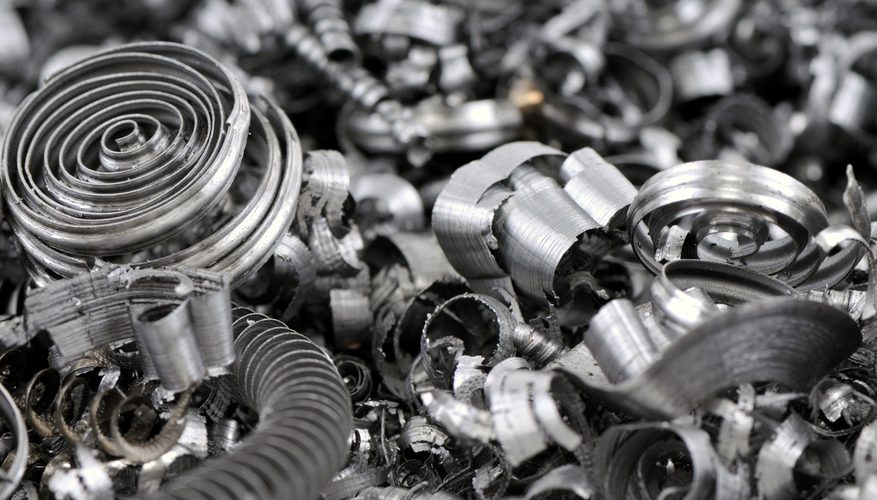

Japanese ferrous scrap prices face downward pressure

The winding down of construction projects ahead of the July event has been a main factor weighing on Japan's steel demand, which is expected to fall by a further 6pc in early 2020. Japan's steel output fell for a third year in 2019 and is likely to drop below 100mn t in 2020.

In response to rising steel inventories, some Japanese mills reduced scrap collection prices by 400 yen/t ($3.70/t) this week to further slow scrap deliveries. Scrap inventories are already at highs across suppliers' yards, and greater domestic collection is exacerbating space constraints. Suppliers are shifting sales to seaborne markets. Buyers, sensing the urgency to offload tonnage, are starting to negotiate for lower prices.

Japanese offers of H1/H2 50:50 scrap to Taiwan began to fall in late December, to $280-282/t cfr on 27 December from $285-290/t cfr on 20 December. Deals were heard at $275-278/t cfr in late December and then at $274/t cfr this week.

South Korean mills lowered bids for Japanese H2 scrap by ¥1,000/t to ¥25,500/t fob Japan this week.

Japanese scrap suppliers will face pressure to clear more stocks in the first quarter of their financial year that begins in April, which could weigh on spot prices. The increased export of that supply and price weakness could lower seaborne scrap prices. With Asia-Pacific steel price strength largely confined to China, other Asia-Pacific mills are struggling to reduce production costs amid weak domestic demand for long products. This comes as US scrap suppliers are increasing prices, supported by slower winter collection, which could push more buyers towards Japanese supply. US suppliers have already responded with export price cuts.

Japan's main buyers are South Korea and Vietnam, the two largest consumers of seaborne scrap in Asia.

Japan's steel output is forecast to fall by 3mn t, or 3pc, to 100mn t in the April 2019 toMarch 2020 fiscal year, the Japan iron and steel federation said. Japan's January-November output fell by 4.5pc to 91.5mn t, with five consecutive months of sequential declines to November. Scrap-based output has fallen faster. Electric arc furnace output fell by 5.7pc to 22.48mn t in January-November.

Japan's domestic steel demand is expected to decline by 6pc in January-March from a year earlier to 15mn t. The country's trade ministry has forecast that total demand with exports is expected to slow by 3pc to 21.7mn t.

Orders for steel products across mills in October fell by 4.7pc from a year earlier, with January-October orders down by 6pc, the federation said.

By Terry Chuay and Xia Ji

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook