Bangladesh: Imported Scrap Trades remain Slow On Weak Domestic Demand

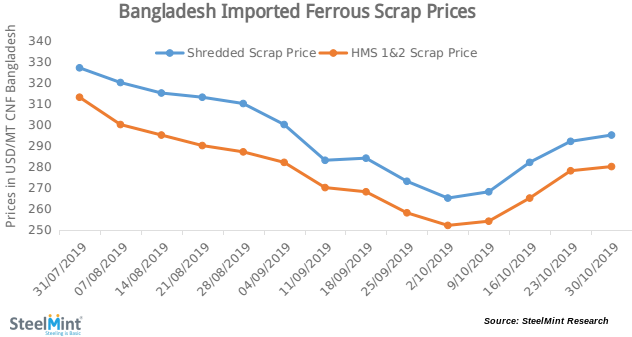

SteelMint’s assessment for containerized Shredded scrap from UK, Europe and North America stands in the range of USD 295-296/MT, CFR Chittagong, rising by USD 3-5/MT against last week’s report. Very few deals of limited quantity were concluded at these levels, with most buyers staying away from the market. A global supplier shared that all South Asian markets in general and Bangladesh, in particular, remained silent this week with few inquiries received.

A source had shared that another Japanese bulk cargo of around 10,000 MT of Shin Daichi scrap was concluded this week to a Chittagong mill, however the deal could not be confirmed by the time of publishing.

HMS 1 offers from European and Australian origins were reported to be at around USD 285/MT CFR Chittagong, while HMS 1&2 (80:20) from South American origins continued to stand at USD 280/MT range, amid limited interest from buyers.

P&S scrap offers stood stable on a weekly basis at around USD 300/MT CFR with few inquiries.

Domestic scrap offers slide down on low demand - As the finished steel demand plummeted further, leaving steel mills with significant unsold inventories and stocks, the slow down was reflected in buying of local scrap as well. With a sharp reduction in demand, ship recyclers have cut down the offer for ship yard scrap to BDT 27,500-28,000/MT ex Chittagong this week, down by BDT 1500-2000/MT w-o-w. Amid the current market scenario, it is likely that the overall domestic steel demand will remain subdued for the short term.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts