Indian met coke imports hit multi-year low in September

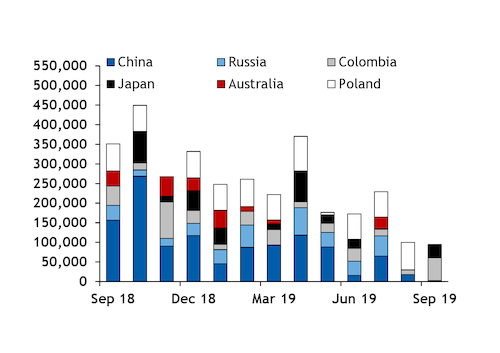

Indian met coke imports were 94,469t in September, down by 73pc on the year and a drop of 42pc from August, according to data from e-commerce company Mjunction.

Many of India's largest steel producers scaled back production to around 75-80pc of capacity in the second half of the year amid weak demand for finished steel products. Met coke is a key feedstock in blast furnace steel production along with iron ore.

Higher domestic coking coal prices in China have left met coke export prices too high to compete with other exporters as well as India's domestic merchant cokemakers. India took 33,487t of met coke from Japan in September as similar steel production cuts there created a surplus of met coke volumes.

Most of the rest came from Colombia in September with 58,702t, more than triple the amount the previous month. India imported just 2,193t of met coke from China in September.

Similar cuts to import volumes were made across the metallurgical coal complex. India imported 3.54mn of coking coal in September, down by 23pc on the month to the lowest level since January and a drop of 51pc from September 2018.

Australia remained the largest coking coal supplier to India with 2.26mn t, down by 41pc from August. But volumes from the US increased by 125pc on the month to 372,309t, while shipments from Canada rose by 117pc to 524,835t.

The Argus spot price assessment for premium low-volatile hard coking coal averaged $140.96/t fob Australia in September, down by 9.5pc from $155.83/t on the same basis in August.

Indian imports of pulverised coal injection (PCI) grades were at the lowest level for the year at 815,438t in September, down by 34pc on the month but an increase of 120pc from the same month last year as PCI utilisation at Indian mills has generally trended higher.

Australia remained the largest PCI exporter to India in September with 495,838t, down by 34pc from August, while shipments from Russia fell by 41pc on the month to 260,580t.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook