Japanese Scrap Export Offers Rebound

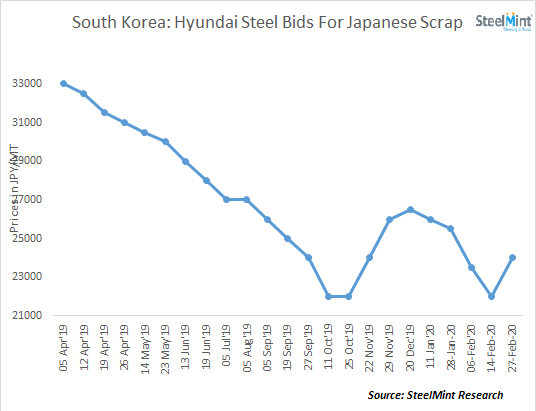

As per recent reports, many Japanese suppliers have quoted H2 offers at JPY 25,000/MT FoB, which is a steep climb from the JPY 22,000/MT levels in mid-Feb '20. Meanwhile, buyers in South Korea have recently bid up to JPY 24,000/MT FoB.

After good buying for Japanese scrap observed to South Korean mills till mid-Feb at JPY 22,000/MT FoB for H2 price level, bookings dropped sharply in the last 2 weeks, as offers started to move up, on the other hand, sales to Taiwan have increased considerably.

Due to the recent global container disruption increasing freight time and cost from US suppliers, Taiwan steelmakers are preferring to import Japanese scrap, on more viability. This increased Taiwanese buying interest has contributed to the ongoing uptrend in Japanese Scrap, Japanese suppliers are getting bookings at USD 255/MT CFR Taiwan for H2, which translates to JPY 25,000/MT FoB Japan.

On the other hand, South Korean steelmakers, have not accepted the sharp rise in offers citing weakening Won currency and flat steel prices, with mills looking to reduce Japanese scrap imports to a certain extent.

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Gold Fields nears $2.4B Gold Road takeover ahead of vote

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014