Bangladesh: Imported Scrap Trades Remain Slow on High Offers

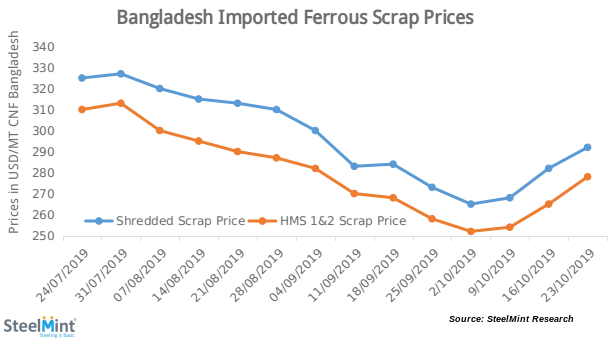

SteelMint’s assessment for containerized Shredded scrap from UK, Europe and North America stands in the range of USD 290-295/MT, CFR Chittagong, rising by USD 5-10/MT against last week’s report. A Dhaka based mill booked 1000 MT of Shredded from North American origins at USD 290/MT CFR for December shipment, while offers from few other global suppliers were reported to be up to USD 295/MT, amid slow trades this week.

A Japanese cargo was concluded at the closing of last week to a mill in Chittagong, comprising of 12,000 MT of Shin Dachi scrap, while no other bulk cargo bookings were reported this week.

Few trades for HMS scrap were reported at USD 8-10/MT higher than previous. HMS 1&2 from Brazil and Australia were recently traded at USD 280/MT CFR Chittagong, with few mills in Dhaka booking at these levels for Dec’19 while HMS 1 offers stand at USD 285/MT from Australia and Europe. Trades for clean bundles from Chile and South American origins were also observed at around USD 255/MT.

P&S scrap offers also climbed up in similar proportions, now standing at around USD 300/MT CFR, however, buying activities remain limited.

Domestic scrap offers withheld by ship recyclers - Although the current offers for the ship yard scrap in Chittagong market stands at BDT 29500-30,000/MT, (USD 348-354/MT) stable against previous weeks, however, the yards are not offering much material, tactically waiting for a further rise in prices by creating a supply-demand gap rising international scrap prices.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts