Viewpoint: Legislation threatens Europe antimony trade

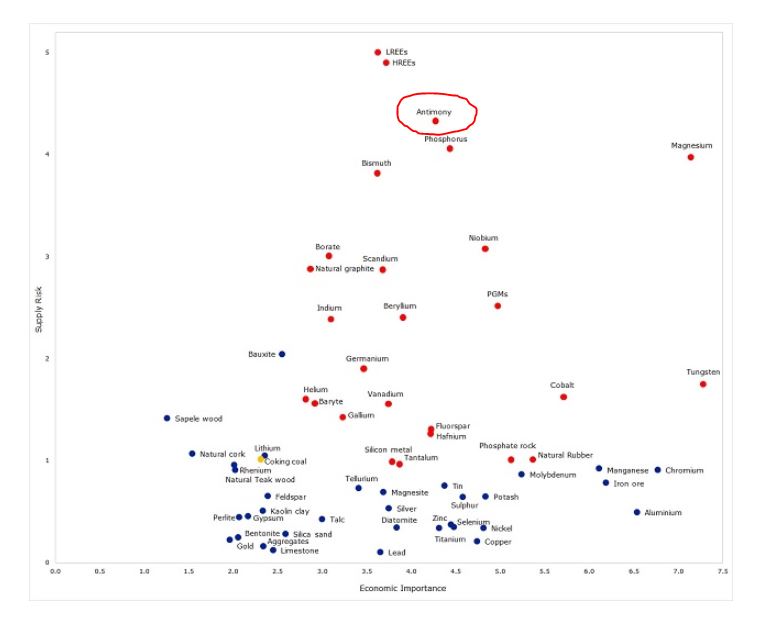

Europe is wholly dependent on imports for its antimony trade, in the absence of regional production. The metal is used to produce flame-retardant chemicals for textiles, rubber and plastics, in lead-acid batteries for cars and back-up power systems, alloys, and defence applications to harden weaponry and ammunition. The EU ranks the criticality of antimony in Europe as secondary only to rare earths based on economic importance and supply risk (see chart). Most of the world's antimony metal is produced in China, and the US is similarly dependent on imports.

The EU's Reach regulation is intended to "improve the protection of human health and the environment from the risk posed by chemicals while enhancing the competitiveness of the EU chemicals industry". But many market participants are voicing concerns that the cost of proving to the European Chemicals Agency that the chemicals are safe for workers to handle in factories — which are already among the safest anywhere — is making it economically impossible to supply raw materials such as antimony.

If nothing changes, trading in antimony metal may end, several traders said on condition of anonymity, leaving consumers entirely dependent on Chinese prices with no competing sources of supply. The safety of the end products — a large share of which are consumed by the European automotive industry in batteries and flame-resistant textiles and plastics — are not under investigation and have already been tested.

The EU Raw Materials Initiative, which was founded in 2008, two years after Reach came into effect, was developed to ensure "a fair and sustainable supply of raw materials from global markets". An EU review of critical materials in 2017 concluded that "unwrought [antimony] metal is the most significant in terms of trade volume and therefore represents the most likely bottleneck in the EU supply chain".

But the way in which Reach is being implemented in Europe is putting the financial burden on small suppliers more than large foreign producers, traders told Argus. Another concern raised by the industry is that the regulation could price out participants by virtue of the size of the market not the safety of the higher-margin downstream chemical intermediaries. The only real beneficiaries could be foreign producers, if there are only one or two companies left that are allowed to customs clear antimony metal into the EU.

Reach makes the entire industry responsible for the cost of proving that all the chemicals are safe to handle and transport in the EU. But it does not appear to consider the possibility of producers being exempt by virtue of not existing in that jurisdiction. This leaves a handful of traders and manufacturers responsible for shouldering the burden of as many tests are deemed necessary with no cap or transparency about potential future costs.

It also makes it impossible for traders to calculate whether they can break even if they continue to contribute. In a larger market such as nickel, with many participants, the costs can be absorbed within the market. But in a tiny market such as antimony, with global production of under 200,000 t/yr compared with 2mn t/yr of nickel, there are simply not enough participants to cover the costs, market participants said.

The US did not impose import tariffs on Chinese antimony, along with rare earths, indium and other critical metals, signalling its strategic importance. The US Defense Logistics Agency awarded a grant of $510,500 in October 2019 to US Antimony to develop a North American source of antimony trisulphide.

By Caroline Messecar

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook