globally it remains to be seem how the trade dynamics in Indian Ge sector unfolds in the upcoming months of 2020.

In terms of prices, the Indian electrodes prices at present of size 600mm UHP grade are currently being heard at around INR 275,000/MT whereas that of 450mm HP grade are in the range of INR 150,000 – 170,000/M

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook