Higher prices, demand to lift China's Ti sponge output

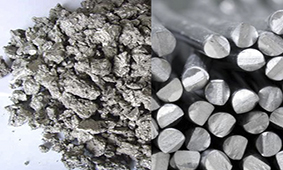

Titanium sponge prices increased to a seven-year high of 80,000-82,000 yuan/t ($11.44-11.73/kg) for 99.7pc grade material and Yn79,000-81,000/t for 99.6pc grade at the start of August 2019, in response to higher feedstock costs during environmental restrictions and increased demand from the downstream chemicals, aerospace, medical and military industries.

Titanium tetrachloride feedstock prices rose to a two-month high of Yn7,700-8,000/t at the end of October because of a rise in prices for high titanium slag feedstock and chlorine gas during environmental restrictions. This pushed up 99.7pc grade sponge prices to above Yn80,000/t.

Titanium sponge demand has risen since last year because of industrial structure changes, with higher demand from the high-end aerospace, medical and environmental protection sectors.

Chinese titanium producer Pangang Titanium Industry restarted a titanium sponge production line at its subsidiary Xinyu Chemicals in mid-July this year, in response to higher prices and a rise in demand from the mill products sector. Pangang Titanium's capacity for titanium sponge has since increased to 25,000 t/yr after the production ramp-up at Xinyu Chemicals, which has a capacity of 5,000 t/yr.

State-owned Citic Jinzhou Metal, with a capacity of 2,000 t/yr, has resumed titanium sponge production since the start of August this year in response to higher prices and firmer demand from the titanium mill products sector.

Chinese private-sector firm Chaoyang Jinda Titanium Industry has built a titanium sponge production plant in Chaoyang city, Liaoning province to boost its capacity and expand its market share. Construction started in March 2018 and the project is scheduled to be completed in June 2020. Chaoyang Jinda's titanium sponge capacity will rise to 20,000 t/yr once the new plant is operational.

Lomon Billions Xinli Titanium Industry, with a capacity of 10,000 t/yr, restarted production on 5 October in response to higher prices. Lomon Billions acquired a 68.1pc stake in Yunnan Xinli Titanium Industry in mid-May.

Xinjiang Xiangsheng New Material Technology, with a capacity of 20,000 t/yr, started production last year. It has been raising production since July to meet its own demand, with a few purchases of titanium sponge from other suppliers to save production costs. The company has not sold any titanium sponge products on the spot market as current output cannot even meet its titanium mills production.

Sichuan Shengfeng Titanium Industry, with a capacity of 10,000 t/yr, completed its construction on 28 August last year. It has increased its output since this year's second half amid higher spot prices and firm buying demand from consumers.

China produced 39,595t of titanium sponge in this year's first half, up by 24.1pc compared with 31,906t in the same period of 2018, according to statistics from China's non-ferrous metals industry association titanium zirconium and hafnium branch.

Luoyang Sunrui Wanji Titanium produced 8,500t in this year's first half, up by 54.55pc from 5,500t compared with the same period of 2018. Chaoyang Baisheng's output reached 6,000t, up by 50pc from 4,000t over the period. The output from Chaoyang Jinda rose to 4,481t, an increase of 481t.

China produced 27,287t of titanium mill products in the first half, up by 26pc from 21,656t in the same period of 2018. BaoTi Group produced 8,766t, an increase of 1,766t from 7,000t over the same comparison. Hunan Xiangtou Goldsky Technology's output totalled 4,500t, up by 125pc from 2,000t.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook