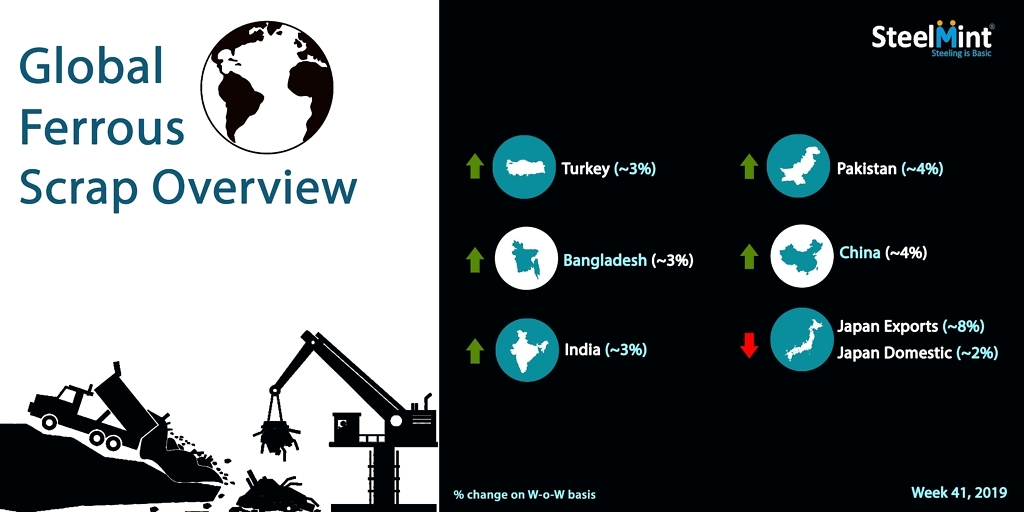

Global Ferrous Scrap Market Overview - Week 41, 2019

Turkey - Turkey imported scrap prices rebound - In a recent deal Concluded towards end of this week 30,000 MT US origin HMS (80:20) was booked by Turkey steel mill at USD 234.75/MT CFR Turkey.

Imported scrap prices reported a rebound on tight supply, however market remains skeptical of sustainability of this increase on dull finished steel market and political tensions.

SteelMint assessment for imported scrap of US HMS (80:20) stands at USD 233-234/MT, CFR Turkey, higher by USD 6-7/MT, W-o-W, while assessment from Europe stands at USD 228-229/MT CFR.

China - Shagang raises scrap purchase price on low inventory after holidays - Eastern China’s largest private ferrous scrap consumer and EAF steelmaker - Shagang Jiangsu Steel group has announced a price hike for all grades of domestic steel scrap procurement by a significant margin, increasing its purchase price by RMB 100/MT (USD 14) effective from 9th October’19.

As per updates, Shagang Steel is paying RMB 2,790/MT (USD 390) inclusive of 13% VAT for HMS 3 (6-10 mm thickness) delivered to headquarter works situated in Zhangjiagang north of Shanghai in China, up by RMB 100/MT against the last report of RMB 2,690/MT on 20 Sept'19. While HMS 1 (thickness not less than 20 mm) and HMS 2 (6-10 mm thickness) stands at RMB 2,870/MT (USD 401) and RMB 2,830/MT (USD 396) respectively.

South Korea - Leading EAF teelmaker Hyundai Steel cuts bid for Japanese scrap by JPY 2000- South Korean leading EAF steelmaker - Hyundai Steel has lowered its purchase bids for Japanese scrap by another JPY 2,000/MT (USD 19) today, in its first price revision for this month, after observing 3 price cuts in Sep’19. The Prices have now plunged sharply by JPY 5000/MT in total since the beginning of Sep’19, in line with the continuous free-fall in the Japanese scrap market, while a further drop in prices can not be ruled out.

In bids presented yesterday for Japanese scrap, the company has reduced its H2 scrap bids to JPY 22,000/MT (USD 204), FoB Japan as against JPY 24,000/MT (USD 222), FoB presented in 27th Sep’19. The bid for other grades of scrap such as H1, stands at JPY 22,000/MT (USD 204), FoB, while shredded and HS scrap now stand at JPY 23,000/MT (USD 213) & 25,000/MT (USD 232) FoB respectively.

Japan - Kanto Tetsugen’- Japan’s monthly ferrous scrap export tender for Oct’19 was concluded on 9th Oct’19. A Total of 21,100 MT of Japanese H2 scrap was awarded at an average of JPY 22,293 /MT (USD 208), FAS, as compared to JPY 24,849/MT in Sept 2019, witnessing another sharp fall by JPY 2,556/MT (USD 24) on a monthly basis.

Tokyo Steel has lowered its scrap purchase price at all 5 of its works, by JPY 500/MT (USD 5). This comes as the 2nd price revision by the company in Oct’19, while the new prices for all grades came to effect on 9th Oct'19.

After the said price cut, the company will pay JPY 22,500/MT (USD 215 ) for H2 scrap delivered at its Tahara plant in Central Japan and Utsunomiya plant in Kanto region.

India - Imported scrap offers to India rose significantly this week on global rebound in prices reflecting in the South Asian markets earlier this week, as well as tight supply from the sellers end.

SteelMint’s assessment for containerized Shredded from the UK, Europe and USA to India stands at USD 260-265/MT, CFR Nhava Sheva, increasing by USD 3-4/MT against last week's report.

HMS scrap prices too climbed up in the last few days, with HMS 1 from Dubai is now being offered at around USD 260/MT CFR. West African HMS witnessed fresh trades at USD 250/MT CFR Goa, which translates to USD 240-245/MT CFR Nhava Sheva. European origin HMS 1&2 (80:20)offers has now increased to USD 245/MT CFR Nhava Sheva amid limited trades

Pakistan - In line with the global trend, imported scrap offers to Pakistan rose sharply in the last couple of days.

It was reported that Shredded scrap offers in containers from both traders and scrap yards in Europe now stand at USD 260-265/MT CFR Qasim, while buying activity had slowed down consequently, in comparison to the active trades in the last 2-3 weeks.

Very limited trades for HMS 1 from Dubai were reported at around USD 260/MT CFR Qasim.

Bangladesh - Offers to Bangladesh also witnessed an upturn this week, on account of global rebound, while trades remained limited with steelmakers seeking further clarity.

Assessment for containerized Shredded scrap from Europe and North America stands in the range of USD 270/MT, CFR Chittagong, rising by USD 5-8/MT against last week’s report. Earlier in the week, few bookings for shredded were reported at around USD 270/MT CFR from the USA and Australian origins.

HMS 1 from Australia and South Africa being offered in the range of USD 260-265/MT CFR Chittagong, with buyer’s interest standing at USD 260/MT. HMS 1&2 (80:20) and from South American and European origins was assessed at around USD 255-256/MT CFR. P&S offers from Brazil stand at USD 270-275/MT CFR.

Hindustan Zinc to invest $438 million to build reprocessing plant

Gold price edges up as market awaits Fed minutes, Powell speech

Glencore trader who led ill-fated battery recycling push to exit

UBS lifts 2026 gold forecasts on US macro risks

Roshel, Swebor partner to produce ballistic-grade steel in Canada

Iron ore price dips on China blast furnace cuts, US trade restrictions

EverMetal launches US-based critical metals recycling platform

US hikes steel, aluminum tariffs on imported wind turbines, cranes, railcars

South Africa mining lobby gives draft law feedback with concerns

Trump raises stakes over Resolution Copper project with BHP, Rio Tinto CEOs at White House

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Emirates Global Aluminium unit to exit Guinea after mine seized

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

US seeks to stockpile cobalt for first time in decades

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Glencore targets 1Mt of copper in Argentina over coming decade

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Abcourt readies Sleeping Giant mill to pour first gold since 2014