Global Ferrous Scrap Market Overview - Week 44, 2019

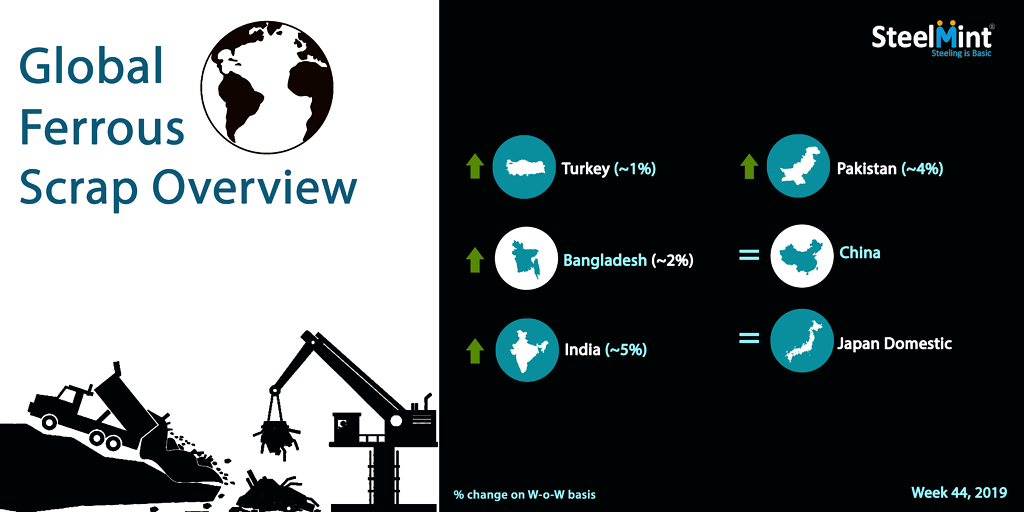

Turkey - Turkish imported scrap prices inched up marginally in deep-sea bulk booking being concluded this week. Only single deal was reported this week.

In latest deal reported, a Mediterranean region-based steelmaker concluded a bulk vessel yesterday from a Netherlands based scrap yard, booking 25,000 MT of mixed cargo comprising of 22,500 MT of HMS 1&2 (80:20) at USD 248/MT CFR, and 2,500 MT of bonus at USD 258/MT CFR Turkey.

As per SteelMint’s methodology, assessment of US-origin HMS 1&2 (80:20) scrap has now escalated to USD 254/MT, CFR Turkey, inching up by USD 1/MT, as against USD 253/MT at the closing of last week. The assessment of European origin HMS 1&2 (80:20) stands at around USD 248/MT, CFR Turkey.

Japan: After observing 3 price cuts till the 3 weeks of Oct’19, Japan’s Tokyo Steel, kept its price unchanged for 2 weeks now. The price for H2 delivery to Utsunomiya plant in Kanto region and Tahara Plant in the Central Japan remain at 22,500/MT (USD 207) and JPY 22,000/MT (USD 203) respectively.

Notably, the company has introduced the scrap inspection system for its western region based Kyushu Works.

China: Eastern China’s largest private ferrous scrap consumer and EAF steelmaker- Shagang Jiangsu Steel group kept its purchase price unchanged after 3 consecutive price cuts in a week of Oct’19. Shagang Steel’s bid for HMS 3 (6-10 mm thickness) delivered to headquarters works situated in Zhangjiagang north of Shanghai in China, stands unchanged at RMB 2,700/MT (USD 381) inclusive of 13% VAT, amid stability in the market.

Thailand: A prominent steel manufacturer in Thailand has booked a bulk scrap vessel from a major USA based recycler. The 30,000 MT cargo comprising of Shredded scrap in entirety and is reportedly booked at around USD 288/MT CFR Thailand. The shipment for the same is expected in November while the vessel is likely to arrive at berth by Dec’19. The bulk vessel offers to South Asia also stand in the range of USD 290/MT CFR Chittagong and CFR Kandla for Shredded scrap

South Korea: South Korean leading EAF steelmaker Hyundai Steel has not bid for Japanese scrap this week, after last week bidding at prices unchanged from 3 weeks ago when it had observed a sharp price cut by JPY 2,000/MT (USD 19) in early Oct’19. The last bid of JPY 22,000/MT (USD 204), FoB Japan for H2 scrap. However as per reports, Japanese scrap prices may find support and there are chances of price rebound.

India - Imported scrap offers to India moved up sharply for another week on the global uptrend, however, no major deal for containers was reported this week due to mismatch in buyers’ bids and offers from suppliers.

SteelMint’s offers for containerized Shredded from the UK, Europe and the USA to India has climbed up to USD 280-285/MT, CFR Nhava Sheva, rising by USD 10/MT against last week, while lower buying interest has kept trades minimal.

HMS 1 (super) from Dubai now being offered at around USD 267-270/MT CFR while HMS 1&2 (with ci & gi) from Dubai was being offered at around USD 262-265/MT CFR. Amid limited inquiries, European origin HMS 1&2 (80:20) offers now stand rangebound at USD 255-262/MT CFR Nhava Sheva, as per quality, while high quality South African origin HMS 1 offers were reported at around USD 270/MT CFR.

Pakistan - Imported scrap offers to Pakistan have moved up through out this week, while Trades picked up in the latter half of the week after more clarity on price levels was achieved.

Assessment for containerized Shredded 211 scrap from UK/Europe stands at USD 285/MT, CFR Qasim, up by over USD 10/MT against last week’s closing. Earlier in the week, few bookings were reported at around USD 278-280/MT, while by the closing of the week, some deals for shredded concluded at USD 285/MT CFR from UK.

HMS trades improved with UAE origin HMS 1 (super) being offered at around USD 272/MT CFR, while UK origin HMS HMS 1&2 (80:20) being reported at USD 267-270/MT and South African origin HMS stood at around USD 275/MT CFR.

Bangladesh: Imported scrap offers to Bangladesh marginally inched up this week, while trades have now turned very slow with no major bookings in containers being reported.

Assessment for containerized Shredded scrap from UK, Europe and North America stands in the range of USD 295-296/MT, CFR Chittagong, rising by USD 3-4/MT against last week. Few limited quantity deals were concluded with buyers mostly staying away from the market.

HMS 1 offers from European and Australian origins were reported to be at around USD 285/MT CFR Chittagong, while HMS 1&2 (80:20) from South American origins continued to stand at USD 280/MT range, amid limited interest from buyers. P&S scrap offers stood stable at around USD 300/MT CFR.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook