Indian Steel Market Weekly Snapshot

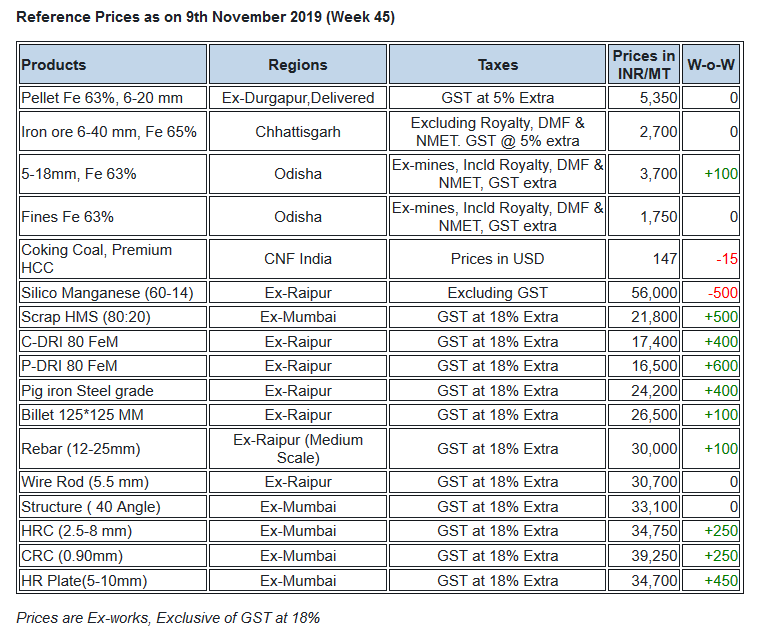

As per assessment, this week prices of Semis & Finished steel products through the mid sized mills surge approximately by INR 100-600/MT (upto USD 8) in across major Indian markets on better demand & high cost raw materials.

Also, the Flat steel prices increased by INR 250-500/MT in traders market on active trade inquiries

IRON ORE & PELLETS

Odisha based merchant miners continue to keep prices unchanged this week.

-- Adani Enterprise Ltd has been recently awarded Mine Developer & Operator (MDO) for Kurmitar iron ore mine owned by OMC Ltd.

-- Prakash Industries Ltd (PIL) - one of the major steel producers has commenced the mining operations in the Sirkagutu Iron and Manganese ore mine of the company at Keonjhar (Odisha).

-- PELLEX stable at INR 5,900/wmt (DAP Raipur) in recent deals. Raipur based pellet offers remain stable & total 15,000-16,000 MT pellets deals reported from Raipur market at INR 5,800/MT ex-plant this week. In Durgapur SteelMint’s reference, pellet price-stable to INR 5,300-5,400/MT in line last. In this week around 69,000-70,000 MT pellet deal reported at around INR 6,100-6,300/t (EXW-Bellary).

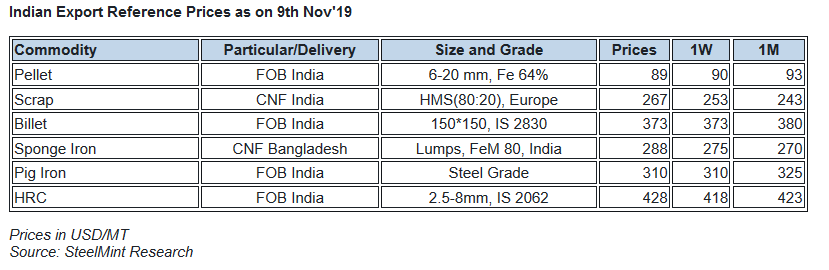

--Three Pellet export deals were reported to China this week. An eastern India based steel Pellet maker – BRPL has concluded two vessels of 60,000 MT each for Fe 64% grade and, 2.7% Al at around USD 102.4/MT CFR China (equivalent to 89-90/MT FoB India). Another pellet export deal was concluded for 50,000 MT by KIOCL for Fe 64% and 2% Al at around USD 95/MT FoB India. However current assessment stands at USD 101/MT, CFR China.

COAL

Australian coking coal prices have weakened further over the past week, amid deteriorating market sentiment on low restocking needs in China. In China, thin buying interest for seaborne coking coal was been observed, as steelmakers appear to be having sufficient inventories till January next year. Simultaneously, Chinese domestic coking coal prices have also fallen off recently.

Nevertheless, Chinese end-users expressed interest for seaborne coking coal cargoes with delivery dates of mid-late December laycan, possibly to utilize their fresh import quotas for the New Year. Market participants expect near-term FOB price levels to stay relatively steady, following the major correction.

-- Latest offers for the Premium HCC grade are assessed at around USD 133.50/MT FOB Australia and USD 147.15/MT CNF India.

FERRO ALLOY

-- Silico Manganese prices fell in line with MOIL lowering Manganese Ore prices. Current assessments are at INR 55,000/MT for Durgapur and INR 56,000/MT in Raipur.

-- Ferro Manganese prices are stable due to low supply in the domestic market. Prices are likely to be stable in Raipur amid less availability of material.

-- Ferro Chrome prices fell marginally by INR 500/MT due to higher selling pressure and low demand in the domestic and the global market.

-- Ferro Silicon prices increased in Guwahati as due to SIMS, the waiting time from Bhutan increased and the buyers have temporarily shifted to Guwahati for procurements.

FERROUS SCRAP

Imported scrap trades in India remained quite slow this week, with buying of Shredded scrap in particular remaining silent all through the week. While offers continued to move up following the uptrend in global market, very limited inquiries were observed.

SteelMint’s assessment for containerized Shredded from the UK, Europe and the USA to India has stands USD 285-290/MT, CFR Nhava Sheva, with most offers now close to USD 290-292/MT now, however, no major booking was reported for Shredded, as buying interest remained significantly lower by USD 10-15/MT. Few offers of UK origin P&S were reported at around USD 300/MT CFR.

-- HMS scrap observed few trades, with HMS 1&2 (80:20) was sold in decent quantity at USD 265-270/MT CFR Nhava Sheva, while South African origin HMS 1 was also sold at USD 275-280/MT CFR this week. Few trades of West African HMS 1 were also witnessed at USD 260/MT CFR Goa, translating to USD 255/MT CFR Nhava Sheva. HMS 1 (super) from Dubai now being offered at around USD 273-275/MT CFR.

SEMI FINISHED

On weekly basis, Semis offers rise slightly, in which Billet offers surged by INR 100-500/MT & Sponge iron by INR 200-500/MT. The participants mentioned that spot trades were on average basis, however due to sufficient orders in hand, prices marginally rise in major locations.

Further the industry sources believed that, prices to remain strong on rising raw materials & seasonal better demand for domestic & exports as well.

SteelMint analyzed that, export demand was quite good this week and healthy deals reported from eastern India to Nepal through the medium & large scale mills.

-- TATA Metaliks Ltd (TML) has kept its pig iron offers unaltered for Nov'19 deliveries. Offers for Foundry pig iron stands at INR 29,000/MT (USD 407) & for Low Silicon (1-1.5%) is around INR 24,700/MT (USD 348); ex-plant, Kharagpur, eastern India.

-- SAIL’s Rourkela Steel Plant tender held on 6th Nov'19 to sell about 2,800 MT steel grade pig iron; had received dull response. The base price for the tender was quoted by RSP at INR 24,000/MT & around 75% material remained unsold.

-- SAIL has raised pig iron (steel grade) offers by INR 500/MT (USD 7) for Nov'19 & fresh offers stood at INR 24,000/MT (USD 337) ex-works, Bhilai Steel Plant (BSP), Central India.

-- Vizag Steel (RINL) has invited two export tenders of Bloom and Pig Iron 10,000 MT and 20,000 MT, respectively. Interested bidders can submit their bids till 12 Nov’19.

-- SAIL has schedule an auction to sale of about 4,100 MT basic grade Pig iron on 11th Nov'19 from its Rourkela Steel Plant (RSP).

-- Vizag steel has recently concluded 30,000 MT bloom (150*150 mm) export tender at around USD 370-375/MT, FoB India, as per sources. The material shipment is to be made by 25 Nov’19 for IS 2830 C20MMn Gr A.

-- Nepal's largest steel producer has booked two rakes of sponge iron (80 FeM, 100% lumps) from an eastern India based mill at around USD 238-240/MT loaded on to rake. This attracts freight of around USD 25/MT, CPT Raxaul border, Nepal.

-- In the begining of week, export deals concluded to Nepal by a Indian large scale mill for around 4 rakes (about 11,000 MT) Billets at around USD 400/MT & 2 rakes of Wire rod (around 5,500 MT (grade SAE 1008, 6.0 mm) at USD 455/MT; CPT Raxaul border, for Nov-Dec'19 deliveries.

-- Mid sized mills export offers to Nepal remained firm & hovering at USD 395-400/MT for Billet & USD 450/MT for Wire rod, CPT Raxaul border.

-- Indian pig iron manufacturer - Vedanta has recently concluded 35,000 MT basic grade pig iron export deal to China for Nov shipment at around USD 330/MT, CFR China.

-- Vizag Steel has conducted auction for around 5,000 MT basic grade pig iron on 7th Nov’19 and the total offered quantity was booked with increased bid price by INR 500/MT to INR 22,500/MT (USD 317) ex-plant.

FINISH LONG

Indian Finish long steel market assessed mix response in most of the regions and sources in few specified locations reported measured trade volume. However following surge in billet prices amid positive trends, the price range of rebars increased by INR 100-600/MT.

Further, it’s been anticipated among trade sources that, current rebar prices might get sustain on account of strengthening prices of raw material in domestic as well in global market, even though the sales is not upto the mark.

-- Current trade reference rebar prices (12-25mm) through secondary mills assessed at INR 29,900-30,100/MT Ex-Raipur & INR 31,700-31,900/MT Ex-Jalna.

-- Central region, Raipur based structure manufacturers have inched up their prices by INR 100-200/MT in light sizes and slightly increase the trade discount on heavy structure to INR 900-1,300/MT and current trade reference price registered at INR 33,400-33,800/MT(200 Angle) ex-work.

-- Trade discounts in Raipur wire rod is currently at INR 1,000-1,200/MT and trade reference prices stood at INR 30,200-30,700/MT ex-Raipur and INR 30,700-30,800/MT ex-Durgapur, size 5.5mm.

FINISH FLAT STEEL

This week Indian HRC prices in traders segment witnessed slight uptick in the range of INR 250-500/MT W-o-W. Improved trades and resumption of buying activities in the domestic market were key observations after the festive holidays.

As per SteelMint's price assessment current trade reference prices in traders segment for HRC (IS2062, 2.5-8mm) is at INR 34,500-35,000/MT ex-Mumbai, INR 34,000-34,500/MT ex-Delhi. And the domestic CRC (0.9mm, IS 513) trade reference prices on a weekly basis are hovering around INR 38,500-40,000/MT ex-Mumbai, INR 37,800- 39,000/MT ex-Delhi. Prices mentioned above are basic and extra GST@ 18% will be applicable.

Indian steel mills raise HRC export offers to Vietnam - Indian HRC export offers to Vietnam have moved up by USD 10/MT for positioned cargoes for Dec shipments, owing to higher bids from Vietnam buyers. Thus currently Indian HRC offers are at USD 440/MT CFR Vietnam. Towards the beginning of this week Indian HRC export offers were reported at USD 425-430/MT CFR Vietnam.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Fortuna rises on improved resource estimate for Senegal gold project

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI