Manganese flake declines on steel cuts, ore prices

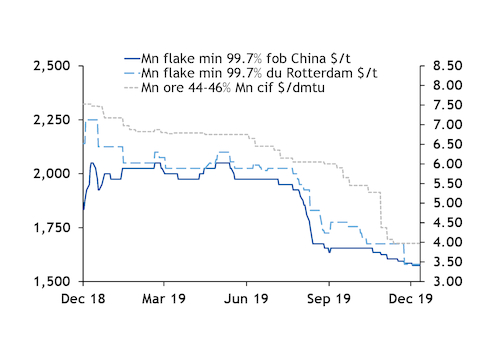

European prices have fallen to $1,540-1,620/t duty unpaid in Rotterdam on 12 December, down from $1,730-1,780/t at the end of the third quarter on 30 September. Chinese prices also fell to $1,550-1,600/t fob from China, down from $1,630-1,680/t on 30 September.

European prices in Rotterdam are usually at a $50-100/t premium to the China fob price, but the depth of the crisis in the European steel market has weighed on the market. Some steel mills have cancelled deliveries and order volumes have reduced, sometimes by up to half, compared with last year.

Crude steel production in Europe in October was down by 6.8pc year on year and by 3.6pc in the first 10 months of this year, the World Steel Association said.

The European Steel Association (Eurofer) expects steel demand in Europe to drop by 0.5pc this year and has forecast a drop of 0.8pc in the first quarter of 2020. The fall in Europe's steel production is heavily linked to economic conditions and the automotive slowdown, but has been further compounded by the impact of flat steel imports from Turkey, China and other third countries competing with EU steel mills.

Chinese production cuts start to weigh on prices

Manganese demand from the steel industry in China has remained consistent throughout 2019 because steel production in the country has continued to rise.

Seasonal steel production cuts, although looser than last year, are adding to the already-bullish trend in regional steel prices, with the Argus daily fob Tianjin index for hot-rolled coil at $470/t today — down on the year by $7/t but up from a year-to-date low of $426/t in late October. But the cuts are acting as a bearish signal for manganese flake consumption, particularly when combined with the normal winter slowdown in steel usage from the downstream industries.

China's largest steelmaking city, Tangshan, has instructed some higher-emitting steel mills to reduce output by half. Hebei province today also introduced pollution restrictions, meaning other steelmaking cities such as Handan will have to cut output at high-polluting mills.

Large steel producers reduced their manganese tender prices in China early this month. Baosteel bought 4,000t of flake at 11,300 yuan/t, down by Yn200/t from a tender at the end of October.

China's manganese metal producers are unlikely to reduce production in response. They are more likely to wait until early in the Chinese New Year at the end of January when they usually stop for the week anyway.

Manganese ore input costs fall

Despite continued steel production growth in China in the first three quarters of this year and steady demand for manganese metal and ferro-manganese, manganese ore prices have fallen throughout the year on oversupply.

Prices fell sharply at the beginning of the fourth quarter as steel production cuts in China approached.

Prices for 44-46pc manganese ore are $3.90-4.05/dmtu cif China, down from $5.40-5.50/dmtu on 26 September at the end of the third quarter. Prices for 36-38pc-grade ore are $3.35-3.50/dmtu, down from $5.10-5.25/dmtu on 26 September. Prices stopped falling in mid-November and have been stable ever since.

Manganese ore port stocks in China rose to 4.87mn t on 12 December, up from 4.04mn t on 18 October, reflecting a seasonal drop in demand for manganese ore, metals and alloys from China's steel industry.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook