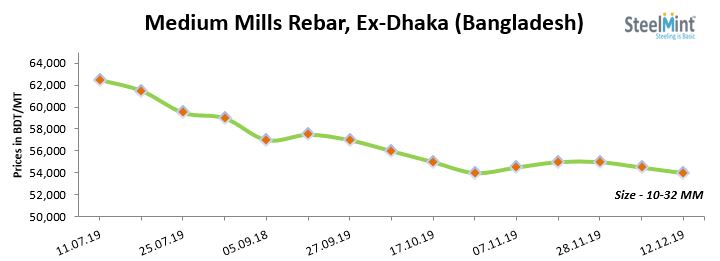

Bangladesh: Secondary Mills Rebar Offer Inch Down on Slow Trades

SteelMint's assessment for rebar offers of mid-sized mills in Dhaka, Bangladesh reported at BDT 54,000-55,000/MT (USD 636-648); for 500 W, same against last assessment. Few small mills were heard offering BDT 53,500-54,000/MT. The prices are ex-works, including local taxes & size 10-32 mm.

In context to large scale mills, the rebar offers were reported at around BDT 61,000/MT (USD 719) ex-works Chittagong, including local taxes & size 10-32 mm, as shared by trade sources.

As per participants, demand remained on average basis, however they are assuming that finish steel prices to improve in the coming days as raw material prices are strengthening since a month's time.

Thus to maintain conversion spread (margins), the mills may go for a hike in price range to pass it among consumers. As per assessment made by SteelMint, imported scrap offers to Bangladesh rose by about USD 10/MT in Nov-Dec'19.

Further, rebar prices have not shown signs of improvement yet but medium/small scale mills have increased rebar prices by BDT 500/MT which have been notified among few specified mills.

Meanwhile, the domestic billet offers are assessed at BDT 45,000-45,500/MT (USD 530-536); ex-works in Dhaka.

On an average the deal price for Bangladesh of lumps grade sponge iron assessed at near to USD 269-270/MT CPT Benapole (dry port of India & Bangladesh), which is equivalent to USD 285-288/MT CFR Chittagong, Bangladesh. Few indications were also reported higher by USD 2-3/MT over USD 270/MT, CPT Benapole levels.

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Gold Fields nears $2.4B Gold Road takeover ahead of vote

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

EverMetal launches US-based critical metals recycling platform

Iron ore price dips on China blast furnace cuts, US trade restrictions

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014