China’s metals import hunger shifts towards raw materials: Andy Home

In part this was a reflection of stuttering manufacturing activity over much of 2019, a slow-growth mini-cycle that was on the cusp of turning before the coronavirus outbreak upended China’s economy.

But China’s reduced pull on refined metal units from the rest of the world is also down to the country’s relentless build-out of smelting capacity.

This is steadily shifting its import appetite towards the raw materials needed to feed that capacity.

Copper and aluminium scrap imports also bucked the trend as Beijing’s purity thresholds strangled inbound flows. A part reversal of the scrap clampdown is due this year, another sign of the focus on nurturing raw material supply chains.

Excess metal

China’s aluminium sector has grown to be the largest in the world to the point that excess production seeps out in the form of semi-manufactured product.

Exports of “semis” fell marginally last year but were still a huge 5.2 million tonnes. China was also a small net exporter of primary metal for the first time since 2007, when exports of aluminium in this form were killed off by a 15% duty.

The volume was a marginal 800 tonnes and may reflect no more than the movement of metal around bonded warehouses but it meant that China was a net exporter of primary, alloy and semis last year for the first time in a decade.

China’s giant aluminium machine needs a lot of bauxite and imports topped the 100 million tonne level for the first time in 2019. They were up 22% on 2018 and almost double the tally in 2016.

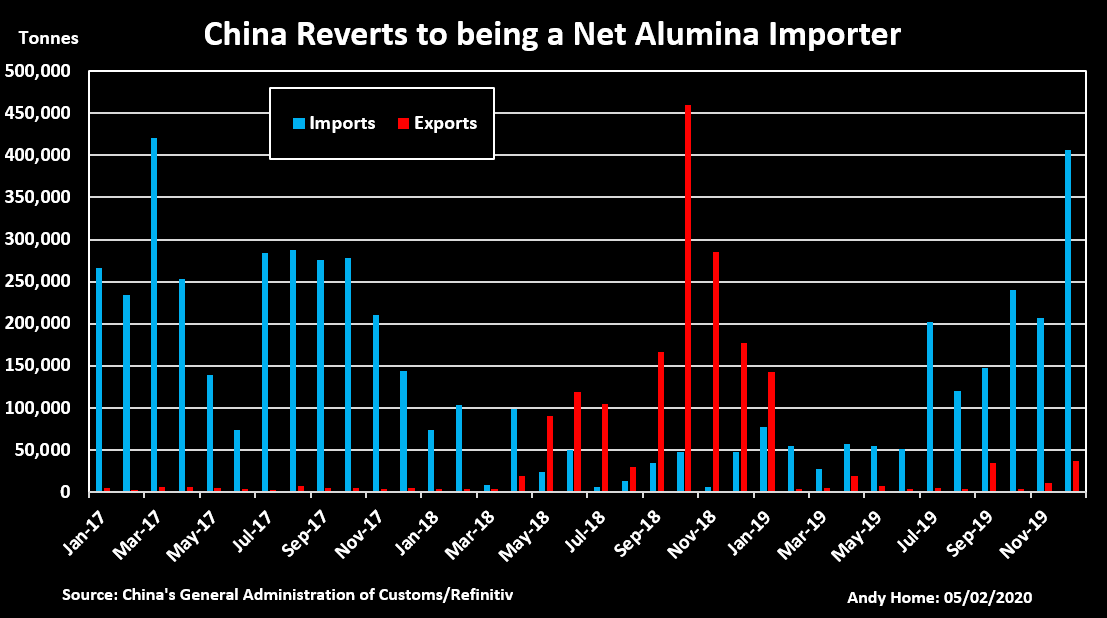

Meanwhile, the country’s trade in intermediate product alumina is normalising after China briefly and unusually turned net exporter in 2018 to fill a supply gap in the global market.

Exports tailed off last year, leaving the country back in net import territory to the tune of 1.37 million tonnes.

China is also the world’s largest producer of tin and it became a net exporter of refined metal in 2018 after the removal of a 10% export tax. It remained so last year to the tune of 3,100 tonnes.

Tin was the only base metals sector to see a fall in raw material imports last year, purely due to the sliding output of mine concentrate across the border in Myanmar.

Imports of concentrates started falling in 2017 and they were down another 20% last year.

Zinc and lead imports slow

China’s imports of refined zinc and lead boomed over 2018 and early 2019 as the country’s smelters were hit by a global squeeze on mined concentrates.

However, the pace of inbound shipments slowed sharply over the second half of last year. Full-year net imports of zinc fell by 21% to 544,400 tonnes and those of lead by 13% to 88,400 tonnes.

Further declines are likely as the concentrates crunch passes.

Imports of lead concentrates jumped by 37% last year and those of zinc were up by 7% after falling in the first half of the year.

Improved raw material availability should feed through into higher smelter run rates, reducing the need for imports.

“China is close to being self-sufficient in refined lead, only occasionally having to import in recent years,” according to analysts at Wood Mackenzie (“Could 2020 market trends bring new lustre to gloomy lead market?”, Feb. 5, 2020).

Chinese zinc production, meanwhile, accelerated to a record high in December as smelters capitalized on high treatment charges and better concentrates availability.

Copper and nickel

China is still some way from self-sufficiency of refined copper.

It has been a huge importer for many years and remained so in 2019, although net imports dropped by 7% to 3.2 million tonnes.

However, new copper smelter capacity is being added all the time and imports of copper concentrates are rising in tandem.

China sucked in 22 million tonnes (bulk weight) of mined concentrates last year, a new record and up 12% on 2018.

It’s a similar story in nickel, albeit complicated by Indonesia’s ban on nickel ore exports from the start of this year.

Imports of nickel ore and concentrates leapt higher over the fourth quarter as shippers tried to beat the deadline. Full-year imports of 56 million tonnes were the highest since 2013, the year before Indonesia’s first ore ban.

As the Indonesian authorities use the ban to stimulate more domestic smelting capacity, the flow of nickel pig iron (NPI) to China is accelerating.

Total ferronickel imports, including the stream of Indonesian NPI, almost doubled year-on-year to 1.9 million tonnes in 2019.

Not surprisingly, this level of raw material inflow damped demand for refined nickel, net imports falling by 22% to 156,000 tonnes.

Scrap – Waste or resource?

A sharp 38% slide in imports of copper scrap would seem to defy the broader trade trend but that’s because Beijing had classified all metal scrap as “waste”.

Purity thresholds have been raised and quotas placed on imports of both copper and aluminium scrap. Imports of the latter almost ground to a halt over the tail end of 2019.

China can survive without aluminium scrap but the steady reduction of copper scrap imports has squeezed what is a key raw material source for many Chinese copper smelters.

China has historically been the world’s largest buyer of copper scrap and its secondary smelters, using scrap as feed, churned out around 1.6 million tonnes of refined metal in 2017.

Imports were supposed to stop completely by the end of this year but under intense lobbying pressure the Chinese government has relented and reclassified both copper and aluminium scrap as a “resource”.

New guidelines have been issued which should mean imports of scrap start increasing again, although by how much will depend on how China’s customs department enforces the new rules and how much global scrap trade patterns have permanently shifted over the last two years.

The reclassification of scrap from “waste” to “resource” is significant, though, both for what it means for the copper market and what it says about China’s changing base metals import appetite.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook