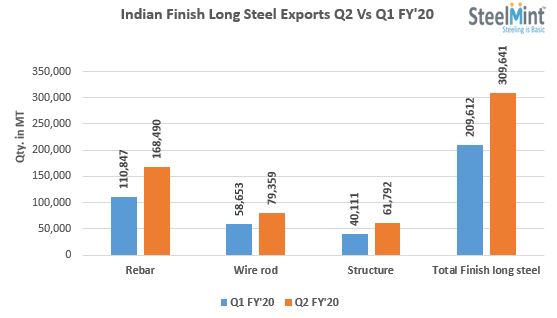

Indian Finish Long Steel Export Increases 48% in Q2 FY’20

Factors which have attributed towards strengthening finish long steel exports is low demand in domestic market amid liquidity issues resulting in high inventories with mills which pushed them to explore better export options in South Asian & Southeast Asian countries.

Average rebar prices in Q2 FY20 was reported at USD 476/MT CNF Singapore and Indian rebar average prices stood at Ex-Mumbai USD 435/MT by medium mills based in western India.

However, on monthly basis Indian finish long steel exports were registered at 82,492 MT in Sep’19, plunged by 28.6% as compared to 115,539 MT in Aug’19. Although on Y-o-Y basis exports surged by 36.2% in Sep’19 as against 60,546 MT in Sep’18.

Commodity wise - Rebar export was registered at 168,490 MT in Q2 FY’20 higher by 52% as against 110,847 MT in Q1 FY’20, followed by Structure stood at 61,792 MT in Q2 FY’20 (+54%) as compared to 40,111 MT in Q1 FY’20 and Wire rod export also surged by 35.30% to 79,359 MT in Q2 FY’20 against 58,653 MT in Q1 FY’20.

Country wise - Nepal stood as top importer of finish long steel from India during second quarter and registered at 109,279 MT in Q2 FY’20, rallied by 53.84% against 71,034 MT in Q1 FY’20 followed by Hong Kong - 97,222 MT in Q2 FY’20 (+225%) against 29,874 MT in Q1 FY’20 and Bangladesh 20,356 MT in Q2 FY’20 (+12.85%) as against 18,038 MT in Q1 FY’20.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook